Low rates until 2022

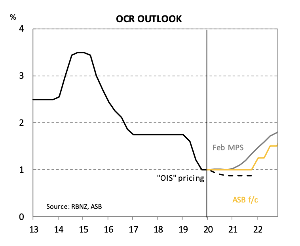

ASB economists predict the next OCR tightening cycle will start in early 2022, with interest rates on hold throughout this year and next year.

Monday, February 17th 2020, 12:19PM

The economists, led by Nick Tuffley, believe the Reserve Bank will hold off raising the OCR for a couple of years, with rates rising to a high of 2.25% in the coming cycle.

The bank expects a "series of mild hikes" from 2022 after a long period of low rates for borrowers.

If correct, the prediction could see mortgage rates hover around current levels for the next 18 months.

However, in the near-term, its interest rate risks remain "skewed to the downside", with the potential impact of the coronavirus "a key uncertainty".

The bank still expects NZ and global interest rates to remain "historically low", with policy rate cuts from other central banks this year.

ASB is buoyed by the Reserve Bank's MPS last week, after the central bank struck a positive note on the economic outlook. The RBNZ pointed to additional infrastructure spending as a boon for the economy over the coming year.

The central bank's OCR track has pencilled in a 25 basis point increase next year, with a further 75 basis points by the end of 2022.

"The RBNZ held the OCR at 1% and again showed little reluctance to move settings in the future given increased fiscal stimulus and signs that the 75bps of OCR cuts in 2019 look to have stimulated the economy."

| « Investors get chance to fund home loans through Squirrel; Harmoney exits | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |