BRICs: the next big things?

Friday, March 2nd 2007, 2:07PM

Economists are not generally renowned for a tendency to get over-excited, but hear Jim O’Neil, chief economist at Goldman Sachs, talk about the potential for the economies of Brazil, Russia, India and China (BRIC) and you can’t help but share his enthusiasm for this investment theme.Back in 2003, Dr Jim and his team undertook some detailed analysis and forecasting on the BRIC markets with the end result being their seminal paper, “Dreaming with BRICs: a path to 2050”.

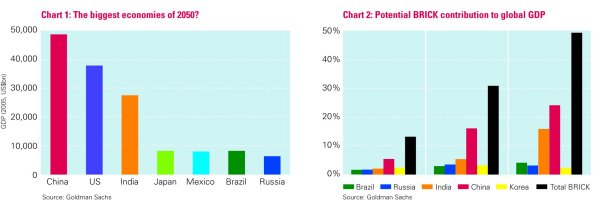

In that paper they speculated that in less than 40 years the four BRIC economies could be larger than the G6 (chart 1), with growth being most pronounced in the early stages of development. A bold and perhaps slightly contentious call? You bet, but the supporting data is very convincing.

Looking back at how the world economy has changed over the last 50 years (or last five years for that matter), it becomes clear that the next 50 years could easily be as dramatic again.

Goldman Sachs outline a case where the BRIC economies have the potential to be economic powerhouses that will fuel global growth throughout this century (chart 2), and looking at the demographics, it’s not easy to dismiss that premise.

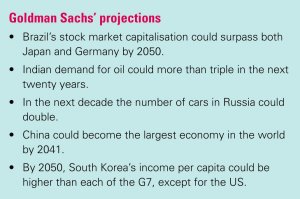

Brazil has been forecast to grow at a rate of 3.6% annually over the next 50 years; such a growth rate means that its income per person will be over five times larger within half a century. The forecasts for China, India and Russia are even more glowing. It’s likely that Russia will grow at a faster pace than Brazil, while China’s year-on-year increase in gross national product of around 8% is expected to slowly ease to 5%, a figure most other countries would be more than happy with.

The forecast for India is the most striking of all: a 5% to 6% annual growth rate that could last decades, eventually leading to a staggering 35-fold increase in the income earned by each person.

Together the BRICs contain more than 40% of the world’s population and account for over a quarter of its land mass. Individually their markets are vast and largely untapped, while collectively they have the capability to grow rapidly and change the face of the global economy. Increasing attention is being given to these markets by global companies punting everything from Coca-Cola to coal-mining equipment.

Major market players

Less government intervention and an opening up of capital

markets, such as we have already seen in India, could see

these markets accounting for up to 16% of global market

capitalisation. The successful outcome of current grow the enhancing policies: rooting out corruption, encouraging capital investment, improving infrastructure, enhancing education and ensuring political stability would have an additional stimulating effect on foreign investor confidence.

The influence BRIC countries will have on global trade policy is also becoming more apparent. Russia is expected to finally join the World Trade Organisation later this year while China joined only as recently as November 2001 (after 15 years’ negotiation). As these markets grow, regional asset weightings within international funds will increasingly favour the BRICs, channelling even more money into their capital markets.

So why add South Korea?

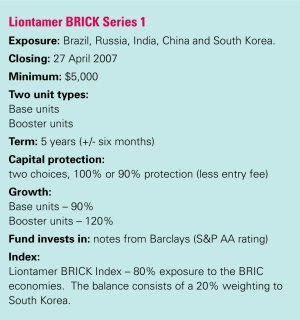

The ‘K’ in the new Liontamer BRICK fund is more than a

marketing ploy; South Korea featured heavily in Goldman Sachs research of 2005. This research identified what they dubbed the N-11 (next 11) emerging markets. Of those, only Korea and Mexico stand out as having real BRIC-like potential.

The ‘K’ in the new Liontamer BRICK fund is more than a

marketing ploy; South Korea featured heavily in Goldman Sachs research of 2005. This research identified what they dubbed the N-11 (next 11) emerging markets. Of those, only Korea and Mexico stand out as having real BRIC-like potential.

We prefer the Asian influence due to Korea’s prospects for becoming one of the wealthiest nations in the world. As a newly industrialised economy, Korea has transformed itself into a ‘knowledge economy’ embracing productive economic policies, adopting a high-growth development agenda, and gaining efficiencies in its labour force.

Consumer wealth creation invariably leads to increased demand for goods and services. We see that as a key driver of all the BRICK markets; South Korea is just more advanced along the path.

The BRIC story is really about potential for long-term sustainable growth. The question remains; collectively can these economies maintain such rapid industrialisation and development? Only time will tell, although South Korea is a good example of an economy that has done just that.

Through use of its low-cost manufacturing network and by developing a knowledge-based economy, Korea established itself as an Asian powerhouse that could deliver quality products to a global market. The proof being that many of us have Samsung televisions in our homes and Hyundai or Kia cars in the garage.

The BRIC economies have all the potential to follow Korea; their economic credibility is being established and their regional domination has meant a more active position in determining global policy.

A safety net

A safety net

The Liontamer BRICK fund not only presents an opportunity

to gain some exposure to the world’s most exciting emerging

economies, it also offers the choice of two levels of capital protection. This safety net means that investors can ride the potential volatility of having some exposure to the BRICK economies knowing that, at the very least, their capital will be repaid to them at maturity.

| « A new option for fixed interest | Guardian Funds in award-winning shape » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |