Having Super Choice

Peter Dine, Head of Business Development, Aegis, talks about a new way to invest in superannuation.

Friday, December 11th 2009, 12:33PM

Personal superannuation schemes in New Zealand have historically suffered from tax inefficiencies for those on lower tax brackets, as well as limited investment choice. In respect of the latter, choice appears to have been largely restricted to vanilla diversified managed funds from conservative through to growth options, along with some sector fund options. KiwiSaver paved the way for addressing the tax issues with the introduction of the PIE regime and PIE compliant KiwiSaver schemes.

Curiously though, while many providers have stepped up to the plate with a KiwiSaver solution, like the personal superannuation schemes of old, investment choice is still largely restricted to a limited range of diversified fund options. However, I suspect that as KiwiSaver fund balances grow, investors will take a much greater interest in their investment options and demand more services and choice than is available today.

As a custodial wrap provider, Aegis understands investment options only too well. A typical portfolio administered on the Aegis service has between 15 and 20 investments with an average aggregate portfolio value between $250,000 and $300,000. The largest portfolios have more than 50 different assets.

Furthermore, portfolios administered by Aegis are typically a combination of direct investment into cash, fixed interest and equities, as well as managed funds. Interestingly, the introduction of the PIE regime has done little to change the composition of direct investment versus managed funds, though many of the domestic managed funds available through the Aegis service have morphed into PIE funds. In principle, why should the range of investments on offer from super schemes be any different to non-super portfolios, and why shouldn’t they include access to direct investment in cash, fixed interest and equities?

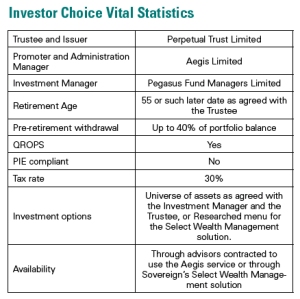

The answer is, there is no reason, it’s just the way superannuation schemes and serviceshave been developed to date. Now Aegis has addressed this by developing a new superannuation scheme called Investor Choice. Conceptually, Investor Choice is a superannuation scheme utilising the Aegis wrap platform functionality which, subject to trustee and investment manager approval, provides investors (via their advisor) with potentially the same range of investments, both direct and managed funds, that is currently available to other non-super portfolios administered through Aegis.

Investor Choice is only available through advisory groups that contract to use the Aegis service or through Sovereign’s Select Wealth Management solution. For the former, advisorscan choose to run with the Aegis branding or, with trustee consent, use their own branding. For advisors preferring a fully outsourced solution, Sovereign’s Select Wealth Management offers the dual benefits of wrap platform functionality and a menu of 40 plus independently researched securities. Either way, Investor Choice offers advisors flexibility, without the time and expense associated with establishing and maintaining their own superannuation scheme for clients.

With Investor Choice, each investor has a unique portfolio of assets. Aegis administers the portfolio in much the same way as other portfolios are administered on the Aegis platform. This provides the trustee with data to calculate and determine Investor Choice’s income tax liability and prepare consolidated scheme accounts, and comply with other reporting requirements under the Superannuation Schemes Act 1989. Advisors have the same web access to Aegis that they have for

non-superannuation portfolios, including a suite of online client and management reporting services. Likewise, investors can be offered direct web access to reporting.

Being a superannuation scheme, Investor Choice does require a minimum retirement date and there are lock in provisions, though there is an opportunity to withdraw up to 40% of funds prior to age 55. Due to the investor membership and investment concentration rules associated with the PIE regime, it is not practical for Investor Choice to be PIE compliant, but this is a trade-off against the high level ofinvestment choice.

Provided investments are for long term retirement and are passively managed, capital gains (and losses) on Australian and New Zealand shares should not be subject to income tax. However investors should check their individual circumstances with their accountant or tax advisor. Investor Choice is mainly for investors who are on a marginal tax rate of more than 30% and require greater investment flexibility than is available from their existing personal superannuation scheme. It is also a Qualified Recognised Overseas Pension Scheme (QROPS), making the UK pension transfer market a primary opportunity for this solution.

So will Aegis be looking to offer a KiwiSaver equivalent, I hear you ask? Watch this space.

For more information, contact Peter Dine, Head of Business Development , Aegis Limited, 09 487 9450, or refer to the Investor Choice Superannuation Scheme Investment Statement. A disclosure statement required under the Securities Markets Act 1988 is available on request, free of charge, from Aegis Limited’s Head of Risk and Compliance, (09) 487 9118. The tax information contained in this document is for general information purposes only and does not constitute tax advice. If you are interested in learning more about the taxation treatment of your specific investments, we recommend you seek independent tax advice.

| « Q&A: TOWER Parallel Portfolios | ING Life Major Medical Cover: Why you should recommend it to your clie » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |