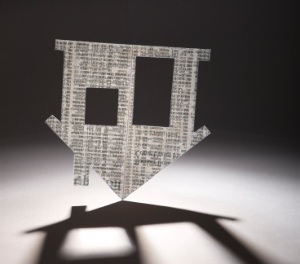

Broker complaint dismissed

FSCL has rejected a complaint against a broker and finance company after a client fell behind on mortgage payments and was forced to sell their home.

Wednesday, September 22nd 2021, 4:01PM  1 Comment

1 Comment

According to the dispute resolution service, a home loan client named Christina borrowed $950,000 to buy a family home while on ACC and income protection payments from her insurer.

The client's mortgage broker assured the lender that Christina would soon return to work, and presented accounts to show she could "easily" afford her payments.

After making the first three payments on her home loan, Christina had a second accident. Neither her insurer nor ACC accepted her claim for the second injury.

The client then phoned her lender to inform them that her mother was unwell overseas, and she would need to leave the country. She requested a three month deferral, with the bank negotiating that down to one month.

The situation then spiralled. The client struggled to pay their loan and was informed that a PLA notice would be issued.

Stranded overseas, the client attempted to sell the property before the lender applied for substituted service.

This was successful, allowing the lender to serve a PLA notice.

Following the notice, the client complained to FSCL.

The client said her lender should not have approved her loan because her income was insecure, and said the finance company should have acted upon her second injury and withdrawn financing.

She complained that her finance company and broker "conspired" to charge her unreasonable fees – $4,295 from the lender, and $4,750 from the finance company.

The client also complained that her rates, at 7.75%, were far higher than the average bank rate at the time.

In addition, the client said the lender had no authority to pursue a mortgagee sale, as her PLA notice was not served in person.

FSCL ruling

FSCL said it had "some concerns" about lending a large sum to someone on income protection and ACC payments, but said evidence presented to the lender underlined the client's ability to service the loan.

"Instead it seemed that Christina’s changing circumstances had caused the default," FSCL said.

The dispute resolution service said the client's lender was obliged to offer hardship relief under the Responsible Lending Code, but noted the lender had done "everything they could" to help the client keep the house.

FSCL said it was satisfied that the brokerage and establishment fees had been disclosed, as had the interest rate details.

It was satisfied the PLA notice had been served appropriately.

Resolution

After receiving FSCL's ruling, the client put her home up for auction. Should the auction be unsuccessful, the finance company will be entitled to take over the sale process to secure the proceeds.

FSCL confirmed its view that the loan was affordable and that the client's change of circumstances led to the mortgage default.

| « CCCFA an opportunity for advisers | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

"The client then phoned her lender to inform them that her mother was unwell overseas, and she would need to leave the country."

Hmmmm..........sounds like the type of client that any decent mortgage broker should have avoided like the plague.