Borrowing strategies changing

Borrowing strategies for people with home loans are changing as New Zealand starts on the next part of its interest rate cycle.

Tuesday, November 11th 2008, 11:16PM

Now that rates have started falling and dropping sharply, the preferred strategy emerging is to go for a floating rate or a very short fixed term rate.

In July the Reserve Bank cut the official cash rate (OCR) for the first time in five years. This 25 basis point cut was followed by further cuts that brought the rate down from 8.25% to 6.50% in three months. Further cuts are expected this year, with one group, Goldman Sachs JB Were arguing for an 100 basis point cut this month.

Borrowers going for floating rate home loans directly benefit when official cash rates fall.

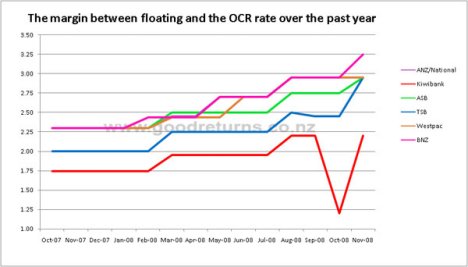

However, while variable rates have tended to move in lock-step with the OCR in recent years, that bond is breaking.

Earlier this year banks increased their floating rates although the OCR was unchanged.

Consequently the lenders’ margins increased. Now the OCR is falling it has become clear, from research done by www.goodreturns.co.nz, that not all the falls are being passed on and lenders’ gross margins have increased. In fact the margin between the OCR and carded floating rates for lenders has increased.

| « Floating rates find legs | OCR cut to 7.5% » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |