Yield Curve: Small lenders v Big banks

With so many home loan rate changes at the moment we have done some comparisons between various lenders to see who they stack up against each other.

Saturday, June 20th 2015, 12:33PM

In this week's look at yield curves we have two graphs the first is the big banks and how they compare with standard rates.

First up is the big banks. The key feature here is that there is little difference between what is on offer. On standard rates BNZ is a clear market leader and Westpac, which has received a lot of flak over its pricing in recent months is looking much more competitive viz-a-viz the other banks on standard rates.

ANZ is in line with Westpac, generally, except with one and two year rates.

ASB, on carded rates looks pretty unappealing compared to its competitors, but it should be noted that it has the biggest number of specials in the market and there are significant spreads between carded and standard rates as follows.

The spread on its one-year rate is 50 basis points, the two-year is 39 points and 36 and 34 points respectively for three and five year rates.

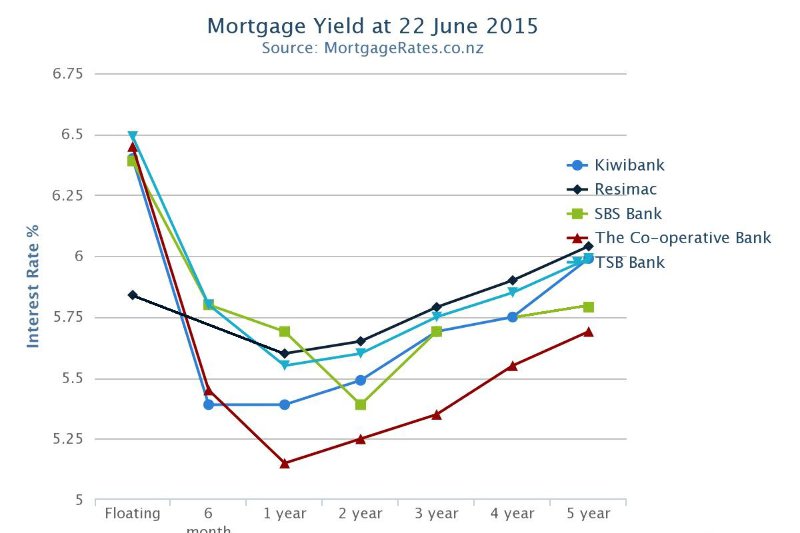

When it comes to the smaller lenders who work with mortgage advisers we see a much bigger divergence in rates.

The key feature of this graph is that The Co-operative Bank is a clear market leader across all fixed terms. We would expect SBS to be up with the Co-operative Bank or even better it, however that isn't the case. In fact SBS only cut its floating rate on Friday and hasn't moved its fixed rates.

Non-bank lender, RESIMAC, is very competitive on the floating rate. It has picked this term as its competitive price point as variable rates have more margin to play with than fixed rates. Today it has reduced all its Prime and Specialist variable Interest Rates by a further 25 basis points. It has also reduced fixed interest rates by up to 28 basis points which is close to its bank competitors.

To do more comparisons see the full rates table. complete with Specials, here.

Notes for readers: We have just graphed standard rates. Many lenders have Specials in the market at the moment. A number of these are below the 5% mark. Also it is possible to negotiate with lenders to get a rate better than what is carded.

| « Under par GDP leads to OCR cut calls | Banks net interest income falls - PwC » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |