AIA: The business of risk

A lingering gap in the protection of business owners has recently been filled, as part of a larger plan to bring much-needed simplicity to insurance in New Zealand. Darrin Franks, AIA New Zealand's Head of Distribution and Marketing, explains.

Friday, August 20th 2010, 12:47PM

A great Kiwi strength is our entrepreneurial spirit. We spend time working for ‘the man', building our know-how and experience, and one day we think, ‘I could do this myself. Take my dream, start a business, employ some help. I don't want an empire, I just want to work for myself and get a lifestyle out of it.'

This attitude is so common that SMEs in New Zealand employing five or fewer people now number nearly 300,000, constituting 87% of all New Zealand businesses and representing immeasurable worth to the national economy. But there's a worm in the heart of the rose: research tells us that New Zealanders are underinsured compared with other Western nations, and anecdotal evidence suggests that business owners, many of whom are the key person in the business, frequently lack some or all of the cover they need.

This is in part because many see insurance as expenditure rather than protecting their dream. One role of the insurance industry is to show people than insurance is not a cost, but on the contrary a vital element of financial wellbeing. A second role is to provide products and services that facilitate that wellbeing.

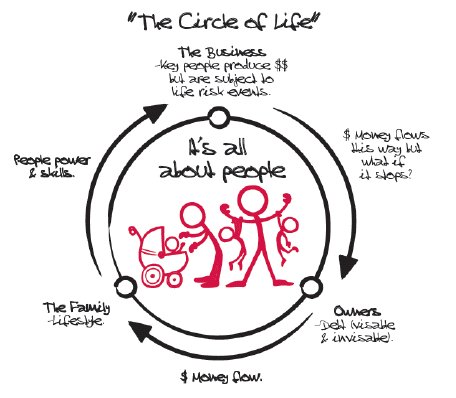

The Circle of Life

It shows all the parties at risk in ‘The Circle of Life'. The business is underpinned by its key people, who are subject to general life risks - accident or illness that could leave them temporarily or permanently unable to contribute to the business.

That financial impact flows on to the owner/s of the business (often also a key person), who is responsible for the debt, both visible and invisible. Some owners think they don't need business or key person cover because they don't see any outstanding debt - they wholly own the business and the business assets such as vehicles and so on.

However, that's just the visible debt. The cost of exiting is invisible - if you suddenly had to close the business, what would it cost you to pay all current utility bills, rates, holiday pay and other entitlements? What about your lease commitments too? Too often these issues can be overlooked.

Then there are the families; the people supported by the business. What does the owner's lifestyle cost? What about their staff's lifestyles? Who and what is dependent on the business, and what happens if that revenue stream drops or stops? But of course, ‘the circle of life' only completes because the business also is dependent on the very people needed to drive revenue.

Business insurance products attempt to deal with this value chain. Certainly, it is the responsibility of business owners and key people to seek advice to get the cover they need. But insurers bear equal responsibility, in that they must help to simplify this process. Getting the insurance you need should not be complicated, and AIA New Zealand has recently introduced two new products to make securing protection easier for business owners.

The first, New to Business Cover, protects owners in business for less than four years. This group of people has traditionally had considerable difficulty attaining business cover because of their higher-risk status, making them unattractive to underwriters - but the need was there. We worked with a supportive reinsurer, RGA, who joined us in recognising the need.

The second is Business Continuation Cover, for established businesses. Both products are supported by the Business Lifestyle Check, our comprehensive yet easy to use analysis tool which gathers information to ensure accuracy in setting business cover and establishing a business succession plan.

The response of advisers to these new products tells us we're on the right track. The uptake has been swift and sizeable, and nearly 40% of advisers who have sold one, or both, hadn't done business with AIA New Zealand in the previous two years.

Part of my role will be to work with our team to introduce other products that fill gaps and help bring simplicity to insurance. We may not be the whole solution, but what we're offering to businesses is relevant and significant to many people, who want simple, easy-to-understand products that support their lifestyle and dreams.

Case study

One week after a Whanganui plumber suffered a severe stroke, the company of which he was principal, which employed 28 plumbers, folded. It was the largest plumbing business in the area, and leading Whanganui financial adviser Mark Stoneman says its collapse has directly affected about 200 people, and indirectly, the entire community.

"He and his company were well-known, and many other companies in town had subcontracts with him. What happened in this instance has prompted a lot of people, both business owners, and employees, to look at income protection and other forms of cover for themselves."

Mark says that the immediate collapse of the firm earlier this year indicates that the plumber, who was in his 50s, had no insurance which protected his business against such a catastrophic occurrence, which has left him wheelchair-bound and permanently unable to work.

"If he'd had trauma insurance, there would have been an immediate lump-sum payout to inject cash into the business and keep all the plumbers employed, and then a regular amount paid out to cover the overheads each month. Total and permanent disability insurance would have enabled the plumber and his representatives to meet his financial needs for the rest of his life."

The premiums for this level of protection would have been approximately $12,000 per year - less than 1% of the annual profit of a typical trade business of this size.

| « Q&A: Sam Stubbs on the 'New Normal' | AIA: The leadership vacuum » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |