Floating rates that don't sink

Even as Reserve Bank governor Alan Bollard reiterates last week’s message that lenders should be passing on his whopping rate cuts to their customers, some are still offering extremely high floating mortgage rates.

Wednesday, December 10th 2008, 10:39PM

by Jenny Ruth

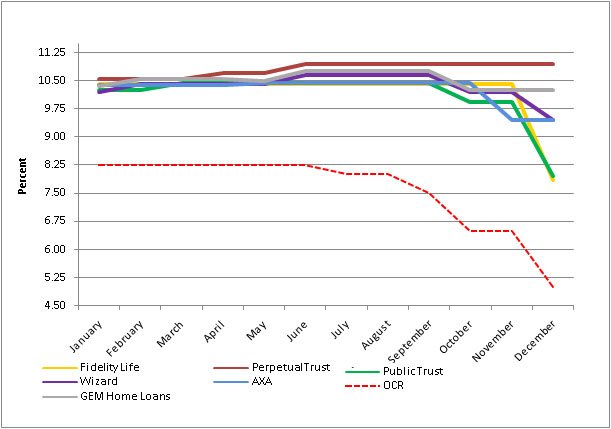

Bollard cut his official cash rate (OCR) from 8.00% to 7.50% in September, to 6.50% in late October and to 5% earlier this month.On Wednesday, he told a Wellington business audience banks shouldn’t be looking to maintain high profit margins, noting they have failed to cut their short- term lending rates by as much has he had cut the OCR.

Perpetual Trust, a subsidiary of Pyne Gould Corporation which plans to turn the trustee company and its finance company subsidiary Marac into a bank, still has its floating mortgage rate set at 10.95%, nearly 600 basis points above the OCR. The rule of thumb in more normal times is for floating rates to be about 225 basis points above the OCR.

By contrast, the major banks’ floating rates range from 7.95% to 8.20% and the lowest rate in the market, 7.20% is offered by new bank SBS.

Charlie Goodwin, head of investments and marketing at Perpetual, says unlike the trading banks, his company’s mortgage funds come from its managed fund.

While that fund remains open, "we’re more in the mode of protecting liquidity. We’re not chasing any new loans," Goodwin says.

As far as existing customers go, only a fraction have floating rate residential mortgages, he says.

Nevertheless, Perpetual is considering a rate cut. "We don’t want to be completely out of the market."

Similarly, AXA New Zealand, whose mortgage funding comes from three managed funds, all of which are currently suspended, isn’t interested in attracting new business, says chief executive Ralph Stewart.

"Because they’re suspended, we’re not doing an awful lot of origination." AXA’s floating rate currently is 9.45%.

The global credit crunch is impacting directly on GE Money-owned Wizard Home Loans whose ultimate head office is in the US. GE spokesman Tristan Everett says all GE’s funding comes from wholesale money markets and even though wholesale interest rates have been falling, GE’s cost of credit remains abnormally high.

GE is being tarred by high profile banking collapses such as Lehman Brothers and Merrill Lynch. "We’re spending a lot of time at the moment in Europe and America trying to educate the market about the fact that our credit is good," Everett says.

"We expect, in time, it will right itself, but at the moment our cost of funding is very high." Nevertheless, GE will be reviewing its lending rates next Monday.

Other non-bank lenders have passed on the OCR cuts but belatedly. The government’s Public Trust, for example, cut its floating rate from 9.45% to 7.95% on Tuesday. Managing director Grenville Gaskell says its wrong to focus on the short-term. "Historically, we’ve offered very competitive fixed and floating home loan rates."

| « HSBC's mortgage book shrinks but profits jump | Wizard puts away wand » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |