by Harbour Asset Management

Key points

Key developments

Despite delta’s impact, global equity markets were upbeat reflecting a reporting season which showed positive earnings growth and confirmation by the US Federal Reserve (the Fed) that it would err on the side of caution in changing monetary policy stimulus. Global bond yields were volatile over the month as investors responded to positive but slowing economic growth data, paired with interpreting the Fed’s next move and when monetary policy tapering will begin. Commodity prices continued to ease with iron ore and oil sharply lower, this was driven partly by signs of an economic slowdown in China.

Despite New Zealand moving into a level 4 lockdown to contain the spread of the delta Covid-19 variant, the New Zealand equity market delivered one of its strongest monthly returns in some time. This result was mainly driven by a much stronger earnings season than consensus market expectations, with the number of profit result beats against expectation higher than misses in the order of 2 to 1 at an earnings per share level. Idiosyncratic factors such as the inclusion of Mainfreight and Serko in the FTSE global stock market benchmarks, and an acceleration in mergers and acquisitions (M&A), also boosted returns. The New Zealand market’s relatively high weighting to growth and defensive stocks may also have attracted capital as global growth expectations were trimmed.

Globally the economic expansion continues, albeit at a slower pace, and this will eventually pave the way to policy normalisation and higher interest rates. The US, for example, has replaced more than three quarters of the jobs lost following Covid-19 but the pace of recent job growth has moderated. Most large, developed countries now have high vaccination rates and the Covid-19 delta variant has not resulted in materially higher hospitalisations or deaths. Economic growth in these countries is well above potential and continues to be supported by the re-opening of service sectors and households deploying the large amount of savings accumulated since Covid-19 hit. The combination of the delta variant and higher inflation, however, appears to have dampened consumer confidence. Global inflation remains high and ongoing supply disruptions suggest it may prove more persistent than previously assumed.

RBNZ objectives are met but the recent COVID-19 outbreak delayed the start the tightening cycle. The August Monetary Policy Statement (MPS) and subsequent communication from RBNZ officials suggests the central bank believes policy settings are too loose, but the timing of the MPS was awkward (just one day after the COVID-19 outbreak). With COVID-19 case numbers stabilising and no community transmission south of Auckland, this tension has reduced. We expect two 0.25% rate hikes by the end of this year, starting next month. This is broadly in line with market pricing.

What to watch

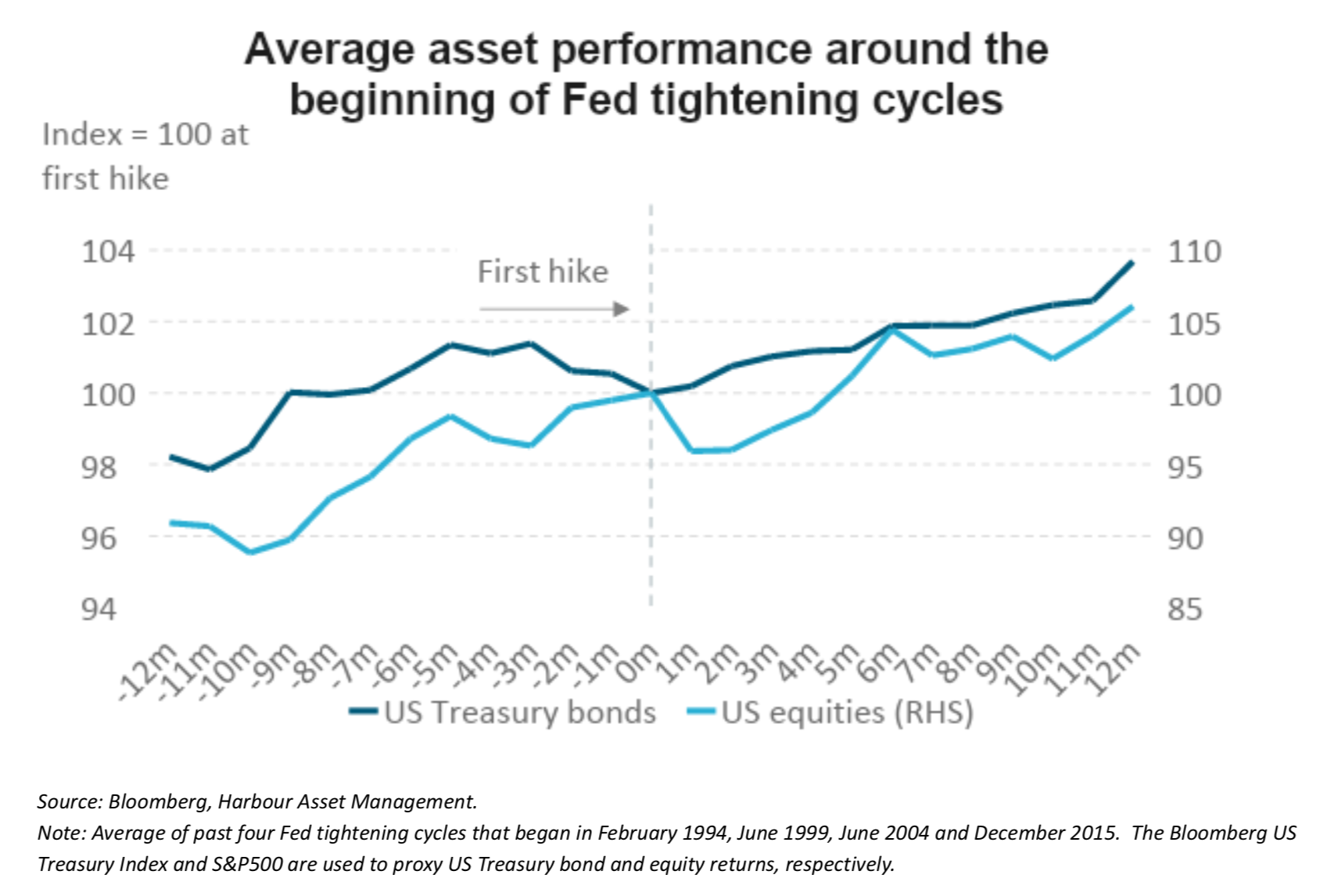

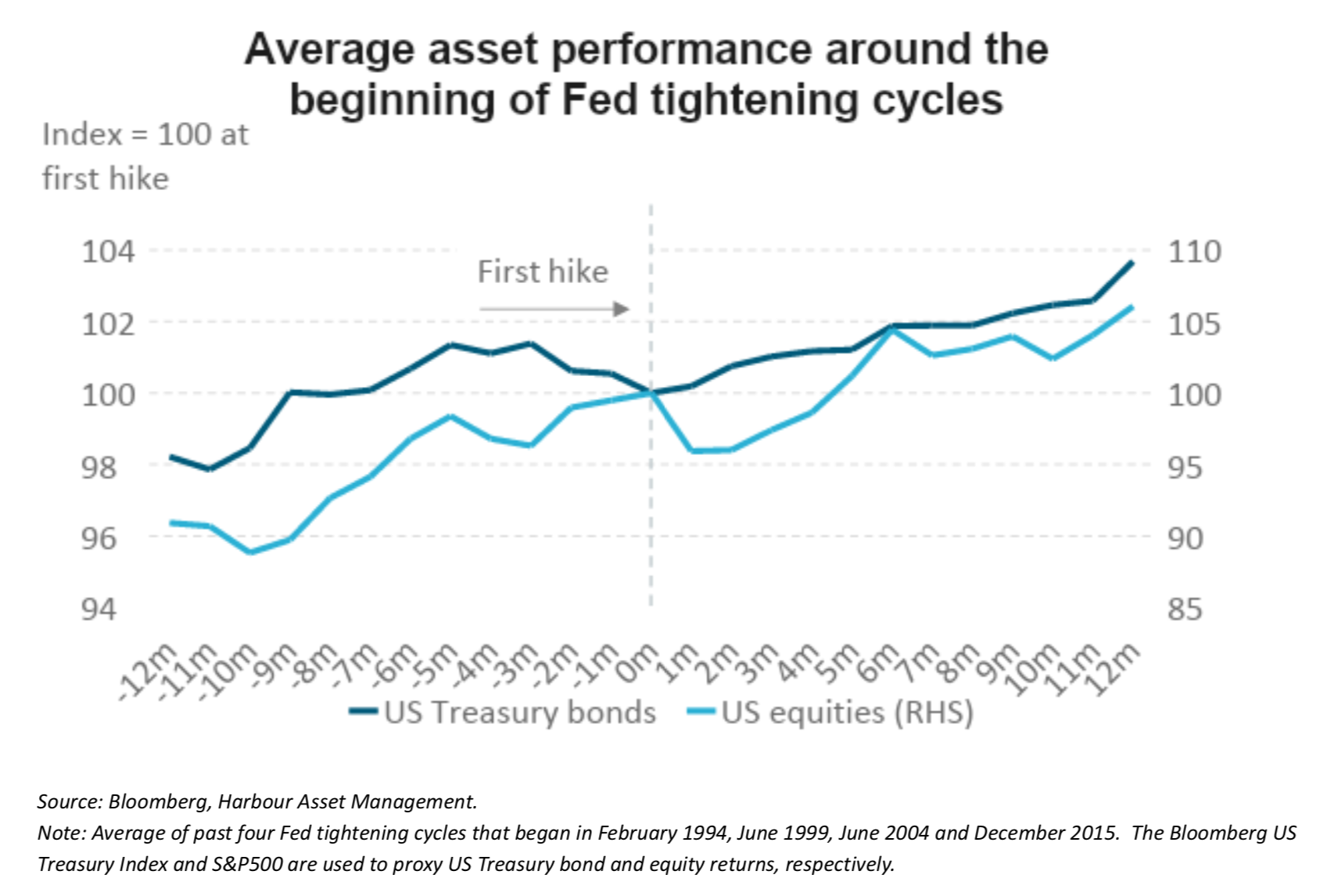

Fed taper - As the US economy continues to improve, the Fed seems close to reducing its pace of bond purchases as part of its quantitative easing (QE) programme. Different to the “taper tantrum” of 2013, however, a reduction in purchases is widely expected and is not being associated with imminent interest rate hikes. That’s not to say it will necessarily be smooth sailing for financial markets. We firmly believe longer-dated interest rates will rise as global QE programmes are reduced but risks exist in many directions and a well-broadcast tapering may not be the largest concern. If history is any guide, US Treasury bond returns tend to be mixed prior to interest rate hikes but US equity markets generally fare much better (for further discussion see The Fed can taper without tantrum, 1 September 2021).

Market outlook and positioning

The macro-economic environment remains broadly positive for equity market returns, but market volatility may increase from ultra-low levels. The global and local recovery in economic activity has seen the level of activity back to pre-2020 levels. We think global growth is likely to continue but Covid-19 mobility controls may make the recovery halting and elongated. Some parts of the global economy may be past ‘peak’ delta fears (e.g., the US and Europe with high vaccination rates), while other regions are at risk with implications for global trade disruption. Not all economic sectors will participate in the recovery – some may be impaired for some time. So, the rate of economic recovery may slow from a steep rate to a solid rate, with some push to the right in timing.

Market volatility signals are at low levels – meaning markets are vulnerable to policy surprises. An economic recovery that is positive but not excessive means policy makers can quietly remove peak stimulatory monetary policy, or signal pre-emptively better than in the past, without surprising capital markets causing ‘taper tantrums’ and ‘buyer strikes’. This ‘goldilocks’ macro-economic mix of positive but ‘not too hot’ economic growth and modest ‘not too cold’ tightening in policy settings is supportive for equity market earnings and valuations. Given the finely tuned nature of markets (ultra-low interest rates, relatively high stock market valuation multiples) there will be a reaction to changes in settings, so we are mindful to position for an increase in volatility by maintaining higher portfolio liquidity.

Within equity growth portfolios, while macro conditions remain supportive for equity returns, news flow will become increasingly ‘noisy’. Harbour’s process continues to cut through the noise and focus on stocks that benefit from pricing power and have productivity upside. Structural growth tail winds including digitisation (internet of everything, big data everywhere, ecommerce, automation and robotics), demographic change, urbanisation, rapid medical advancements and the rise of sustainability will provide enduring earnings growth for those companies positioned to benefit from them. Given full market valuations we remain selective and nimble - not all stocks will benefit from pricing power, productivity and structural tail winds in a peaky investment world.

Within fixed interest portfolios, our investment strategy has continued to be based on the medium-term view that the global and domestic economies would shift into a fairly regular, yet strong, expansion phase. Economic data have been generally supportive of this thesis. We have also been expecting this to drive central banks to start to reduce the amount of stimulus they are providing, initially by reducing QE programmes and then by raising official interest rates. Given market pricing anticipates a slower path towards rate hikes than we foresee, we expect bond yields to rise over time, with returns suffering as a result.

Within the Active Growth Fund, despite the strong recovery in share markets, we still see pockets of opportunity, sufficient enough to retain an overweight position to share markets. For example, the global listed infrastructure stocks within the portfolio are still not at pre-Covid levels using many metrics we follow. We are still finding plenty of opportunity within our Long/Short sleeve of the portfolio, which returned just under 5% over the month despite taking a third of the risk of a fully invested long-only strategy.

The Income Fund’s investment strategy has continued to reflect the themes of economic expansion and inflation risks. Over the medium term, we expect to see central banks reducing monetary policy support, which would flow through to assets markets in the form of a reduction of the immense amount of liquidity supporting prices. Higher inflation would heighten risks for bond and equity markets. However, in the more immediate outlook, inflation is not yet demonstrably going to be persistent, and the majority of central banks and investors expect inflation rises to be mostly temporary. That is enabling equity markets to focus on earnings, which have been strong and helped drive markets forward. This has benefitted the fund which is overweight equity markets. Given the recent strong run, we are now being a little more hesitant about adding to exposure, on a tactical basis.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

Important disclaimer information

| « Why DIY investing and professional advice can see eye-to-eye | Big returns for NZ Super Fund » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved