OCR cuts and when they will start

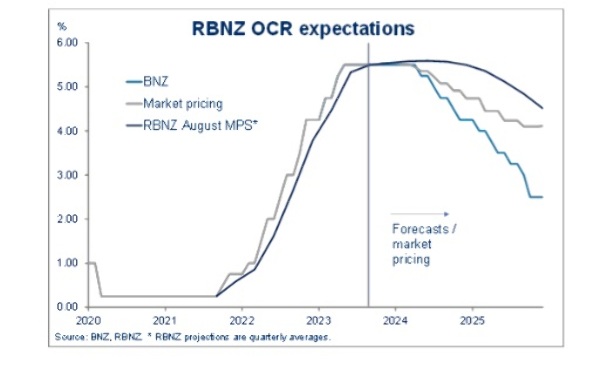

Financial markets are pricing in an aggressive easing of almost three OCR cuts next year – a quantum leap from the RBNZ’s previous forecasts of no cut until the first quarter of 2025.

Tuesday, November 21st 2023, 10:24AM

by Sally Lindsay

Squirrel Mortgages managing director John Bolton says if the OCR does start falling, previous experience suggests there will be no advance warning from the RBNZ beforehand.

“It always tends to talk rates up until the moment it starts to drop them — so there’s no way of knowing exactly where its head is at.”

Most economists are still picking the end of next year or early 2025 before rates start to fall. ANZ has ditched its prediction there will be another OCR rise early next year, although Westpac is still favouring that track.

Bolton says with the economy’s weakness, he wouldn’t be surprised if there was an OCR cut as early as the middle of next year.

Six days away from the RBNZ’s final monetary policy decision for this year, Kiwibank says the data has aligned for the OCR to remain unchanged.

Inflation has fallen beyond the RBNZ’s forecast and the labour market has loosened at a swifter pace than expectations, Jarrod Kerr, Kiwibank’s chief economist says.

BNZ head of research Stephen Toplis says movement in the labour market is nothing short of startling. “Businesses have rapidly moved from not being able to find staff, for love nor money, to having choice in who they hire.”

This is best seen in NZIER’s QSBO which shows the ease of finding skilled labour improving markedly and labour turnover tumbling. Both of these variables are key indicators for future wage inflation. This, plus feedback from businesses, convinces us that wage inflation has well and truly peaked, Toplis says.

Adding to the OCR expectation, high interest rates have also depressed consumer spending – down 3.7% over the past three quarters and falling.

Migration hitch

However, the BNZ says a potential ankle tapper in its hypothesis is the role of migration in the economy. The ongoing net inflow of migrants is defying expectations. This is putting upward pressure on demand and is a key booster of the apparent turn around in the housing market.

“Both real activity and housing activity are probably running hotter than RBNZ expectations. All other things being equal, this is inflationary,” Toplis says.

He believes the RBNZ will chip a few basis points, say five, off its published OCR rate peak in next week’s Monetary Policy Statement (MPS) and then move its first modest rate cut sooner.

“Given there will be no specific date identified for a rate cut this could simply be expressed as a modestly lower cash rate for the first quarter of 2025 or, maybe, moving the rate track nearer by a quarter intimating that a cut in the fourth quarter of next year is now a real possibility.

“On the one hand, we believe the RBNZ will have to present a slightly easier stance than it did previously but, on the other, it will still have to be fairly aggressive in its commentary that there will be no rate cut any time soon.”

The ANZ says while it is universally expected that the OCR will not change, the RBNZ faces a communications challenge, given the market is itching to price in cuts more aggressively. It expects a firm tone to the MPS.

“If the RBNZ gives an inch, the risk is the market takes a mile,” Sharon Zollner, ANZ’s chief economist says.

“Publishing a lower OCR track could cause an unintended and unhelpful easing of monetary conditions. If the OCR track is raised, on the other hand, the market is likely to raise a sceptical eyebrow.”

By far the most straightforward approach, Zollner says, is to keep the OCR peak unchanged from August’s 5.59%, stress there is a long way to go yet and the next move could be in either direction, depending on how the data rolls. “This is a common line amongst central banks globally, many of whom are facing variations of the same challenge,” she says.

| « Payments NZ wants changes to open banking bill | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |