Roy Morgan paints sobering picture of insurance coverage

More Kiwis running the risk with falling rates of health, home, car and life insurance. [WITH GRAPH]

Monday, April 7th 2014, 2:46PM  4 Comments

4 Comments

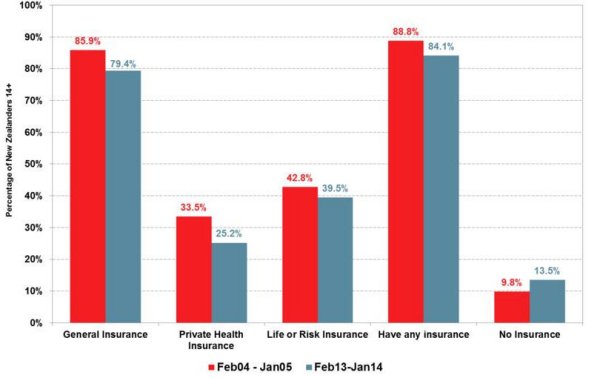

Almost one in seven Kiwis (13.5%) now have no insurance whatsoever, up from fewer than 1 in 10 (9.8%) in 2005, the latest data from Roy Morgan Research shows.

The proportion of New Zealanders covered by all types of insurance has been in steady decline. In the 12 months to January 2005, 85.9% had general insurance such as home, vehicle or other property; as of January this year, it is 79.4%. The proportion with life or risk insurance is down from 42.8% to 39.5%.

But private health insurance has suffered the biggest proportional decline over the period, from 1 in 3 Kiwis covered in 2005 to just 1 in 4 at the start of 2014.

Over the period, average annual private health insurance costs have ballooned by over 50%, from $1136 to $1726, costing the average policy-holder almost $600 more per year.

The rising average dollar expenditure can be largely attributed to members dropping out altogether when policy costs become too high. In 2005, 782,000 Kiwis had health insurance costing them under $2000 per year; today, it’s 516,000. But while the number of Kiwis who spend over $2000 per year on private health insurance has almost doubled from 115,000 to 222,000 in the period, this still equates to around 159,000 leaving the system.

Private health insurance coverage rates have declined across all groups, most dramatically among 25-34 year-olds, with only around 1 in 5 now covered compared with 1 in 3 in 2005. The proportion of 50-64 year olds covered has also declined sharply, from just under half in 2005 to 37% now.

Overall, 84.1% of New Zealanders have some kind of insurance, down from 88.8% in 2005.

“The rate of all forms of insurance coverage among New Zealanders has declined over the past decade, particularly in the area of private health, Roy Morgan Research general manager Pip Elliott says. “Consequently, Kiwis have become increasingly reliant on the national public health system.”

“Right now, it’s a vicious cycle: rising private health insurance policy prices lead to fewer participants (and a concentration of them with higher-cost medical needs), which in turn leads to higher costs again.

“Two thirds of Kiwis (66.5%) with private health insurance are with one of the top three providers: Southern Cross Healthcare (including Aetna), Tower or Sovereign. Although the market share for Southern Cross has declined from 52.7% since 2005, it still remains far and away the largest provider, with 48.4% of the market.

“Around 4 in 10 of those with private health insurance obtained it through their employer, and another 4 in 10 through an insurance broker, institutionally affiliated or independent financial advisor or the insurance company directly.

“Australians are slightly less likely than New Zealanders to have general insurance (74.6% compared with our 79.4%) but are overwhelmingly more likely to have private health insurance (40.6% vs our 25.2%).”

| « AMP offers direct life cover online | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

New Zealand's social policies and ACC system have been, and still are, among the best in the world - if "best" means generous/comprehensive. This has led to several consecutive generations who have become accustomed to the perception that the state will provide for them, and insurances therefore being regarded as a nice-to-have item that directly competes with fuel, food, and entertainment in the typical Kiwi budget.

Those same welfare and health systems are also expensive and increasingly inefficient, and struggling under the demands of an ageing population, shrinking tax base. These perceptions are not based on the current reality (eg the oldest baby boomers are already retired), and expectations far exceed the capabilities of govt to provide for them.

Any adviser who has worked recently with migrants from countries such as SA will understand the vast difference in NZers attitudes.

Either NZ's attitudes to insurance, or their expectations for health and welfare, need to change. Perhaps both.

Sign In to add your comment

| Printable version | Email to a friend |