Rental prices inch up; property sales slump to new low

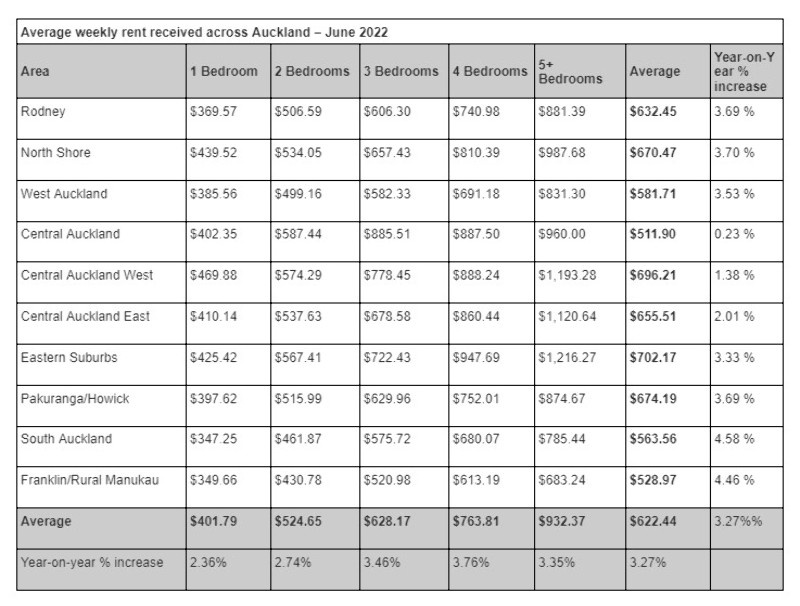

Auckland’s average weekly rent rose by $6.12 (or 1%) to $622.44 per week for the quarter ending June.

Monday, August 8th 2022, 10:10AM

by Sally Lindsay

When compared to a year ago, the increase is 3.27%, or $19.70 more per week, data from 16,000 properties managed by Barfoot & Thompson show.

Barfoot & Thompson director Kiri Barfoot says the figures are consistent with the trend observed over recent quarters, which typically sit about 3% year-on-year, but she notes there are a wide range of factors at play.

“The market has been catching-up off the back of frozen and slower-moving rents in 2020 and early 2021.

“At the same time, property owners have been working to accommodate new levels of compliance and higher operating costs, including rising interest rates and the removal of tax deductibility.

“All of these have put pressure on rental pricing, although the recent increases have been quite measured compared to the 5% and 6% peaks we’ve seen in the past.

Barfoot says contrary to the existing trend, rent increases might ease in the months to come.

While not visible in the agency’s data, Barfoot says she is hearing of instances across the country, including in Auckland, where properties are becoming slower to rent or need a reduction in price to meet the market.

“This could be partly seasonal – we often see people hunker down in the winter months, but it is more likely to be the rising cost of living. People are grappling with tight budgets, and property owners will be recognising the importance of a shorter vacancy and a sustainable tenancy over higher yield.”

Central Auckland properties – dominated by apartments, were the cheapest in the quarter at an average of $511.90 per week in June, while homes in the eastern suburbs were the most expensive at an average $702.17 per week.

West Auckland, South Auckland and Franklin all offered average weekly rents under $600 per week.

By size, four-bedroom homes attracted the most price growth at 3.76%, while one and two-bedroom homes attracted the least.

For the typical Auckland rental, a three-bedroom home, the average weekly rent was now $628.17, up 3.46% or about $21.01 per week on a year ago.

Table of averages by area and property size:

July sales plummet

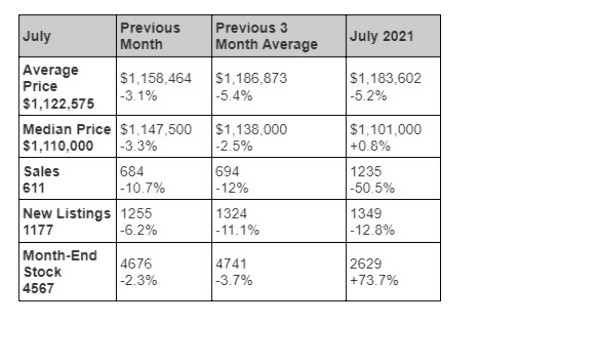

House sales by Barfoot & Thompson during July were the lowest for that month 22 years.

Just 611 properties were sold. Barfoot & Thompson managing director Peter Thompson says prices and sales out of sequence, as vendors and buyers establish where the market is priced.

He says the July sales data indicates the Auckland market is gradually readjusting to a lower sales price point in a controlled manner rather than vendors reacting impulsively to slower sales.

“There is still a strong flow of new property reaching the market and in July the agency listed 1,177 new properties, lower than normal for this time of the year but given slow sales it is giving buyers new options.

While the number of residential properties sold fell significantly, the median sales price retreated only slowly.

The median sales price for the month at $1,110,000 has fallen only 2.5% on the average median price over the past three months and is still 0.8% ahead of the median price in July last year.

“Prices are definitely retreating but at the current level, these prices would have been regarded as excellent 12 months ago,” says Thompson.

“There has been greater movement across the average price, which at $1,122,575, is down 5.4% on the average price for the previous three months.

The rural and lifestyle sectors did not experience the same downward pressure of sales as the residential market, and experienced the fourth best trading month of the year, with sales in excess of $78 million.

| « Biggest fall in house prices for 14 years | Staggering drop in housing market annual growth » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |