Westpac says RBNZ capital proposals would add $6,000 a year to an Auckland mortgage

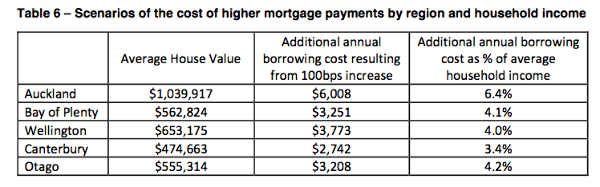

Westpac says the Reserve Bank’s bank capital proposals will mean homeowners with an average mortgage in Auckland will be paying about $6,000 a year more in interest.

Friday, May 24th 2019, 10:02AM

The bank says the central bank has greatly underestimated the cost of its proposal to near double minimum tier 1 capital from 8.5 percent currently to 16 percent for the big four banks and 15 percent for the smaller banks.

The RBNZ has said its proposals would add between 20 and 40 basis points to the cost of a home loan and that amount would be lost in “noise” around interest rate changes but Westpac says the cost will be more than 100 basis points in its submission on the proposals.

Westpac says RBNZ hasn’t provided “quantitative justification” for the proposals which “go well beyond international norms.”

It criticises the central bank’s failure to produce a cost-benefit analysis, a criticism already levied by many commentators who, like Westpac, have said that should have been the RBNZ's starting point.

Westpac says the absence of that analysis means “it is unclear that the economic costs of implementing the proposals are justified.” It estimates one of the costs will be to shave 1.3 percentage points off New Zealand’s annual GDP.

GDP in the year ended March was 2.8 percent so, if Westpac is right, the bank capital proposals would reduce that to 1.5 percent.

Westpac’s submission is littered with savage criticism of the analysis RBNZ has done. For example, the consultation paper released in December “does not adequately consider” the adequacy of existing bank capital levels.

“The RBNZ has not considered whether there is in fact a problem with current capitalisation and, consequently, has not defined the problem that the proposals seek to solve.”

RBNZ has said New Zealand banks on average carry about 12 percent tier 1 capital, significantly above the current 8.5 percent minimum.

Westpac says the proposals “are not justified by any supporting data or evidence,” RBNZ’s analysis is “materially incomplete and flawed”, and that the central bank has selectively used academic research to back its proposals while ignoring research that doesn’t support them.

It submission points out that as late as November last year, six weeks before the consultation paper was released, RBNZ was proposing to cap the probability of a banking crisis to a one in 100 year event. In the consultation paper, that cap was doubled to one in 200 years.

The consultation paper, and subsequent supporting documents, use assumptions “which do not provide a complete picture of crisis scenarios nor a realistic view of how the proposals may impact borrowers and savers in ordinary times.”

Detailed analysis of the impact, including on interest rates and credit rationing, “has not been undertaken” and RBNZ has needed “considerable manipulation to unreasonable levels” to get the outcomes it wanted.

“The proposals have essentially assumed that New Zealanders would be willing to pay for protection against a banking crisis occurring within a period equivalent to that from the time between the failure of the Medici Bank in 1494 through the South Sea Bubble in 1720 to today.”

Westpac complains about the lack of regulatory checks and balances in the Reserve Bank’s mandate to be prudential regulator compared to the checks and balances on other regulators.

Westpac is also railing against the RBNZ’s proposal to limit the advantage the big four banks get from using their own internal models to calculate risk-weighted capital. All the other banks, including the four New Zealand-owned banks, Kiwibank, TSB Bank, SBS Bank and the Co-operative Bank, have to use standardised models.

In February, RBNZ illustrated that advantage by showing that ANZ needs to hold slightly more than half as much capital as Kiwibank does for each $100 of mortgage lending.

The central bank is proposing to reduce that advantage to no more than 90 percent of the capital required by the standardised models all four of the smaller banks are required to use.

Westpac describes that as “creating some simplistic public support for this aspect of the proposals.”

The logic behind internal models is that each individual bank is supposed to apply its own actual experience of how different types of loans perform and how likely borrowers are to default.

Reducing the benefit so much discourages bank investment in risk analysis and risk modelling and “has the effect of dulling portfolio signals in the event of an economic downturn.”

Westpac says average risk weights for mortgages in New Zealand are about 28 percent compared with 24 percent in Australia and would rise to about 34 percent under the RBNZ proposals.

RBNZ talks about “levelling the playing field” for the locally-owned banks but “levelling the playing field between banks is not currently within the statutory mandate of the RBNZ,” Westpac says.

It suggests that all RBNZ needs to do to level the playing field is to adopt the latest Basel lll rules rather than to continue using the Basel ll rules, standard-setting agreements between banks internationally.

For example, RBNZ’s current rules and the Basel ll rules impose a 35 percent weighting for mortgages with loan-to-valuation ratios up to 80 percent. The superceding Basel lll rules would mean a 20 percent weighting on mortgages with 0-to-50 percent LVRs, a 25 percent weighting on mortgages with 50-to-60 percent LVRs and a 30 percent weighting on mortgages with 60-to-80 percent LVRs.

Like a number of other submitters, including the four NZ-owned banks, Westpac is also criticising RBNZ’s proposal to disallow using hybrid securities – those which normally behave like debt but which could be converted to equity in a crisis – to be part of tier 1 capital.

Hybrids are significantly cheaper than equity and “we strongly suggest that this decision should be revisited.”

Reserve Bank governor Adrian Orr was Westpac's chief economist between 2000 and 2003 and National Bank's chief economist before that. National Bank was later taken over by ANZ Bank.

(BusinessDesk)

| « Kiwibank one year special down to 3.85% | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |