by Andrea Malcolm

The commission has worked with the financial sector, including regulators, over the last 18 months to develop De-jargoning Money for organisations and institutions working across the finance and insurance sectors to use when explaining personal finance on their websites, in documents, on the front line, and in the media.

Retirement Commissioner Jane Wrightson says standardising industry language, removing jargon, banishing outdated terms, and trying to avoid the many acronyms is critical.

“We know that many terms are not readily understood by New Zealanders and this is a chance to reshape and demystify our customer and consumer-facing language.

“While this is not a legally binding document, the more organisations that adopt it, the better off consumers will be.”

Consultation included all major banks,insurance providers, investment companies, government agencies, legal departments, financial mentors and community groups. Customer testing has also been conducted with more than 1500 ASB customers, and digital-platform Banqer tested it with 960 school students, 13–15 years old.

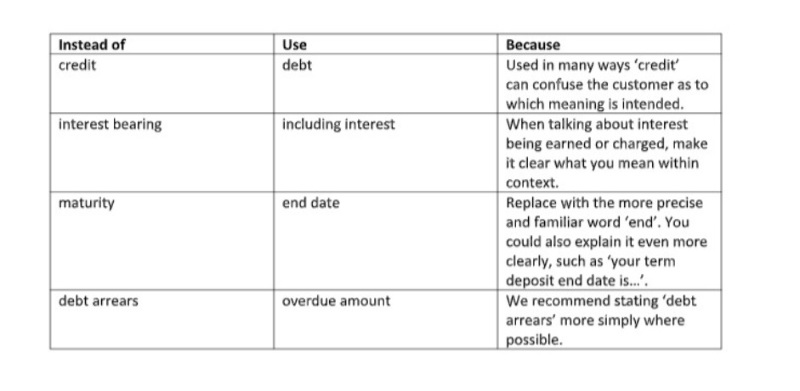

The glossary provides suggestions for words to be phased out and a plain language term used instead, or where they cannot be changed, encourage the industry to provide good context to their customers.

It spans general terms for everyday banking and spending, lending and loans, insurance and estate planning, investment and KiwiSaver to ethical and sustainable investing. Some examples of words recommended to be phased out:

| « Hitting the Ceiling | Heading in the right direction » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved