ASB flattens out home loan prices

ASB (and its related lenders) have increased some short term home loans while lowering longer term ones.

Friday, June 20th 2014, 6:12PM

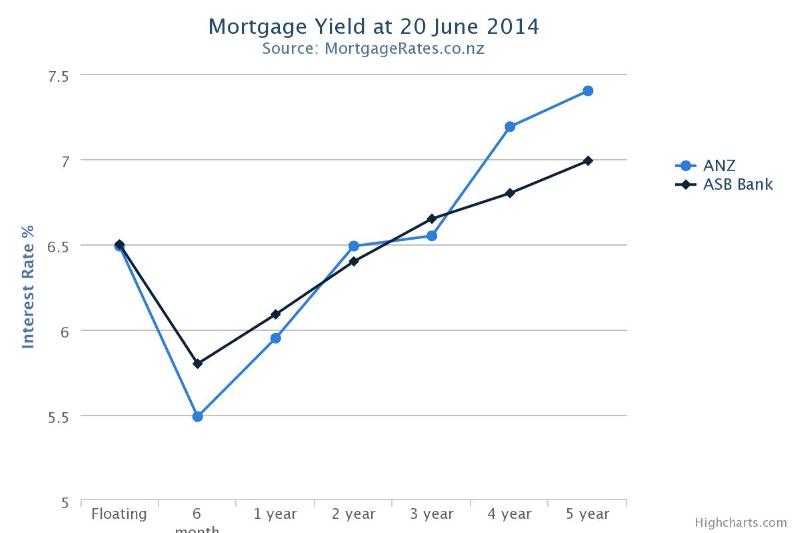

How ASB's new rates compare to ANZ

The move to its rates have seen the yield curve flatten significantly and reducing the gap between shorter and longer term rates. Indeed there is only a 90 basis point spread now between its one year fixed rate and its five year rate.

Rates whihc have increased are six-month, one-year, 18 month and two-years. These have increased between 21 and 35 basis points. Rates of more than two years have fallen 20 points for three year terms, 39 points for four years and 41 points for five years.

The above graph compares ASB to ANZ. We have chosen ANZ as it is the biggest lender in New Zealand and has consistent pricing across the curve, bar the three year rate.

ASB's rates also apply to its fully-owned bank subsidiary Bank Direct and insurer Sovereign.

At the same time as making these changes ASB has also removed two of its three "special" rates. Gone are three and five year specials. However, the two-year special of 5.85% (with conditions) is still available.

The two-year rate is where the most competition is with nearly all the big banks offering specials on this term. We have sorted the rates table from lowest to highest two-year rate which graphically shows the intense competition.

See the table here.

NEW FEATURE: Special rates in our rates table are now underlined. If you hold your mouse over the rate you will see the special conditions that apply to that rate.

| « [MRadio] Listen to the latest home loan news | [MRadio] Listen to the latest home loan news » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |