Prospa bounces back from first lockdown

Small-business lender Prospa has seen its lending flourish after drying up at the end of last year due to the Covid-19 pandemic.

Friday, September 3rd 2021, 6:00AM

New Zealand originations were at A$78.2 million, significant growth of 77% compared to FY20.

Originations were driven up due to the increase in registered partners across New Zealand.

In New Zealand the average loan size has risen 29% to $31,000 and the average term is a touch over 15 months, in the year to June 30. The term is on par with Australia, and the average loan size is $6,000 less in New Zealand compared to Australia.

New Zealand makes up 15% of Prospa's lending book.

Prospa NZ managing director Adrienne Begbie thanked mortgage advisers for their support: "Our broker partners have also been working tirelessly to champion our small businesses and collaborating with us to find solutions that fit their clients’ needs."

"We’re proud of the support we’ve been able to offer to not only help businesses recover, but also take hold of new opportunities and even grow and expand their operations during times of uncertainty."

“Being able to support so many small businesses during such a trying year has been truly rewarding. New Zealand’s economic recovery from Covid-19 has been leading the way in many aspects and our small business sector has contributed significantly to that recovery.

"While our current lockdown is no doubt a difficult setback for many, we know Kiwi small business owners are resilient, and we will once again rally around them to show our support."

"New Zealand's go hard and go early approach has served us before, and we trust it will again," she said.

The big picture

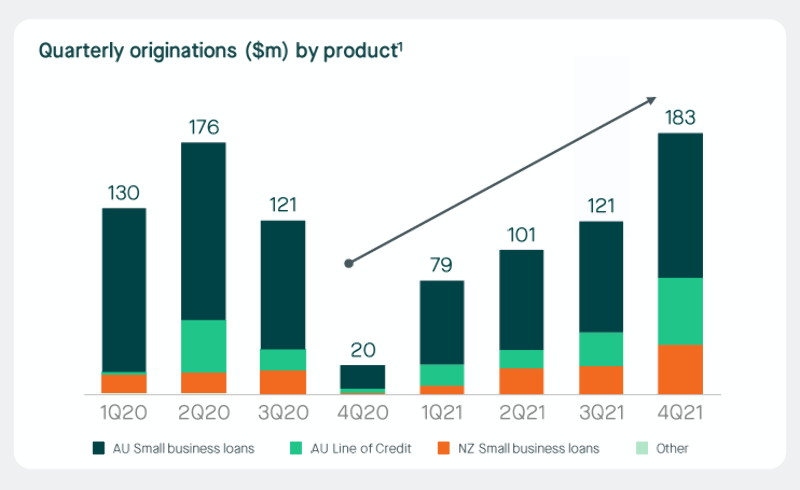

Over, the group said its full-year results were supported by record fourth-quarter originations and that it was in a strong position to sustain rapid scale and growth.

Loan originations for the year were up 8.1% to A$483.7 million, compared to A$447.5 million in the previous year. It said there was a strong rebound from Covid-19 in the second quarter, leading to a record quarter of originations in fourth quarter of A$183 million. This was an all-time record in the company’s nine-year history.

Prospa had 11,900 active customers. With a growing loyal customer base, 54% of originations valued at A$262.4 million were generated from repeat customers, achieving a materially lower acquisition cost than the cost of attracting new customers.

The company said in its results announcement that it "witnessed small businesses struggle, but the entrepreneurial mind of a business owner enabled many to focus on recovery and growth. Over the past quarters, the company observed small business owners take advantage of the economic recovery to evolve their business models, create new products, and adapt their cost structures."

"The ability to meet small businesses’ needs helped Prospa achieve strong results, including a key milestone of more than A$2 billion in loan originations for nearly 34,000 small business customers since Prospa’s inception.

"The first billion in capital funding took six years, and the second billion took just two years."

| « Resimac writing more prime loans and dealing with more advisers | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |