by Andrea Malcolm

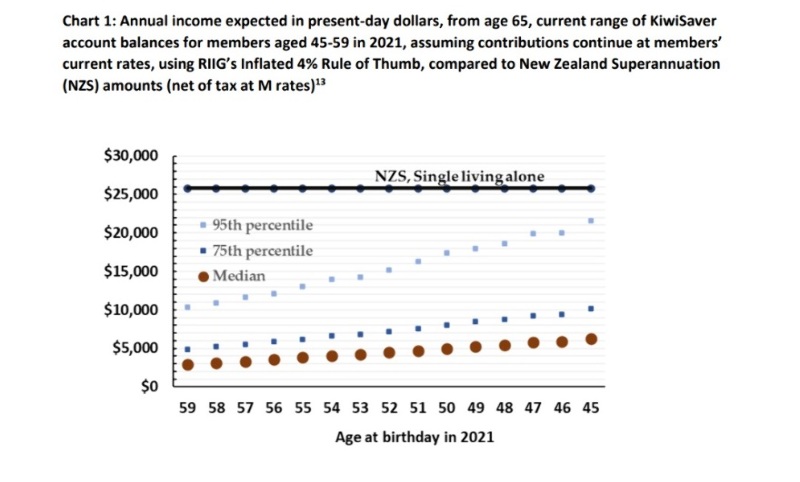

In a review of NZ superannuation (NZS) the group (RIIG) refutes arguments that the country can’t afford to keep the retirement age at 65 and says means-testing would be too complicated. Instead it hangs its hat on KiwiSaver but not under the current policy settings and public saving behaviour.

Looking at the latest longevity data and other research, RIIG says trends which argue against diminishing the role or restricting the value of NZS should be recognised. It says debate usually focuses on the ‘cost’ of NZS, which is often portrayed wrongly as being in crisis.

“Expenditure is a policy choice. Looking at KiwiSaver policy is more relevant than reforming NZS now.

“KiwiSaver balances are not going to be high enough to allow any painless reduction in NZS. And inequalities in length of life are significant and visible to the extent that they should be addressed before planning to make them worse.”

The report says all proposed reforms to NZS are problematic, and none are simple enough to be “silver bullets”.

It says means-testing, which is complex to administer and can be a disincentive for working past 64 or saving for retirement and flexible age of eligibility as particular fails when assessed against its principles for reform.

These principles are that retirement income should be equitable, give retirees an adequate level of income, be empowering by encouraging people to save for and plan their retirement with certainty, be sustainable and easily accessible and understood.

Mortality and ethnicity

Looking at mortality rates RIIG says after decades of improvement, mortality has plateaued and future trends are not clearly positive. It suggests an independent review of the age of eligibility should be repeated at intervals with planned increases cancelled if trends turn out worse than expected. Increases for successive generations will probably happen in waves due to technologies such as advanced cancer diagnostics and personalised medicine.

However lifespans vary by ethnicity and are significantly shorter for Māori and Pacific groups, which is a key concern.

The most likely age of Māori and Pacific people who die in 2023 is under 65 but is expected to be 75-84 in 2043. However, the deaths of those in other ethnic groups are already most likely to be at ages 75-84 and are expected to be at ages 90+ in 2043.

While a large part of this is because of the younger age structure of the Mōri and Pacific groups, it also points to significant ongoing mortality differentials between ethnic groups.

“The significant visible differences in lifespans in New Zealand suggest at least not increasing the NZS age of eligibility until there is evidence of the gaps closing.”

Younger generations

The report says today’s younger people may need NZS more than older generations. Although younger people could be in KiwiSaver for longer, they might have less potential to own a home and save. “The importance of NZS could grow if younger generations turn out to have saved less than older generations, as seems likely.

“Retaining NZS at current settings is one way every generation can have similar financial security in later life, recognising there will be differences in work and savings potential over time.”

If the age of eligibility were to be increased, simply linking it to a longevity index is not a good option, RIIG says.

It would not take politics out of the decision; ignore inequalities and not work as intended as it could be highly sensitive to assumptions which can change frequently. “Instead, we favour a well-designed independent assessment of relevant factors including longevity trends.”

But if the eligibility age were to be increased, there should be a reasonable lead-in time, 10 years from overseas experience, and a phased approach, so people would have time to adjust their financial situation, says the report. Putting information on NZS including age of eligibility, on KiwiSaver statements, would help to ensure people are not taken by surprise.

| « US rally boosts Sharesies retail sentiment defying usual Christmas jitters | Salt looks to valuation and thematic support in 2024 » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

My parents in Australia recently reached retirement age and the process to establish and manage their age-pension has been a challenge. This is coming from an actuary with a background working in superannuation.

The system of means-testing is so complicated and ever-changing that the unfortunate Centrelink staff tasked with administering it often struggle to apprehend the rules. On more than a few occasions, payments have been incorrectly calculated and hours have been spent over the phone (and in person) correcting the mess.

Retirement planning is a long-term proposition. Governments must resist the temptation to muck around with it to give people the confidence they need to plan.