Kauri Notes - Higher returns, regular income

Summary of the key features of Kauri Notes invested in Merrill Lynch Prosper Notes Permal Delta.

Friday, December 14th 2007, 11:56AM

BackgroundKauri Units are the second Kauri offer made by Savings & Loans Superannuation and investments ("S&L") as the manager of the Kauri Unit Trust No.1.

Kauri Notes which have been invested where from 1 September 2007 to 23 November 2007 have an accumulated return over the 84 days of 5.73%. This financial performance has been achieved during a period of considerable volatility for other securities.

Savings & Loans Superannuation and Investments Limited is a funds management organisation with a focus on providing Securities that are:

- Capital guaranteed,

- Provide regular income or capital appreciation

- Offer the opportunity to earn higher returns, and

- Have a clear secondary market mechanism for investor liquidity.

Kauri Income Units, the proceeds of which are invested via Merrill Lynch S.A. Prosper Notes into the Permal FX, Financials & Futures Limited Fund ("the Permal Fund"). Income Units will be attractive to those clients wanting to diversify their finance company debenture holdings and other fixed interest securities into rated investments with higher returns but which also provide regular income (9.5% p.a.).

Kauri Growth Units, the proceeds of which are invested in Permal Delta 2.5 Shares ('the Permal Delta"). The Permal Delta provides private investors a capital appreciation opportunity to gain a leveraged investment in a combination of 6 Permal multi-manager funds with over 150 managers representing diversified asset classes.

For both Income and Growth Units

Merrill Lynch & Co., Inc the Guarantor rated A+

Merrill Lynch International is one of the world's leading wealth management, capital markets and advisory companies, with offices in 37 countries and territories and total client funds under management of approximately US$1.6 trillion. Merrill Lynch is ranked number 22 in the Fortune 500 (being the list of the 500 largest public corporations in the United States by gross revenues aggregated by Fortune magazine). Merrill Lynch & Co., Inc, the guarantor has a A+, A+, A1 credit rating (Fitch Ratings, S&P's, Moody's respectively).

Tax Efficient

Kauri Units will benefit from the new tax rules for portfolio investment entities (PIEs) and Foreign Investment Fund (FIF).

Investors Interests protected through appointment of Trustee The Perpetual Trust is acting in a trustee role on behalf of Kauri Unitholders. The Trustee holds the Prosper Notes Series III and Permal Delta 2.5 Shares in favour of the Kauri Unitholders.

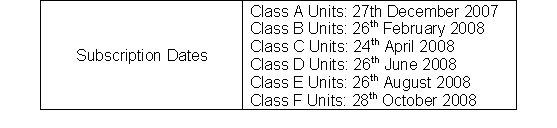

Twelve Months Issuance

Kauri Units offers 6 subscription dates over a 12 month period.

The initial value will be $1.00 per Unit for Class A Units and NAV on allotment dates for Class B to Class F Units.

Brokerage S & L will pay to advisors 1.5% brokerage of the aggregate Issue Price Amount in respect of the Income Units allotted; and for subscriptions received through any financial intermediary which in total exceeds $250,000 over the 12 months of the Offer, the S & L will pay trailing brokerage of 0.20% per annum paid quarterly.

Secondary market liquidity Kauri Units can be sold back to S&L early by Unitholders each month, subject to certain circumstances. The sizes of the Permal funds, the very liquid instruments in which the Fund managers invest and Merrill Lynch International's secondary market trading experience all assist in making this secondary market liquidity feature possible.

For Income Units

Kauri Income Units – High targeted returns

The most recent back test for the seven years ending on 30 September 2007 shows that the Prosper Notes Series III would have provided an annualised return of 13.28%*.

*Past performance is not necessary a reliable guide for future performance.

Regular quarterly distribution payments

The Income Units are limited recourse Units designed to provide Income Unitholders with a regular distribution rate of 9.50% per annum return paid quarterly, over the 7 year 3 month term of the Income Units.

Distributions guarantee in respect of the first eight Interest payments from the Prosper Notes – Series II As well as the capital guarantee, the payment of the first eight quarterly distribution payments of the Income Units are supported by a Prosper Notes interest guarantee from Merrill Lynch & Co., Inc which is rated A+. Subsequent distribution payments are subject to the performance of the Permal Fund into which Merrill Lynch invests the proceeds of Prosper Notes Series III. This means the actual rate of return achieved by Kauri Income Unitholders could be higher or lower than 9.5% pa.

Higher Returns through Uncapped Redemption Premium potential (Gain on Issue Price)

In addition to the distributions that have been paid to Income Unitholders as at Maturity, the accumulated returns on the Income Units which have not been distributed either as Fixed or Performance Distributions will be distributed to holders of the Income Units as a redemption premium.

A diversified investment in the Permal FX, Financials & Futures Limited portfolio The net proceeds raised from the issue of Kauri Income Units (via Prosper Notes) will be invested in the flagship Permal Fund via Kauri Income Units. The US$ 8.6 billion Permal Fund portfolio is diversified across more than 50 different managers. The Fund is currently closed to new investors but subscribers to Kauri Units will enjoy participation under a current allocation.

The Permal Fund, which has been operating successfully since 1992, has been selected for its long history of delivering real returns to investors in all market conditions, for its resilience to past market shocks over a 15 year period and for the liquidity of the instruments in which its managers invest. The Permal Fund achieves diversification through the range of investment styles and trading strategies in numerous U.S. and international currency, futures, options, forward and other liquid markets.

This Permal fund does not invest in either sub-prime or high-yield debt securities. It is specifically designed not to be correlated to debt and equity returns in order to maximise its diversification value to an investor.

For Growth Units

Kauri Growth Units – High targeted returns

Historical analysis indicates Growth Units, including the Issue Price protection, invested in Permal Delta 2.5 shares would have achieved capital appreciation of 46.13% over the 2 year 4 month period ending on 30 September 2007*.

*Past performance is not necessary a reliable guide for future performance.

Capital Appreciation

Growth Units which also carry an Issue Price guarantee are designed to provide Growth Unitholders with capital appreciation derived from investment of the net proceeds of issue of the Growth Units by the Trustee in the Permal Delta 2.5 shares issued by ARES Investment Funds a segregated portfolio company for whom Merrill Lynch International is both Sponsor and Investment Manager.

Growth Units aim to provide investors with returns higher than the 90 day Bank Bill Yield published by the Reserve Bank of New Zealand over the term of the Growth Units plus 5 % p.a.

A diversified investment in the Permal Delta 2.5 Shares Kauri Growth Units provide a leveraged investment in over 150 managers of six Permal multi-manger funds. These are the Permal FX, Financials& Futures Ltd (21%), Permal Investment Holdings N.V. (41%), Permal Fixed Income Holdings (15%), Permal Japan Holdings (14%), Permal Emerging Markets Holding N.V. (4%), and Permal Natural Resources Fund (5%).

Further Information

To receive further information, an investment statement can be obtained from www.kaurinotes.co.nz or call 0800 728464 (0800 Savings).

| « Absolute return funds expand with Kauri Notes Series II | Riding the Global Credit Crunch and Commodities Boom » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |