The 10 commandments of hedge fund investing

Frank Russell's Ed Smith outlines the 10 commandments of hedge fund investing.

Saturday, September 1st 2001, 11:13PM

- 1. Avoid poor manager selection - the

biggest risk in hedge fund investing

- Unlike investing with active managers in traditional asset classes, the dispersion of risk and return amongst hedge fund managers is huge, even amongst managers pursuing similar strategies.

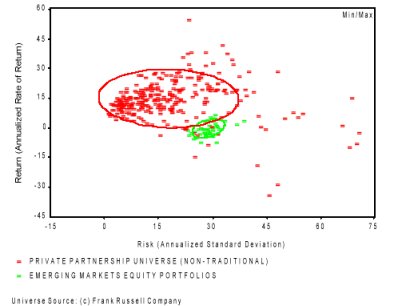

The chart below presents the historical dispersion of risk and returns between hedge fund managers, and arguably the most volatile 'traditional' asset class, emerging markets equities.

The ellipses represent the outer band of risk and return for 68% of managers in each asset class. As you can see, in hedge funds manager selection is critical.Dispersion of Risk and Return

5 Years Ending 31 December 2000

68% Ellipse

- Unlike investing with active managers in traditional asset classes, the dispersion of risk and return amongst hedge fund managers is huge, even amongst managers pursuing similar strategies.

2. Diversification is the key to risk

control - use it to your advantage

Hedge funds are not a homogenous asset class. There are a number

of distinct strategies with differing risk and return characteristics.

An effective means of controlling risk in your hedge funds program

is to diversify across a number of strategies.

You should also

spread your investments across a number of hedge fund managers.

3. There are no free lunches - if it

sounds too good to be true, it probably is

Do not be swayed by promises of fabulous returns. There is always

a catch, and often risks are not fully explained.

4. Know your enemy - If you don't understand what you are investing

in, don't invest

Historically, the hedge fund industry has been opaque, with managers

unwilling to provide significant information regarding portfolios, and their risks. You wouldn’t

climb Mt Everest without the right training and using a guide.

So don’t invest in hedge funds without an experienced guide.

- 5. You can't buy past performance -

don't use it to pick hedge fund managers

- Numerous studies show that past performance is a very poor guide to future performance, which is why most managers state this in their advertisements. So don't rely on it to choose managers.

Research is the key to good decisions. If you are not an expert, hire one.- 6. Researching hedge funds - a mixture of art and science

- Researching hedge funds involves at least as much qualitative analysis as quantitative analysis.

This means that to be able to pick the most attractive funds one must be an insider. One has to know the industry and the managers within the industry.

Without this insight, attractive funds will be closed to new investment before one has had the opportunity to receive information.- 7. Size matters - the economics of hedge fund investment

- Building your own bespoke hedge fund program has a great deal of appeal for many investors. It provides total control over manager selection and asset allocation. However, costs may be prohibitive.

Generally speaking, we would estimate the point at which it becomes cost effective to create your own portfolio is in excess of US$100 million, based on fees alone.

This does not include the cost of manager monitoring and researching new managers in the market.- 8. Manager access - the economics of hedge fund investment

- Gaining access to quality managers is perhaps the most difficult element of investing in hedge funds. Indeed, many managers when raising additional capital tend to look toward their existing investors, rather than to new investors.

Consequently, without the proper entrée into the industry, many first time investors may find it exceedingly difficult to access quality managers.- 9. Hedge fund consultants - a disappearing breed

- More and more hedge fund consultants are now only offering packaged hedge fund products.

These products are not only more appealing to the provider, as they attract an annual management fee rather than a flat fee for advice, they are also more appealing to the investor.

Clients are less likely to compete with each other for the limited capacity of some hedge funds.- 10. Multi-manager hedge funds - all the gain, none of the pain

- The multi-manager approach ties together many of the positive elements of building a hedge fund portfolio, while removing a number of the negatives. This approach provides:

- Numerous studies show that past performance is a very poor guide to future performance, which is why most managers state this in their advertisements. So don't rely on it to choose managers.

- Access to expert research and proven investment experience.

- Access to top-tier funds not available to smaller investors.

- Instant portfolio diversification and ongoing monitoring.

- Lower underlying manager fees through

larger investments.

| « Demystifying Hedge Funds | Portfolio Talk: Hedge Funds smooth rough ride » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |