Twice the gain - Limit the pain

Liontamer's GLOBAL Series 3

Wednesday, June 20th 2007, 3:27PM

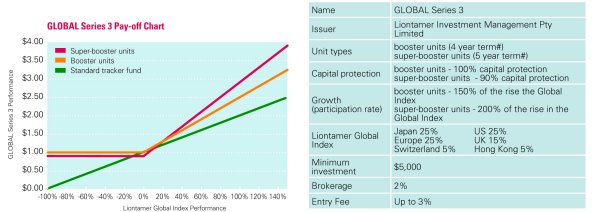

Liontamer's latest capital protected product, GLOBAL series 3, is a fund with a compelling difference. First of all, GLOBAL Series 3 provides a choice of two different unit types; both have an exposure to international sharemarkets, plus either full or partial capital protection at maturity*. Nothing that unusual there you might say, however, the key distinction is that both unit types are 'booster units' which give investors the opportunity to really accelerate their potential returns – by 150% using standard booster units and by an impressive 200% using super-booster units.Like each of Liontamer's previous funds, GLOBAL Series 3 shields investor's capital from falls in the market, in this case by offering two different levels of protection; booster units provide full (100%) capital protection, while super-booster units provide partial (90%) protection. The capital protection is a key feature that offers investors a good degree of comfort; however, the really exciting thing (as you can see in the chart below) is the added boost these units can give to returns.

With the rest of the world now less reliant than ever on the US to consume their exports and provide a head of steam to roll the global economy along, and with the emergence of influential new markets like China, there remain some good reasons to keep some exposure to international equities.

However, there are some glimmers of volatility in certain key markets, namely the US, which have the potential to impact on returns from global markets in the medium-term. Advisers can take steps to ensure their clients' portfolios are positioned to weather any possible future volatility. We believe that capital protection combined with accelerated market returns is an ideal combination for many portfolios.

Five ways to benefit from GLOBAL Series 3

1. Lock-in previous gains

Most well-diversified portfolios will have benefited from rising

global (as well as local) equity markets. Given the generally

positive outlook for global equities, the consensus seems to

be that now is not the time to sell up. However, for advisers

who are cautious about the medium-term outlook for global

sharemarkets this may be an ideal opportunity to lock-in those

past gains. Switches into capital protected products allow you

to ensure the amount of a client's current investment is not

diminished, while still maintaining an exposure to international

equities.

2. Dial down the risk profile

Using a product like GLOBAL Series 3 can provide a strategy to

change the risk/return profile of the international equities sector

of your clients' portfolios. Lowering risk, accelerating returns

and hedging currency dramatically changes risk profiles. This

leaves more flexibility to use more aggressive funds or niches

providers to greater advantage.

3. Achieve a lower weighting to the US

While the prospects are still looking good for many markets,

the possible exception is the United States, where a few storm

clouds have been building in the credit markets and growth

has slowed to an ambling 2-2.5% p.a. The Liontamer Global

Index has an underweight exposure to the US for these very

reasons. The Global Index allocates quite differently to major

benchmarks. For example, some will be as much as 50%

weighted to the US – we've cut that to 25% for this fund based

on our research view.

4. When good markets go bad – boost your returns

And if you are at all concerned that there is a risk that returns

from global markets will ease off and even be mediocre over the

medium-term then our booster units provide a possible solution.

By using a growth multiplier such as our super-booster units you

can double the Index return, making even ordinary performance

look good – while minimising the downside risk.

5. Get in while the going is good

Now is a great opportunity to take advantage of one of the

best pricing environments that we have seen for capital

protected products. Our high interest rate means we can build

products that have participation rates which are the envy of our

international peers.

Full details are contained in the Investment Statement and registered Prospectus, provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325). # Liontamer has the discretion to reduce or increase the maturity date by six months, depending on market movements during the offer period. *Capital protection at maturity, means you will receive back 100% for booster units, or 90% for super-booster units, of the combined amount invested and early bird interest (earned during the offer period) less any entry fee charged (up to 3%). There is a more detailed description of capital protection in the Investment Statement and the limited circumstances when capital protection may not be available.

| « Guardian Funds in award-winning shape | WATER - Blue Gold » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |