Westpac's top rate nudges close to double digit interest rate

[UPDATED] Westpac’s latest changes to its fixed home loan rates have put it at the most expensive end of the market, particularly for borrowers with a deposit of less than 20%. (Rates corrected)

Thursday, March 27th 2014, 9:23AM  6 Comments

6 Comments

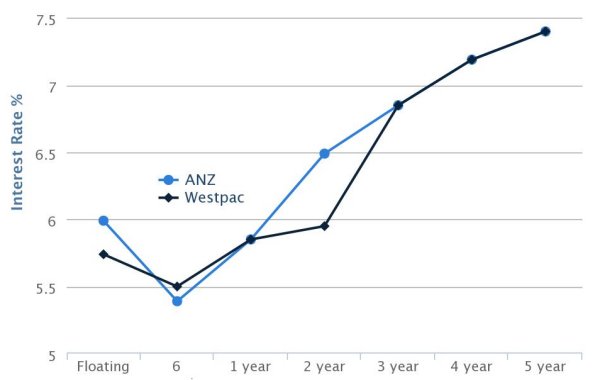

It has increased its fixed rates across the board this week and has pricing which is much closer to ANZ which has been higher than other lenders following changes after the Reserve Bank increased the OCR 25 basis points.

The smallest increase was to the six month rate which went up 10 basis points and 20 point increases were made to the standard two-year rate, and its four and five year rates.

Westpac has chosen to compete in the two year space and making the biggest increases to rates either side of this term and removing the 5.69% 18-month special.

Westpac has chosen to compete in the two year space and making the biggest increases to rates either side of this term and removing the 5.69% 18-month special.

The three-year rate went up 50 basis points to 6.85% and the one-year up 36 points to 5.85%.

Where Westpac has become particularly uncompetitive is in the low equity lending space. Its rates here have risen along with standard rates.

The bank also charges borrowers an additional premium which is essentially an even higher rate. Other banks charge a one-off fee.

An exampie is a borrower with a 90% LVR on a two-year term would now be paying 7.99%.

However a borrower could expect to negotiate a two-year fixed rate of 5.99% at other big banks.

The combination of a two tier rate structure and low equity margin makes Westpac significantly more expensive than the other banks at this level of borrowing.

For an even longer term rate Westpac is getting close to double digit interest rates. Westpac’s new five year fixed rate above 80% is now 8.00%. With the addition of a low equity margin of 1.25% added at 90% LVR this would make this rate now 8.90%.

Westpac's capped rates for one and two year terms have risen between 40 and 50 bps.

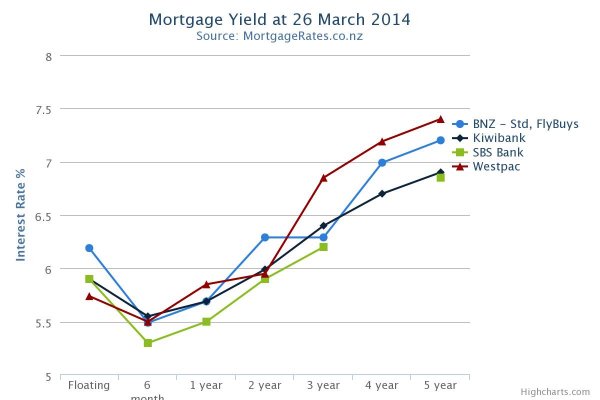

The following graph compares a selection of bank rates on offer. It is not all banks. We have selected banks where there are clear differences in pricing strategies.

| « Low-equity fees face legal questions | Higher rates give RBNZ scope to lift LVR rules » |

Special Offers

Comments from our readers

The question also has to be asked of Westpac (and ANZ) why they still insist on charging their home loan customers a higher tier of interest rate above 80% LVR for new mortgages when every other bank isn’t doing this. BNZ recently scrapped two tier interest rates so why are Westpac and ANZ still the only banks charging them now?

Yes all of the banks now have to hold additional capital aside for new mortgages above 80% to satisfy Reserve Bank requirements but the last time I checked ANZ and Westpac were the two biggest banks in the country and had plenty of capital reserves to set aside against their respective loan balance sheets.

So why are only Westpac and ANZ essentially “double dipping”? The only logical conclusion is that they are price gouging and will do so as long as they can get away with it.

The fact that ANZ & Westpac are only prepared to offer carded rates to existing home loan customers above 80% LVR is another example of them "double dipping"

Sign In to add your comment

| Printable version | Email to a friend |

Break fees can be high and that's another way to make money, for banks that is. Be careful out there Mr & Mrs Public.

The World is not in great shape. Our bank loan interest rates are already much, much higher than most other countries. Be brave, negotiate and float your rate. If they won't play ball, go elsewhere. Just my tuppence worth!