No jab, no job - legal rights in the workplace

Covid-19 and its highly infectious delta variant are coming to a workplace near you and it's important for everyone in financial services to know what they can and can't do in the interests of workplace safety.

Tuesday, November 9th 2021, 6:54AM  3 Comments

3 Comments

by Matthew Martin

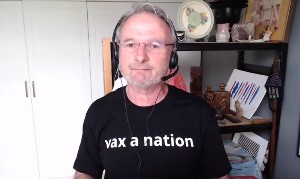

Professor Rod Jackson.

Those attending a Financial Advice New Zealand "Bring in the Experts" webinar yesterday were treated to the usual Covid-inspired misinformation by some members, however, the majority were given the chance to hear from two experts about an issue that is becoming increasingly important to all employers and employees - the issue of "no jab, no job".

Financial Advice NZ chief executive Katrina Shanks admitted she was nervous about running the webinar but said everyone was entitled to an opinion on an issue important to the industry.

Presenting a legal position on the subject was Russell McVeigh partner and employment, health and safety expert Emma Peterson, while on the medical side was Professor of Epidemiology & Biostatistics at the School of Population Health Rod Jackson.

Russell McVeigh has decided not to allow any staff or visitors into their buildings unless they have had both vaccinations due to health and safety concerns.

"As an employer, you will want to know if your employees are vaccinated," Peterson says.

"You can ask, but they don't have to tell you...but then you can assume they are not vaccinated."

Peterson says employers must look at the roles within an organisation and make a risk assessment of staff who may not be able to be vaccinated under health and safety rules.

This includes what roles employees have, are they able to work from home, how often do they interact with colleagues, the public and clients, and the risks involved with those interactions.

Under health and safety provisions, businesses can introduce vaccine passports as a condition of entry, but looking at other solutions such as working from home or a change in roles is also helpful.

Peterson says under the New Zealand Bill of Rights employers cannot require staff to get medical treatments but companies can deem some roles can only be done by vaccinated staff, or make it a requirement that anyone who comes into a business must be vaccinated.

She says there is not yet any case law testing vaccine mandates in workplaces and the key for employers are health and safety risk assessments followed by WorkSafe guidance, which should be released soon.

Peterson says a lot more workplaces will be introducing vaccine passports and dealing with unvaccinated staff will involve compromise.

This can include redeployment, working from home or a new role, but all options must be exhausted before termination of employment.

Professor Jackson told viewers that the delta variant was the game-changer for New Zealand as it's an extremely contagious variant and Covid-19 is the worst public health issue since World War II.

"Eventually, everyone in New Zealand will be either immunised by the vaccine or the virus - and I can tell you, you do not want to be immunised by the virus."

He says he's a supporter of 'no jab - no job' and virus containment measures saying New Zealand has to pull out all the stops to get Kiwis vaccinated.

Professor Jackson spent some time debunking Covid-19 and vaccine myths put forward by some viewers and says for the next few years the country will see off and on restrictions on a smaller level depending on the proportion of people who are vaccinated.

"A fully vaccinated office is very good protection against infection and you probably won't have to shut down - the more unvaccinated in your office the more it will spread."

| « Reserve Bank gives more details on DTIs | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

I actually LOLed at the UK "immunity capacity loss" and then almost fell off my chair at the "graphene oxide" bit.

FFS srsly

I couldn't believe I was watching actual vaccine disinformation, credibly debunked, being passionately presented as truth like some sort of gotcha moment.

Sign In to add your comment

| Printable version | Email to a friend |