The future arrives: TOWER launches global commodities fund

Michael Coote, National Manager Mezzanine Clients TOWER Investments explains the thinking behind the company’s new commodity fund.

Wednesday, September 27th 2006, 9:49AM

Michael Coote, National Manager Mezzanine Clients TOWER Investments explains the thinking behind the company’s new commodity fund.The TOWER Global Commodity Fund introduces a new asset class for New Zealand investors. It is a collateralised commodity fund (CCF), which provides unleveraged passive exposure to “the market” for the world’s most significant commodities as represented by the Dow Jones-AIG Commodity Index. The index comprises a long-only, carefully weighted, and annually rebalanced portfolio of 19 commodity futures contracts selected on two combined criteria:

· most important for global production (US dollar-weighted)

· most liquid futures contracts

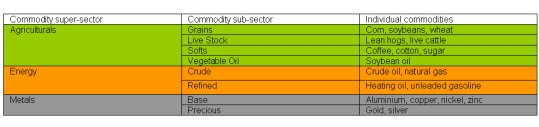

Futures markets are the most efficient way to invest in commodities. Physical commodities are typically transacted in bulk and costly to store and handle. Moreover, the investment should be widely diversified to exploit low correlations that exist between many commodities themselves. Table 1 shows how the Dow Jones-AIG Commodity Index provides the TOWER Global Commodity Fund with diversification across three uncorrelated commodity super-sectors: Energy, Metals and Agriculturals.

Table 1: TOWER Global Commodity Fund diversification:

A CCF like TOWER’s matches its nominal dollar exposure to the commodity index with funds invested in fixed interest collateral in order to strip out potentially distorting leverage. The result is that the actual performance of the commodity asset class is passed straight through to investors on a continuous, open-ended basis. This feature distinguishes TOWER’s fund from other commodity-linked investments previously offered in New Zealand.

Pacific Investment Management Company (PIMCO) provides active management of the TOWER fund’s collateral and also arranges its passive commodity index exposure. PIMCO is the world’s largest global bond manager (approximately $US 617 billion under management) and CCF manager (around $US 14 billion under management). Active collateral management can add significant extra alpha return to the commodity index’s intrinsic returns sourced from beta of “the market” plus annual rebalancing yield.

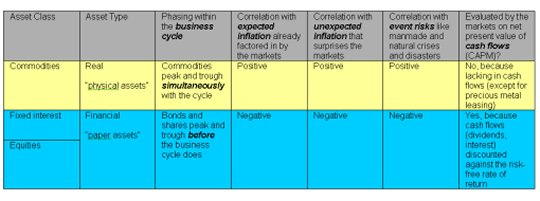

Apart from attractive returns arising from diversified commodities and the CCF structure they are embedded in, the TOWER Global Commodity Fund provides additional diversification benefits to investment portfolios due to its low or negative correlations with the traditional asset classes of equities and fixed interest. The underlying reasons for these correlation differences are shown in Table 2.

Table 2: Sources of correlation differences between commodities and traditional assets like bonds and shares

Commodities are real assets produced and consumed in the real economy and consequently have a different price cycle than financial assets. They are positively correlated with inflation - both expected and unexpected - and economically pervasive examples like oil even cause inflation. When central banks increase interest rates to combat inflation, financial assets usually decline in capital value as their cash flows become worth relatively less. Because commodities do not pay out cash flows (except for precious metal leasing) their price is not as dependent on interest rate changes.

Event risks are diverse, unpredictable and disruptive threats to normal market functioning. They can impact financial assets badly through downgraded economic outlook, whereas commodity prices are driven up by production shortage or supply blockage. Commodity users pay up a “convenience yield” premium to obtain emergency stockpiles.

Examples of manmade event risks:

· Markets: unexpected inflation, regulatory changes, OPEC quotas, supply cuts, demand jumps

· Conflicts: labour unrest, political crises, war, terrorism

Natural examples:

· Climatic: storms, floods, droughts, freezes, heat waves

· Geological: earthquakes, eruptions, tsunamis

· Biological: pests, diseases, plagues

The TOWER Global Commodity Fund is a great diversifier of traditional asset classes and should receive a long-term strategic allocation within investment portfolios. Additionally, the TOWER Global Commodity Fund has low/negative correlation with hedge funds like the TOWER Advantage Multi-Trading Fund. These two funds combined together with bonds and stocks bring potent diversification benefits to the total portfolio, assisting investors with meeting their needs and objectives. Daily liquidity of the TOWER Global Commodity Fund helps facilitate client portfolio rebalancing.

For further information on the TOWER Global Commodity Fund, please contact your TOWER Investments business development manager, call 0800 4 TOWER, or visit www.tower.co.nz

| « Macquarie looks for diversity with Commodity Bonds | The perfect asset allocation » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |