Hedge Funds - The next essential asset class

Ever wondered what all those different terms for hedge funds really mean? In this article Deutsche Asset Management explains global macro, long-short strategies and more.

Saturday, September 1st 2001, 7:34PM

Absolute return strategies

In a nutshell

Absolute return strategies typically offer higher returns with bond-like risk. Their low correlation with traditional asset classes and capacity to generate high absolute returns regardless of market direction represents a potential major benefit for investment portfolios. This benefit comes to the fore in a period during which traditional asset returns revert to historical norms. This is consistent with the general market consensus for lower returns from equity markets over the next few years.

The appropriate allocation to absolute return strategies depends on an individual fund’s specific requirements and objectives. As a guide, however, between 5% and 30% of a diversified fund is considered suitable to gain the benefits that these strategies offer.

Hedge fund strategies

Although fund strategies can be broadly categorised as below, there is no industry standard definition. Potential investors should take this into account when comparing different fund managers strategies.

- Equity hedge – aims to take advantage of superior stock selection by short-selling overvalued securities and taking long-positions in undervalued stocks.

- Relative value (market neutral) – this strategy attempts to exploit temporary anomalies between related equities, fixed interest securities and derivatives, usually involving the same company, by being simultaneously long and short.

- Global macro – this strategy uses macroeconomic research to take advantage of expected movements in different national markets by taking simultaneous long and short positions. Such funds may be highly opportunistic and highly geared.

- Event-driven – this strategy focuses on companies in special situations such as corporate restructuring, acquisition, merger and bankruptcy. Fund managers will typically take a long position in the company being acquired and a short position in the acquirer. The principal risk factor is the deal risk rather than the market risk.

- the fund is offered via a unit trust which has limited liability

- the fund invests in underlying limited liability companies.

Typical example: A fund manager specialises in e-commerce stocks. After a market correction in technology stocks the manager seeks to capture the potential benefit a rising from stock valuation inconsistencies.

Overvalued stock is then sold short before the price falls. New or undervalued stocks with strong growth potential are then bought before they become well known.

The fund thus benefits irrespective of overall market movements in the Internet sector.

Typical example: The fund manager identifies pricing discrepancies between convertible bonds issued by ABC Company, their constituent components, and the company’s ordinary shares. The market price of the convertible bond is less that the sum of the theoretical values of its components and the bond is therefore bought. To offset the stock-specific risk the manager sells short shares of ABC Company.

When the pricing anomaly disappears and the intermediary net cashflows are positive, the fund profits when the manager unwinds the initial trades.

Typical example: Approaching the euro launch date on 1 January 1999, Italian interest rates were expected to fall substantially to the eventual euro-zone average and thus the price of Italian government bonds would rise. German government bonds, by contrast, with a yield likely to approximate the eventual euro-zone average, were expected to remain relatively stable.

The hedge fund manager would have bought Italian government bonds and sold short German government bonds in order to hedge the overall euro-zone bond market risk.

When prices of Italian bonds rose (yields fell) as expected, the manager locked in the profit.

Typical example: Company A plans to take over company B at a purchase price 20% above B’s current stock price. However, the market doubts the take-over will succeed and B’s stock price does not increase following the announcement.

The event - driven manager anticipates the takeover will succeed at the offer price. He expects the stock price of company A will decline and buys stock of company B, simultaneously short selling Company A stock. The fund profits from the rising stock price of company B, and the declining stock price of company A.

This profit will be made if the takeover occurs regardless of whether the equity market moves up or down.

Multi manager Funds

Due to the complexity of markets and sophistication of strategies investors have generally accessed the hedge fund industry via a multi manager portfolio or also commonly referred to as a fund of hedge funds.

The vast majority of hedge fund investors have invested in these portfolios which are diversified across a range of managers and strategies. They generally offer investors low entry requirements, access to experienced management, regular reporting and enhanced liquidity.

Summary

Due to growing appreciation of their objectives and the potential benefits, combined with improved transparency and much easier access, absolute return funds are gaining wider acceptance as suitable investments for both individual investors and institutional funds.

Deutsche Asset Management

Deutsche Asset Management’s Absolute Return Group has packaged a number of investment opportunities encompassing absolute return strategies for the market. As a market leader with more than $1 billion in funds sourced from the Asia/Pacific region and more than $11 billion globally, the Deutsche Strategic Value Fund (DSVF) was the first multi-manager product for the Australian market place that meets all the local tax and regulatory issues.

The DSVF offers investors access to global relative value strategies in a wholesale vehicle. The objective of the DSVF is to deliver consistent medium term appreciation with low volatility and low correlation to the broader equity and fixed income markets. The fund aims to preserve capital and achieve its objectives through a multi-manager approach which combines lowly correlated assets with superior risk adjusted returns.

The DSVF invests in "Blue Chip" specialist funds from around the world and only uses those specialists that are from within the conservative end of the hedge fund spectrum, that is non-directional or that have a ‘hedged’ approach.

Whilst hedge funds are perceived to be risky, the use of derivatives within the fund is primarily to mitigate risk within the portfolio. In addition the fund has two levels of risk in terms of its structure;

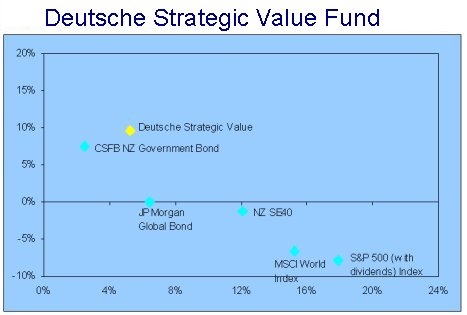

The performance of the DSVF since inception (December 1999) has been 9.6% pa with a volatility (as measured by standard deviation) of 5.2% This compares favourably with many traditional equity and debt markets both locally and globally as can be seen in the graph below.

It is the heightened volatility and uncertain economic environment combined with the outlook for lower returns from traditional markets over the next few years that has created the impetus for investors to seek absolute return investments like the Deutsche Strategic Value Fund.

|

|

Compound Return |

Annualised Volatility |

|

Deutsche Strategic Value Fund |

9.6% |

5.2% |

|

JP Morgan Global Bond Index |

0.04 |

6.4 |

|

CSFB NZ Govt Bond Index |

7.5 |

2.5 |

|

MSCI World Index |

-6.7 |

15.3 |

|

S&P 500 (with divs) |

-7.9 |

17.9 |

|

NZSE40 Index |

-1.2 |

12.1 |

|

Performance (net of fees) is from inception of fund December 1999 to July 2001 |

Source: Bloomberg and Deutsche Asset Management |

|

Performance figures show compound returns of the Fund and of the various indices for the period 1 December 1999 to 31 July 2001. Fund performance is net of fees and transaction costs and assumes the reinvestment of all distributions and earnings. Performance of the Fund is in Australian Dollars, therefore NZ Dollar returns may be impacted by currency fluctuations. Past performance is not necessarily indicative of future performance.

Initial investments in the Deutsche Absolute Return Strategic Value Fund may only be made on an application form attached to the current investment statement, which is being registered for offer in New Zealand. The holding of units in the Fund is subject to investment and other risks, including possible delays in repayment and loss of income and principal invested. No guarantee is made as to the return of capital of performance of the Fund.

References to "Deutsche" or "Deutsche Asset Management" are to the global asset management division of Deutsche Bank AG. Unless otherwise indicated, all figures are as at 31 July 2001.

| « Taking tech's pulse and assessing its future | How do hedge funds work? » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |