It released its latest Financial Stability report this week, which looks at the banking and insurance sectors.

The report highlighted life insurers' tendency to rely on financial advisers, rather than shifting to online and direct distribution as many general insurance providers have done.

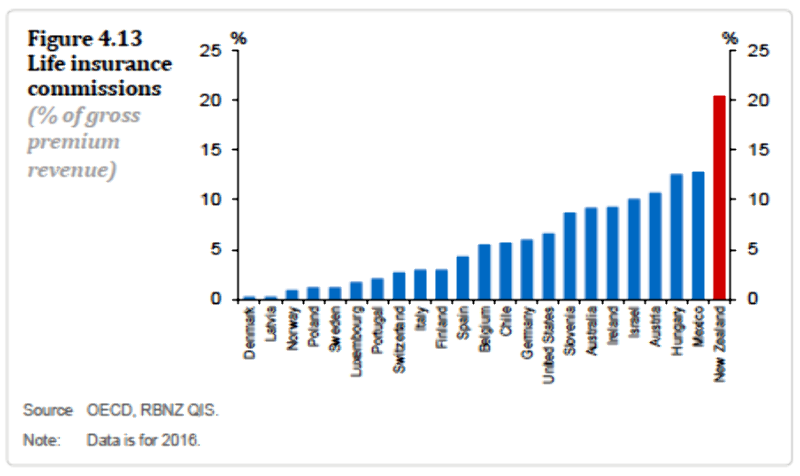

It compared commission in New Zealand to that paid by insurers in other countries and found New Zealand's insurers - paying commissions of about 20% of gross revenue - were at a level almost double their nearest counterpart, Mexico, at just under 13%.

The United States was at about 5% of revenue and Australia just over 10%.

Reserve Bank governor Adrian Orr said the comparison was included "because sunlight is a good disinfectant".

“We can’t micro-manage this industry but it has some real specific issues.”

The report said, while advisers had an important role in helping buyers pick the right products for their circumstances, the commissions and other incentives they were paid created a risk.

"In some cases, advisers could be incentivised to encourage policy-holders to switch to different insurance policies, even if the changes do not benefit the policyholders.

"Such activities can compromise the efficiency of the sector because policyholders may not be matched with the best policies and ultimately end up funding high commissions through high premiums."

The Reserve Bank and Financial Markets Authority are working on a review of the conduct and culture of the life insurance sector, following a similar investigation into banks.

A report is expected in January.

Orr said insurers should expect a verdict worse than that handed down to banks.

| « It's goodbye to Sovereign | Mixed reviews from advisers on FMA regulation » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

And, as usual, no empirical evidence provided to show that consumers suffer adverse outcomes as a result of the remuneration structure.

In other words, tired old chestnuts trotted out in "me too" fashion as some sort of definitive revelation - without a shred of evidence, research, or proper investigation.

The author clearly has no idea how a life insurance premium is constructed or the role that reinsurance plays in funding retail distribution.

Even in these brief extracts, note the deployment of "could". "might", "can" and "may" - nothing more than surmise. hypothesis, and conjecture.