Best bank rate review

An increase to the OCR last week has triggered the start of increasing home loan interest rates, but these rises haven't been limited to floating rates. Philip Macalister reviews what's happening and which bank is offering the best pricing deals.

Wednesday, March 19th 2014, 8:55AM  2 Comments

2 Comments

One bank boss said to me last week before the OCR increase that pricing for floating home loans wasn't tied to the official cash rate. Despite that the bank he works for and every other bank, except Westpac, have increased their rates since the Reserve Bank announcement.

One bank boss said to me last week before the OCR increase that pricing for floating home loans wasn't tied to the official cash rate. Despite that the bank he works for and every other bank, except Westpac, have increased their rates since the Reserve Bank announcement.

What, possibly, caught people by surprise is that fixed rates have been rising this week too in the back of increased wholesale rates. What's unclear at this stage is if banks are seeing a rush of new business. If this happens they may be forced ot hike rates sufficiently to slow down the volumen of applications.

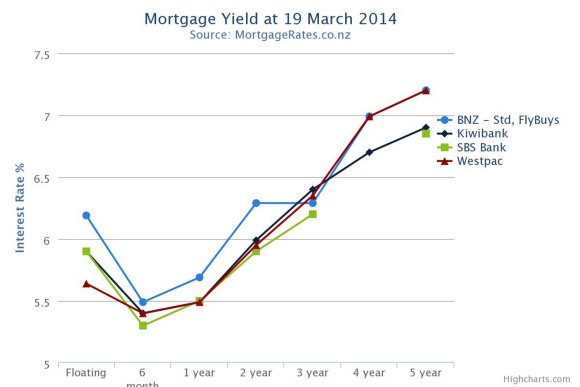

The one bank to hold its line has been Westpac, however as our yield curve graph shows Westpac was already the most expensive bank notably for longer dated terms.

In the two-year space HSBC has rolled out a special rate of 5.79% which is the best bank rate for this term. However to qualify a borrower has to be an HSBC Premier customer which requires lending of $500,000 or at least $100,000 in deposit. HSBC says for existing Premier customers this rate is only available if they drawn down a minimum of an extra $100,000.

The next best bank rate in this term is SBS and its subsidiary HBS which is offering 5.90% for loans with a deposit of at least 20%.

Click here to see the rates table sorted from lowest to highest on the two-year term.

In the three-year space BNZ has made a pricing play here and dropped its Standard, Fly Buys and Global Plus rate to 6.29%.

Despite doing that it is not the bank market leader. SBS and HBS actually increased their rates for this term yesterday and priced nine points lower.

SBS are clearly being aggressive with its pricing at the moment, however mortgagerates.co.nz understands it has no appetite for low equity lending. HSBC also has a similar lack of interest in this space.

Click here to see the rates table sorted from lowest to highest on the three-year term.

With floating rates rising we would expect Offset Home Loan product rates to rise too. Of the three players in this market, BNZ has increased its Total Money rate to 5.99%, Kiwibank chose to leave its rate unchanged when it increased its floating and revolving credit rates and as noted previously Westpac hasn’t moved any rates – yet.

Key points

- SBS is the market leader

- Westpac hasn’t moved, but was already the most expensive in longer term home loans

- BNZ has made a pricing play in the three year term

- Westpac’s floating rate usually appears uncompetitive as it prefers to push its Everyday Choices Revolving credit product

| « Household indebtedness increasing | High-LVR lending inches up » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |