One and done, latest rates call

Markets are under-pricing the odds of future interest rate rises, according to ANZ economists.

Thursday, June 5th 2014, 7:00AM

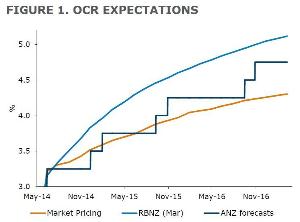

The market is expecting the OCR to rise more slowly

than what the Reserve Bank forecasts show

It says that “amidst the negativity some are focusing on, there are still massive positives (in the economy).”

But it also points out the economic story looks less picture perfect, but that needs to be put in perspective: it never was.

The economy is now settling into a glide-path expansion, which naturally sees more oscillation in indicators. Amidst the negativity some are focusing on, there are still massive positives. With demand still outpacing supply, the RBNZ has more work to do, and if we were them we certainly wouldn’t be closing the door on a July hike in the upcoming Monetary Policy Statement. In the wake of the small adjustments to the Fonterra payout, this week’s commodity price data will set the tone. While the direction of recent commodity price and confidence readings has been downwards, levels clearly matter in terms of the impact on inflationary pressure and the amount of work the RBNZ has to do. Data inputs for Q1 GDP are expected to convey a reasonable pace of base momentum, but with sector differences.

In the latest weekly Market Watch ANZ says the “economic story no longer looks so picture perfect.”

“Well, it never was in our eyes – strong growth was always masking frictions and tensions – but we’re now seeing downwards adjustments across economic indicators. Credit growth has slowed, business confidence has waned, the terms of trade are starting to recede more markedly, and anecdotes on the ground suggest the housing market has softened a lot price-wise.”

It characterises the economy as slowing from a gallop to a canter.

“We now characterise the economy as settling into a glide-path; growth is still robust, though less breakneck in pace, and it is still putting ample pressure on resources.

“Right here and now growth is tracking around 3.5% – down from the 4% pace seen in late 2013. That’s a margin of excellence adjustment.

Markets have naturally latched onto signs of waning momentum and market pricing is now calling the RBNZ “one and done”; that is, one more hike then a bit of a pause.

“Indeed, it is notable how far below the RBNZ’s March projections the market is now trading.“

“Three hikes up front then a pause fits with our long-held view, but we’re going to offer some words of caution here; if we were the RBNZ we’d be keeping the door wide open to a July hike as well, and we believe the odds on a follow-up move are now under-priced.”

| « [MR Radio] Listen to the latest home loan news | Rates may not rise as quickly as expected: Economists » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |