Home a-loan this Christmas

Milford Asset Management portfolio manager Michael Higgins explains why mortgage brokers have become so dominant in Australia.

Thursday, December 12th 2019, 8:57AM

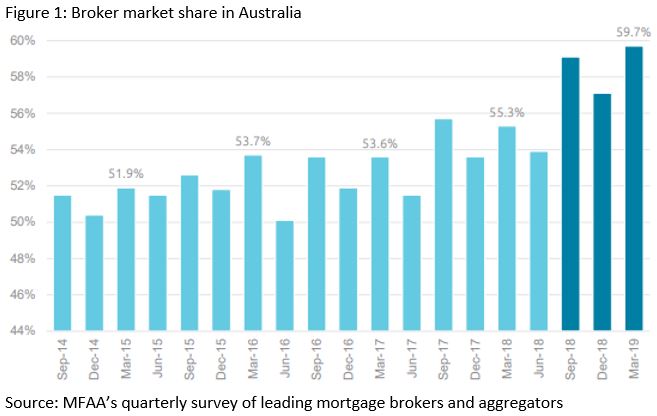

If you’re looking for a home loan in Australia today, chances are, you’re going to use a mortgage broker. In the latest home loan channel survey, six out of 10 residential mortgages are now originated using a broker (Figure 1).

Broker share in the early 1990s was estimated to be in the teens at best! The explosion has been a function of

i) a better understanding of a brokers value proposition and more competitive interest rates,

ii) the consistent closure of major bank branches which have shrunk ~40% since the early 1990s, and

iii) the increased complexity required in getting a loan.

The Royal Commission has also been a huge positive to brokers driven by more intrusive and detailed requests for information about income and expenditure. Interestingly, when the UK announced a similar Mortgage Market Review (MMR) in April 2014 post the GFC, broker originated loans has since ballooned to ~80%.

Tighter regulation under the MMR drove borrowers into the arms of brokers, as applicants faced longer interrogations to ensure they could repay their loans.

During a recent refinance of my own three-year-old family home loan, my bank didn’t even respond when I enquired over email about refinancing at a better interest rate. When I engaged a broker for no out of pocket expense, I had three comparison major bank rate offerings within a week that were all ~50bp sharper.

The bank I ended up choosing was a major bank that not only offered a great rate but also a $3,500 cash incentive payment to move. Even when I submitted the relevant loan transfer forms, my original bank didn’t even call me back to retain my business!

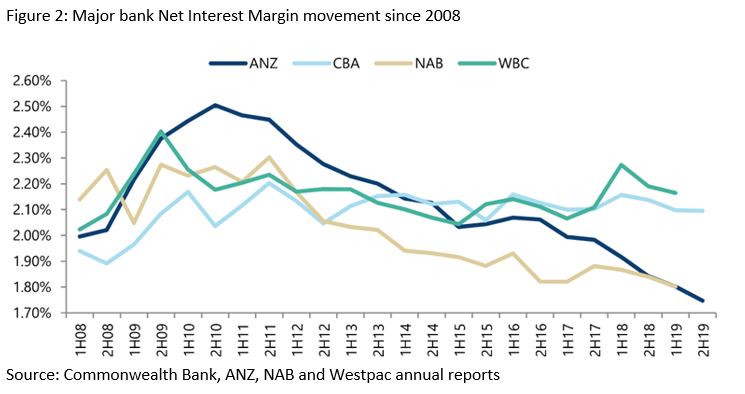

Mortgage brokers increase choice and competition between lenders which in many cases lead to better service levels and competitive pricing. This is reflected in the Net Interest Margins ‘NIM’ across major banks.

The NIM is the ratio between what a bank earns in interest across its loan book compared with its funding (i.e. consumer deposits). The proliferation of mortgage brokers has been a key contributor to the fall in bank profitability over the past 20 years (Figure 2).

Like the UK experience, we think the shift towards mortgage brokers is likely to continue. Milford is exposed to this thematic through our position in Australian Financial Group (AFG.ASX). AFG is currently one of the largest mortgage originators in Australia.

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice. Milford Funds Limited holds shares in Australian Financial Group on behalf of its clients.

| « Home a-loan this Christmas | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |