EMERGE Series 2: New capital protected emerging markets fund

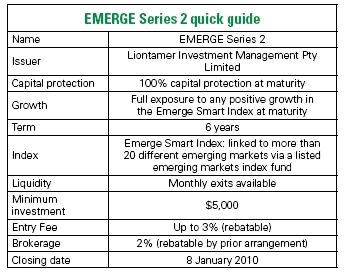

Liontamer's latest capital protected fund provides an exposure to over 20 countries that are preparing to become major players on the world's economic stage, including China, India, Brazil, Russia, Mexico and South Africa*. To help manage the risk inherent in these rapidly growing, but sometimes volatile, markets EMERGE Series 2 has two key elements: 100% capital protection at maturity and a new Smart-Exposure feature.

Friday, October 30th 2009, 11:17AM

Why emerging markets?

Why emerging markets?

Emerging markets can play an important role in an investment portfolio. Firstly, there are diversification benefits that may be gained from having an exposure away from local markets, and secondly, companies operating in rapidly developing markets tend to be more dynamic and faster growing than those in more traditional developed markets. For investors, this means that emerging countries can offer the potential for higher returns from growth markets as well as the important diversification benefits that can be obtained from an exposure to a variety of companies in different geographic regions.

Emerging market countries represent over 80% of the world's population and yet only produce around 20% of the world's goods and services1. Meanwhile, according to the IMF, more than two-thirds of global growth is currently being contributed by emerging market countries. While the US and Europe struggle to maintain growth rates of 2-3%, many emerging markets are growing at 6% or more2. Unsurprisingly, the economies of China and India lead the charge, growing at much faster rates than those of the developed west, despite a backdrop of global financial turmoil.

One of the engines driving this growth has been demographics. While the populations of the developed world are ageing rapidly, those of the emerging nations tend to have a much younger profile. According to a recent report3 in the UK, the developed world has a working population (in the age range of 15 to 64) of about 830 million. This is set to fall to less than 750 million by 2050. In contrast, the working-age population in emerging markets is about three billion and is expected to be more than four billion by 2050. These people will provide emerging economies with a valuable pool of labour and an expanding consumer market.

In addition, major reforms in emerging markets over the last few decades have helped to stabilise currencies, regulate financial systems, attract foreign investment and make it easier to trade with the rest of the world. Governments with developing economies now increasingly have the means to finance and build essential infrastructure like roads, schools, energy projects and telecommunication systems. Crucially, as these economies grow and prosper, their massive populations are becoming more educated and workers are in turn able to demand higher wages. This has created a large group of middle-class consumers who are now able to afford more nutritious foods, healthcare, and big-ticket items like houses, cars and TVs.

Smart-Exposure

While there's the potential for higher returns from emerging markets, it's important to recognise that they are often riskier and more volatile than larger, more developed, sharemarkets. To help manage this risk, EMERGE Series 2 has an innovative new feature called Smart-Exposure that aims to provide a more intelligent method of generating returns from emerging markets. It does this by varying the exposure to a listed emerging markets index fund from between 0% and 200% on a daily basis.

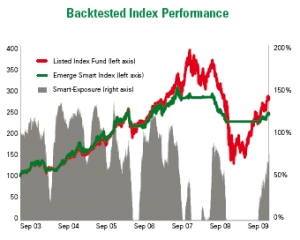

When the markets are showing steady, more stable, daily movements, the Smart-Exposure strategy increases the extent to which the Emerge Smart Index tracks a listed emerging markets index fund. The exposure can be significantly over 100%; boosting the daily movements. When the markets become riskier and returns are increasingly volatile, the strategy reduces the Emerge Smart Index's exposure to daily movements in the listed index fund to below 100%. At the extreme, EMERGE Series 2 can even have no exposure at all (0%) until things stabilise. This happened during the recent credit crisis and would have prevented large losses (see chart).

While it's important to remember that past performance should not be used as a guide to the future, it's interesting to consider how the Emerge Smart Index would have performed in opposing situations of stability and extreme volatility.

The chart shows how the Emerge Smart Index (green line) has tracked the underlying listed index fund (red line) over the last six years. The black shaded area shows the daily changes in the level of Smart-Exposure. When returns have been fairly stable (e.g. September 2003 to August 2007) the tracking between the Emerge Smart Index and the underlying listed index fund was very close. In the past two years we have seen an unprecedented level of volatility in markets, including the credit crunch and the resulting world recession. In this situation, the effect of Smart-Exposure was to smooth out returns.

The latter half of 2007 saw a sharp upward move in markets with large daily movements. This frequently caused the level of Smart-Exposure to be reduced to zero. As can be seen, the gains were quite short lived and were followed by one of the largest falls ever seen in sharemarkets. At this time the Emerge Smart Index again had its exposure to these movements reduced to zero, which protected it from a substantial decline.

A smart way to access emerging markets

By providing a dynamic and varying exposure to a range of growth markets, the EMERGE Series 2 Smart-Exposure feature aims to help manage risk and smooth out returns. And when combined with the reassurance of a full return of capital at maturity, EMERGE Series 2 provides a compelling option for those advisers and investors seeking the growth potential of emerging markets but who may be concerned about the potential risk of capital loss.

For more information and a copy of the EMERGE Series 2 Investment Statement contact Liontamer on 0800 210 450 or email adviser_relations@liontamer.com

Full details are contained in the Investment Statement and registered Prospectus, provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325). Copies are available upon request from Liontamer by calling 0800 210 450.

1. Goldman Sachs, JP Morgan, October 2009. 2. IMF Global Outlook, October 2009. 3. The Times, 10 October 2009. *Capital protection at maturity means you will receive back 100% of the combined amount invested and early bird interest (earned during the offer period) less any entry fee charged (up to 3%) and any exit fee. Capital protection only applies at maturity. There is a more detailed description of capital protection in the Investment Statement and the limited circumstances when capital protection may not be available.

| « The rational bubble | Q&A: TOWER Parallel Portfolios » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |