Pricing chaos in home loan market

There is “chaos” in pricing of home loans, according to one bank chief executive and borrowers have all the power.

Wednesday, April 16th 2014, 12:01PM  6 Comments

6 Comments

The Co-operative Bank chief executive Bruce McLachlan says there is significant discounting happening amongst lenders.

“Rate cards are quite high in my view,” he says.

Borrowers need to be asking for the best possible deal when they take out a loan or refinance an exiting one.

“The poor old customers who don’t challenge are missing out,” he says.

ANZ economists agree competition has stepped up in the past few weeks.

“All power to the borrowers!”

“Competition is more aggressive in the Auckland and Christchurch area; precisely those regions that are the house price hot-spots,” they say in the latest Market Focus report.

One of the reasons is that lenders have got their minds around the Reserve Bank’s lending restrictions and have realised there is room to increase their activity in this area.

McLachlan says just under seven per cent of The Co-operative Bank’s lending is in the low equity space and he would like it to be around 8%.

ANZ says: “The initial knee-jerk reaction post the implementation of the 10% limit on high LVR lending partly reflected uncertainty surrounding how the swathe of pre-approved loans would roll off. Six months on and financial intermediaries have managed that pipeline so high LVR lending can tick back up closer to the 10% threshold.”

The other reason is that a sizable chunk of fixed rate mortgages rolling off at present which presents an opportunity to gain market share.

McLachlan is critical of the discounting happening in the market and says The Co-operative Bank does minimal discounting and tries to be “transparent” with its pricing.

How they compare

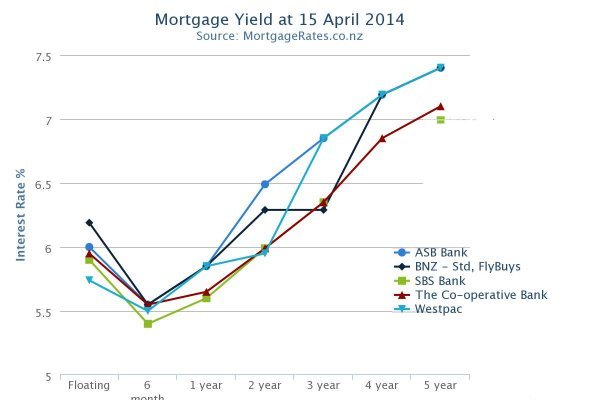

The following graph illustrates the differences in pricing at the moment. For practical reasons we have selected a sample of lenders rather than trying to graph all of them.

- We have selected five lenders: three big banks (ASB, BNZ and Westpac) and two smaller banks (The Co-operative Bank and SBS).

- Across fixed rates the two smaller banks are clearly the best and most consistently priced.

- ASB and Westpac area at the opposite being highest priced and consistent pricing.

- Interestingly Westpac and BNZ have opted to compete strongly in the two and three year fixed rate markets respectively with rates that are very similar to the small banks.

| « Welcome Home Loans to expand | Economists: Expect another increase » |

Special Offers

Comments from our readers

I would have thought you'd be more supportive since they are consistently competitive.

The Co-operative Bank was selected as the article included comments from its CEO and SBS was the second small bank as it consistently has the lowest pricing. Interestingly neither of the small banks get involved in all the giveaways.

Kiwibank hid behind their six year home loan guarantee which was clearly a load of baloney on these types of low equity mortgages.

Anyone with a calculator could have figured that out! Unfortunately a lot of people fell for Kiwibank’s marketing spin and paid a significantly higher cost by electing to have their mortgage with them.

No doubt some of these borrowers are sadly still paying off the higher low equity premium charged by Kiwibank originally to approve their loan before they even begin to make inroads now on the principal amount they borrowed.

They are a higher risk!

Sign In to add your comment

| Printable version | Email to a friend |