A test of inflation targeting credibility?

Recent inflation expectation surveys create a real headache for the Reserve Bank, Harbour Asset Management director of fixed interest Christian Hawkesby says.

Thursday, February 25th 2016, 2:46PM

by Harbour Asset Management

The most recently released New Zealand inflation expectation surveys compound the Reserve Bank's headache over persistently low inflation. On balance, in our view, these help keep the door open for further cuts in the Official Cash Rate (OCR), as soon the next March meeting.

Back in January, headline annual NZ CPI inflation for 2015 Q4 came in lower than expected at just +0.1%, well below the bottom of the RBNZ’s target range.

In the face of stubbornly low headline inflation, the RBNZ have been at pains to emphasise that core inflation measures (that strip out volatile items) and inflation expectations remain well anchored. This helps justify their decision to look through the current low headline CPI inflation numbers, and instead focus on achieving future inflation outcomes. As if to underline this point in bold print, in a recent speech the Governor took aim at critics of the RBNZ that take “a mechanistic approach” that leads to “an inappropriate fixation on headline inflation”.

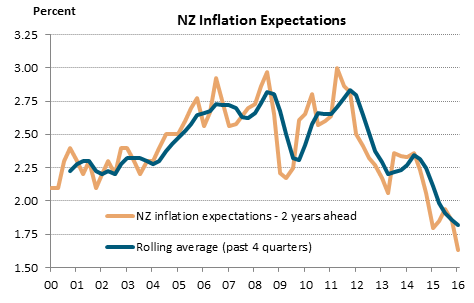

For many years, the RBNZ’s favoured measure of the NZ CPI inflation expectations was its own survey of expectations two years ahead. For much of Alan Bollard’s tenure as Governor this averaged around 2.5%, which in part motivated the inclusion of a new phrase in the Policy Targets Agreement (PTA) to “focus on keeping future average inflation near the 2% target midpoint”.

Source: RBNZ survey

As the RBNZ’s two-year inflation expectations survey measure fell towards 2% in 2013, it was initially seen as a great triumph for the new regime. However, the story has become much more complicated since then, with this measure of inflation expectations continuing to trend lower. This creates both an analytical and communication challenge for the RBNZ.

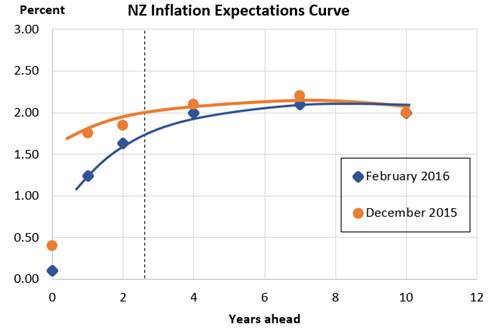

In search of a more comprehensive measure of NZ inflation expectations, last year the RBNZ introduced the concept of an inflation expectations curve. Instead of relying on a single number, they created a scatter plot of the results from a range of different survey measures. By fitting a curve through these observations, they create a richer picture, with the 2-to-3-year part of this curve being an important summary measure of the level of inflation expectations.

In the December Monetary Policy Statement, this approach had inflation expectations sitting around 2%. That reinforced the RBNZ’s confidence that inflation expectations remain well anchored, with little spillover from low current headline inflation numbers. However, the latest inflation expectations data released by AON and the RBNZ in February change this picture noticeably. The chart below is our own back of the envelope attempt to produce a new inflation expectations curve, updated to February 2016. With the one and two year ahead inflation surveys sharply lower, the 2-to-3-year part of this curve has been dragged down to around 1.75%. As such, it becomes harder to conclude inflation expectations are well anchored.

Source: RBNZ and AON surveys.

Source: RBNZ and AON surveys.

Notes: The one-year ahead measure is an average of RBNZ and AON. Two-years ahead is RBNZ. Four-year and seven-year ahead is AON.

This leaves the RBNZ with an awkward policy judgment to make.

They could take a Bundesbank-type approach. That is, take no action and instead rely on their past inflation-targeting credibility for inflation expectations to eventually rise back to the mid-point on their own accord. Alternatively, they could take an ECB-type of approach. That is, be very clear they are willing to “do whatever it takes” in order to generate inflation pressures that would lift inflation expectations back to the mid-point of the target, to avoid persistently low inflation. The ECB-type approach would involve taking action now.

Of course no single piece of economic data or survey will dictate the RBNZ’s approach. Some areas of the New Zealand economy are still performing strongly, particularly tourism and migration. The Auckland housing market also remains a financial stability concern. However, when added to a persistently elevated NZ dollar, falling dairy prices, a fragile global backdrop, and rising bank funding cost, in our view falling NZ inflation expectations help keep the door open for further cuts in the Official Cash Rate (OCR), as soon the next March meeting. For investors, this all reinforces the theme of lower interest rates for longer, with continued demand for income generating assets.

Important disclaimer information

| « ASIC outlines commission review scope | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |