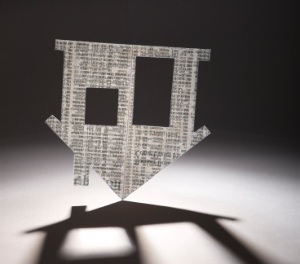

Mortgage lending falls in June

Latest data from the Reserve Bank shows mortgage lending tapered off in June following a strong surge in May.

Wednesday, July 25th 2018, 4:34PM

by Dan Dunkley

According to figures released today, lending volumes hit $5.3 billion last month, roughly comparable with the $5.09 billion lent in June last year, but significantly lower than the $6.5 billion borrowed in May.

The data suggests the market comeback kick-started by the relaxation of LVR rules in January has calmed.

First time buyers cooled their interest in the New Zealand property market after a strong showing so far this year. According to RBNZ, they borrowed $803 million, compared to over $1.1 billion in May.

Government restrictions on property investors, including tough LVR limits, kept investor borrowing subdued in June. Fears over further government measures have put the brakes on investor activity in New Zealand’s major cities in recent months.

Investor borrowing was in line with June 2017. Investors borrowed $1.25 billion last month, compared to $1.21 billion in June last year. Volumes were much lower than May, however, when investors borrowed $1.5 billion.

The investor lending figure is the lowest since February, when investors borrowed $1.03 billion. In June 2016, investors borrowed more than $2.3 billion. Investors took a 23% share of the new lending market in June. Yet this remains significantly below the 35% investors had back in June 2016, as RBNZ introduced the third round of LVR.

High LVR lending remains scarce in the market, the data shows. A total of $406 million was borrowed on an LVR of more than 80%, broadly similar to June 2017, when $319 was borrowed.

| « Dealer groups divided on Code | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |