Inflation; transitory traveller or a more permanent fixture?

In this article we contribute to the on-going discussion of is inflation coming or not.

Friday, August 6th 2021, 6:42AM

by Stephen Bennie

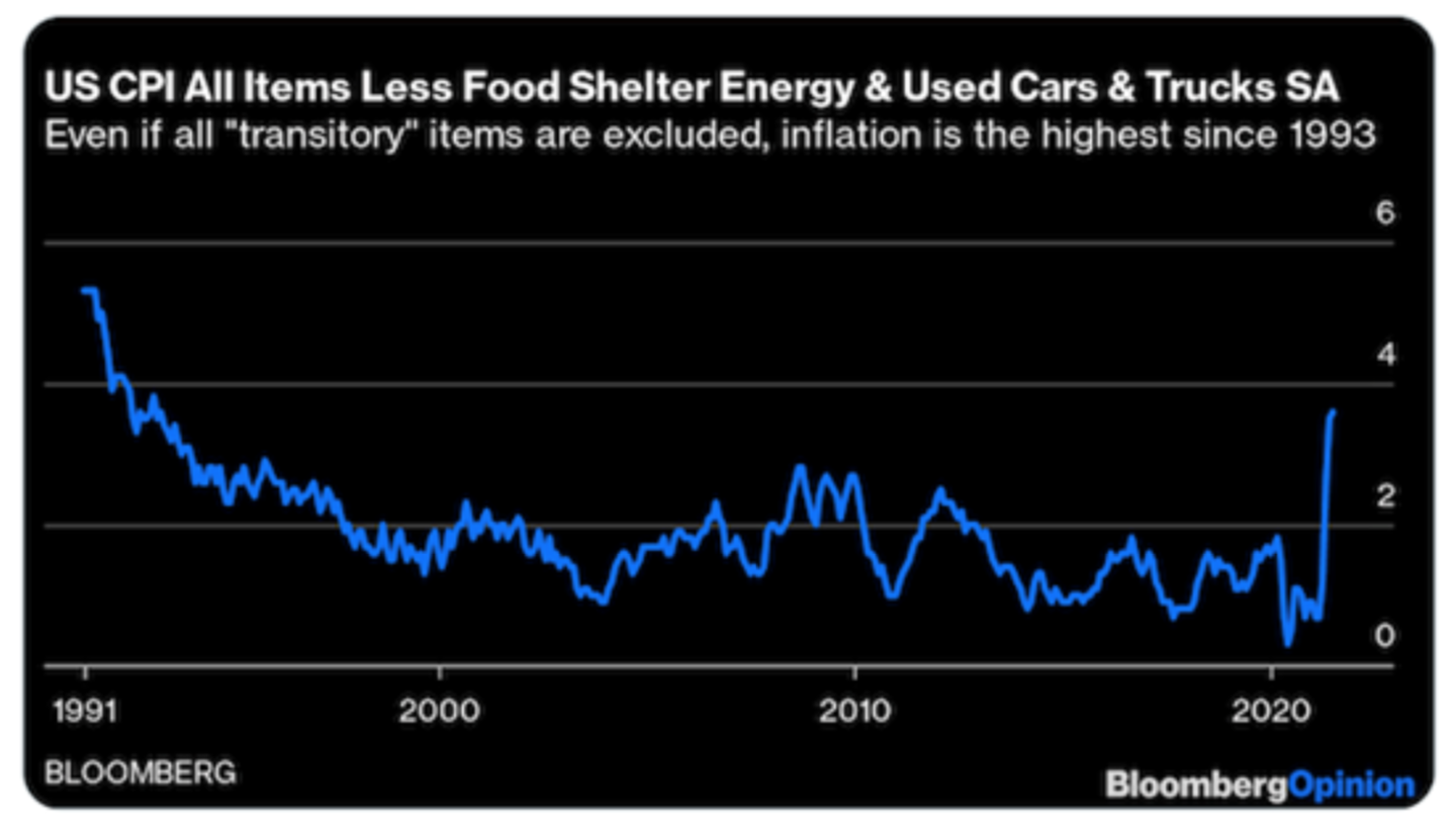

There is little doubt that Elvis is in the building, in this case Elvis being elevated data points of price inflation. Central banks are adamant that these data points are merely the result of transitory inflation, and that Elvis will shortly be leaving the building. The chart below is a very clear indication that since the beginning of 2021 prices have been rising, certainly in the context of United States consumer price index (CPI).

Their CPI is sharply higher even when baskets of goods and services that might be considered more “transitory”, such as rent and petrol, are removed from the calculation.

That version of CPI is at its highest level in nearly 30 years. Elvis and his band have definitely started playing some rock and roll music.

To be more accurate then, central banks should really be talking about high but transitory inflation. That could turn out to be what happens but it’s clearly a harder ask than dealing with a bout of moderate short-term inflation.

To be more accurate then, central banks should really be talking about high but transitory inflation. That could turn out to be what happens but it’s clearly a harder ask than dealing with a bout of moderate short-term inflation.

So, what are bond investors making of the situation? It is a massive issue for them because transitory is a short-term bump while full blown inflation is potential carnage. The chart below shows the yield of the bell weather 10-year US Treasury Bill over the past decade. The long-term trend has been downwards, to such an extent that yields reached inter-generational lows, particularly in the virus sell-off last year when yields touched 0.5%. That’s a very, very long way from the 15% yield that prevailed in the 1980s when central banks were struggling to control inflation.

The really interesting part of this chart, if charts can ever be interesting, is that despite the recent raft of expansionary economic data prints, over the past few months 10-year yields have dropped quite sharply. Back in March consensus was firmly of the view that rates would certainly get back over 2%, as the global economy reopened and reflated. Yet here we are heading into August and rates have dropped back closer to 1% again. It appears that bond investors have settled into a view that inflation pressures are transitory and further economic disruption from the delta variant will see economic data readings cool as we head into 2022. This may prove right, and Elvis may be about to leave the building.

The really interesting part of this chart, if charts can ever be interesting, is that despite the recent raft of expansionary economic data prints, over the past few months 10-year yields have dropped quite sharply. Back in March consensus was firmly of the view that rates would certainly get back over 2%, as the global economy reopened and reflated. Yet here we are heading into August and rates have dropped back closer to 1% again. It appears that bond investors have settled into a view that inflation pressures are transitory and further economic disruption from the delta variant will see economic data readings cool as we head into 2022. This may prove right, and Elvis may be about to leave the building.

However, anecdotes abound regarding price increases that suggest transitory inflation may be more hopeful than realistic. One example, McDonald’s until recently paid their restaurant staff an hourly rate of around US$10. Today new staff are being offered US$18 an hour. That is a massive rise, and it has a twofold impact. McDonald’s employees will have greater discretionary spending power, and the cost of McDonald’s burgers will be going up. As an aside, imagine being paid more than $50k a year to flip burgers, 2021 is a different world for sure.

The likely two main reasons for this rapid wage inflation are that travel restrictions are hampering the work force from going to where the jobs are, and due to the massive direct stimulus packages workforce participation is lagging the reopening of the economy. The key question is, can those issues be resolved which will ease near-term pricing pressures.

Investment markets are a highly unpredictable experience, and that lack of certainty is the genesis of every investment opportunity. But a statement that can be made with some certainty is that the CPI chart and the 10-year US Treasury chart cannot point in such polar opposite directions for much longer. And if it turns out that Elvis is doing a full 3-hour Las Vegas set then there’s going to be much higher bond yields before he finally leaves the building.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

More information can be found at:

www.castlepointfunds.com.

| « Murder House memories: why KiwiSaver investors need to brush-up on good financial habits | 2000 new investors flock to latest commercial property deal » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |