by Pathfinder Asset Management

Equity ETF background

There are an astonishingly large number of equity ETFs listed in the US – in fact there are over 1,300. The average expense ratio (total management fee) for large cap equity ETFs is 0.39%. For broad equity ETFs covering all market caps the average expense ratio is higher, at 0.51%. Some (but far from all) US equity ETFs are very cheap and can have an expense ratio less than 0.10%.

Below, we provide a “real life” US ETF vs NZ PIE fund expense comparison by matching a Pathfinder PIE fund against the US ETF alternatives. This is not intended as a product push, but rather it is intended to be a reasoned example of how the low fee ETFs are not always the cheap solution they appear to be. Investors and advisers need to look further than simply the headline expense ratio.

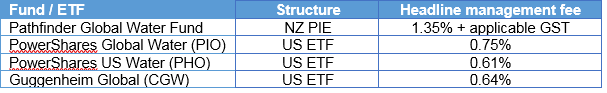

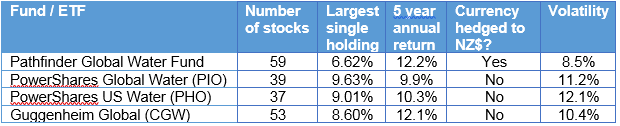

Pathfinder’s Global Water Fund is a niche equity fund directly investing in water industry stocks which can include industrials, utilities, tech and materials companies. There are several US ETFs that also invest in the water theme. Let’s start by comparing the headline expense ratios:

On the face of it, the PIE fund has about twice the costs of comparable ETFs. But this comparison is far too simplistic. Please read on…

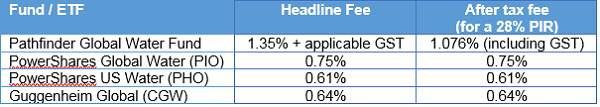

ETFs – management fees aren’t tax deductible

For a start, costs inside a NZ PIE are tax deductible, while with FDR tax on the ETFs there is no tax deduction (in this example we are assuming FDR tax applies on the US ETFs. The analysis is different if CV tax treatment applies). This makes the biggest difference to a 28% PIR tax rate which we show below (it makes no difference for a zero PIR):

The tax deductibility of fees narrows but does not entirely close the gap between the PIE and ETFs. But there is more to come…

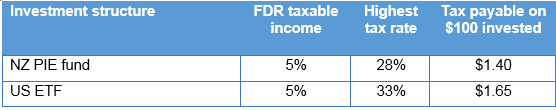

PIEs – the PIR benefit

For a high rate taxpayer, investing in a NZ PIE has another key benefit – capping the tax rate at 28% (compared to the top marginal tax rate of 33%). This sounds like a trivial benefit, but it is significant. Where FDR tax applies, the difference works as follows:

For a high rate taxpayer with FDR tax on the US ETF there is a clear benefit to invest through a NZ PIE fund. The tax saved adds 0.25% per annum to the investment return through a PIE. Because of the nature of FDR tax (assumed 5% return regardless of how the asset performs) this benefit applies whether markets are rising or falling.

ETFs - custody fees can hurt

Investors who hold US ETFs will typically pay a custody fee to the offshore sub-custodian. For example, if the ETF is purchased through a NZ broker, it appears to be held in the custody account of the NZ broker. It is, however, held by a sub-custodian offshore (the sub-custodian holds it for the NZ broker who in turn holds it for the NZ client). The offshore sub-custodian will charge a fee for holding the ETF - this may not be an obvious or transparent fee. The charge is likely to be at least 0.20%.

By comparison, the NZ PIE may have a much more efficient custody structure. In the case of the PIE fund we are comparing here to US ETFs, there is no custody fee incurred in the Water Fund’s sub-custody arrangement. This is a saving of 0.20% (and possibly more) through the PIE structure.

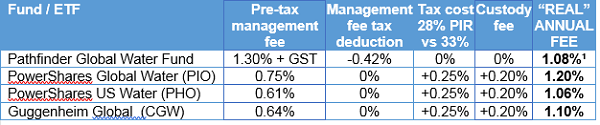

Putting it all together

If we aggregate these numbers we see the “cheaper” US ETFs suddenly aren’t any cheaper. In fact, some that, at first glance, appear much cheaper are in reality more expensive for a 28% PIR investor where FDR tax applies:

The headline price doesn’t give the full story. It’s like signing up for a $50 a day rental car and later finding the real cost is $100 a day after the rental company adds insurance, an excess waiver and a roadside assist charge.

But wait, there’s more…

There are a few other issues to be taken into account by an adviser when considering if clients should hold US equities directly or via an NZ PIE. These are difficult to quantify, so are not included in the table above, but are further benefits of using PIEs:

Summary of the US ETF vs NZ PIE match race

So in summary:

Many (but far from all) US ETFs are very cheap. This is particularly true for broad market exposure where headline management fees can be below 0.10%. However, investors and advisers need to do a complete comparison when looking at US ETFs against NZ PIE fund options. There is a lot more involved than simply comparing headline management fees.

John Berry

This commentary is not personalised investment advice - seek investment advice from an Authorised Financial Adviser before making investment decisions.

¹ The 1.08% cost includes GST

² Sources: Bloomberg and company websites. Data to 31 May 2017.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « Canterbury economic activity still robust | Traditional balanced funds - return free risk? » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

Very interesting but the example of an esoteric fund like water is something few retail investors would/should own. I would rather see the analysis on global or whole of market ETFs or such like which retail investors should own. I suspect the figures would look much less interesting for investors.