Kiwi appetite for housing debt seems to be abating

New Zealanders’ appetite for debt, mostly put to use in buying property, seems to have at last abated after a decade of giddy growth, according to the Reserve Bank.

Monday, July 9th 2001, 12:03PM

by Jenny Ruth

Growth in household debt slowed to 6% in the year ended May from 8.4% in the previous year. That’s the slowest rate of growth of borrowing experienced for more than 20 years, say Clive Thorp and Bun Ung in the Reserve Bank’s latest bulletin.

Almost 91% of the $71.9 billion New Zealanders owed at the end of May was in housing loans.

As Thorp sees it, since the banking system was liberalised in 1985, we’ve been catching up with patterns seen in other OECD countries with similar banking systems.

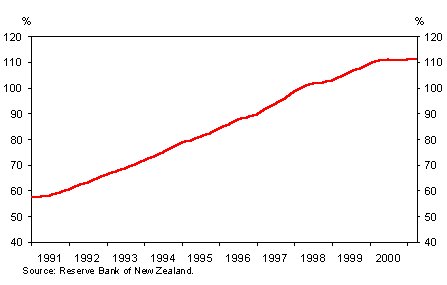

The growth in debt was certainly phenomenal. As a percentage of disposable income, household financial liabilities almost doubled in the decade to 2000. Debt is now at about 110% of disposable income.

"In other similar countries, it hasn’t carried on getting higher. It’s sometimes declined. It looks like 100% to 120% is what countries do when they have banking systems like ours," Thorp says.

During the course of this borrowing spree, household financial assets have increased 80% in real terms since 1980 while household liabilities have increased 240%, his article shows.

In 2000, housing represented more than 80% of the net wealth of New Zealand households, an increase from under 70% in 1980.

Household real net financial wealth (financial assets less liabilities), which was relatively constant from 1985 to 1995, has declined over 20% since then.

Net household wealth as a ratio of personal disposable income has declined over 10% from its peak in the mid-1990s to a level now similar to that of the mid-1980s.

"In 2000, there has been some evidence that the pace of housing investment has slowed. Over the next five years we might expect to see some improvement in the value of the gross net financial assets of households as they rebalance their wealth holdings," it says.

The article also concludes that the borrowing needs of New Zealand households are well catered for, even though household debt is highly concentrated with five large banking groups holding over 90%.

"The lending market’s high degree

of concentration is associated with vigorous competition for market

share and efficient delivery of home loans," it says.

Household debt as a percentage of nominal disposable income

| « RB leaves cash rate unchanged | Interest rates continue to rise » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |