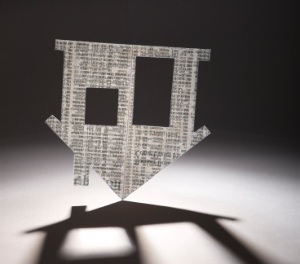

How many people are still asking for home loan help?

While it has been several months since our last lockdown, a steady stream of people continue to ask for help on their home and business loans.

Tuesday, November 24th 2020, 6:53AM

A look at the latest data on mortgage deferrals indicates requests have remained steady for the past month, with more than 200 home loan customers making deferral requests each week.

In the week to November, 257 home loans worth $68 million went onto deferral, while 992 loans worth $344 million were restructured to interest-only.

The numbers show Kiwis continue to struggle in the wake of the Covid-19 pandemic and subsequent financial shock.

The mortgage deferral programme, launched by the government and retail banks at the height of the crisis, saw 28,000 home loan customers go onto deferral at its peak, representing loans worth $7.8 billion, in the second week of April.

ANZ New Zealand, the nation's largest bank granted 24,000 of its 529,000 home loan customers (4.5%) payment deferrals, as of October. About 10,000, or 1.8% of home loan customers, remain on deferral, it said last month.

Advisers report a small number of clients remaining on deferral following redundancies and loss of working hours.

Q Group's Geoff Bawden said some clients had asked for help.

"Most have reverted to normal terms. We have a few that took the extension of another six months and even less that are likely to need further assistance in due course."

Bawden said customers had taken deferrals due to uncertainty over income, "and the reality that they might not have quite recovered": "Some had been made redundant or had hours reduced, mainly a reduction in hours, and some were just being cautious," he said.

The Reserve Bank extended the mortgage deferral programme until March to give borrowers more time to get their finances on track during the pandemic.

Banks will still be able to offer deferrals to borrowers after March, but will not receive the same concessionary regulatory treatment from the RBNZ.

The Reserve Bank data also shows an increase in takeup of the Business Finance Guarantee scheme, a loan scheme underwritten by the government to provide access for funding during the crisis.

According to November 6 data, 93 people used the scheme in the first week of this month, following an increase since the beginning of October.

| « Tough conditions for first home buyers | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |