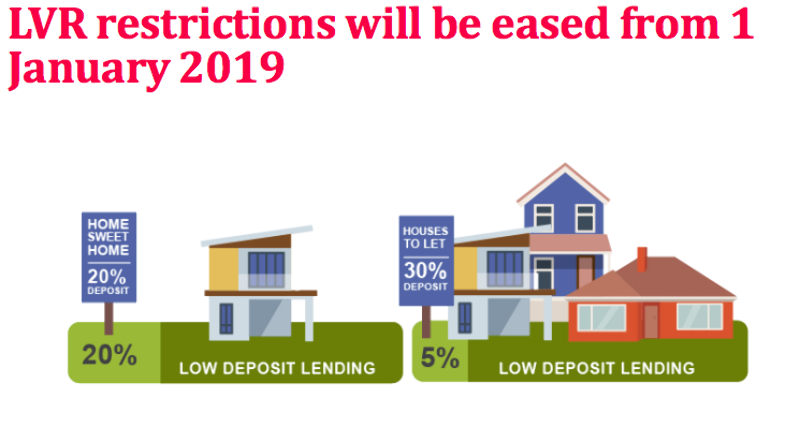

LVR restrictions eased for investors and owner-occupiers

The Reserve Bank has loosened LVR restrictions, with changes coming into effect in January. Banks will be able to provide 20% of their owner-occupier loans to borrowers with a deposit of less than 20%. While lenders will be able to allocate 5% of new investor loans to borrowers with less than a 30% deposit.

Wednesday, November 28th 2018, 9:11AM

The changes, unveiled with the central bank's Financial Stability Report, mark a gradual relaxation of LVR restrictions designed to cool the housing market. Current LVR rules stipulate that banks can lend only 15% of their book to owner-occupiers with a deposit of less than 20%, and 5% of their investor loans to those with a deposit of less than 35%.

The Reserve Bank Governor Adrian Orr said: "Risks to New Zealand’s financial system have eased over the past six months, but vulnerabilities persist. In particular, households remain exposed to financial shocks due to their large mortgage debt burden."

The central bank said slower household lending growth, reduced high LVR lending, and slowing interest-only lending rates had reduced risk in New Zealand's financial system. The Financial Stability Report predicted slow growth for the long term due to government measures and supply initiatives including KiwiBuild: "House price growth has also slowed, particularly in Auckland. We think house price growth will remain low for some time, particularly as some Government initiatives are likely to weaken demand and support supply. The longer that house prices grow slowly, the less likely it is that they will fall sharply in the future."

RBNZ governor Orr said the central bank would further relax LVR rules in the coming years, as long as risks "continue to diminish".

| « Reserve Bank to ease loan-to-value ratio restrictions | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |