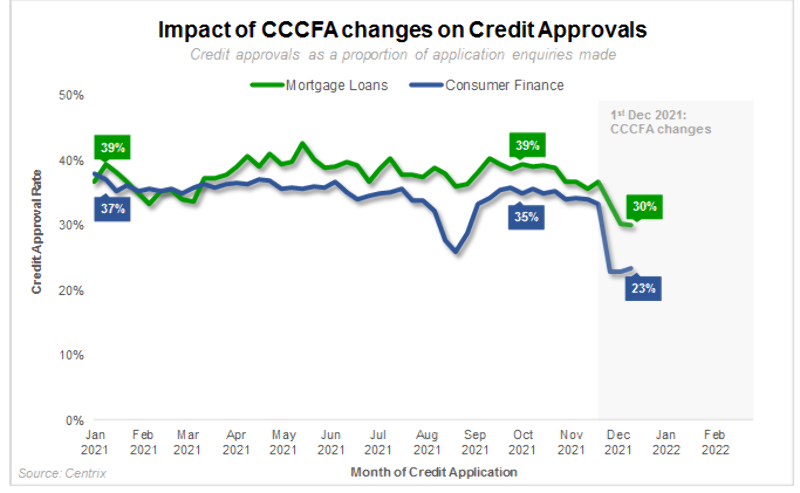

CCCFA cuts mortgage acceptances by 23%

New information suggests the Credit Contracts and Consumer Finance Act (CCCFA) is already biting sharply into people's ability to get a mortgage.

Friday, January 14th 2022, 2:15PM  2 Comments

2 Comments

by Eric Frykberg

It suggests a 23% drop in the number of people getting a mortgage after the Act came into force. Consumer finance applications such as credit cards were also hit.

The figures come from the credit reporting company Centrix.

They show, in summary, one in five mortgage loan approvals have been hit by the new CCCFA regulations.

In other words, many consumers who were previously approved are no longer eligible under the CCCFA changes.

Centrix stresses it is early days, and further information will come in as the subject is researched deeper.

But it says in the pre CCCFA-era, monthly mortgage commitments were on average, $8.3 billion per month.

Post-CCCFA, the number was down to $6.4 billion, which is a 23% drop.

Centrix stresses that these figures are indicative at this stage and might change slightly in the coming weeks as more data is received.

But it says a clear picture of thwarted customers is starting to reveal itself.

The CCCFA has been widely criticised as a broad brush approach to specific and often quite rare problems, and the managing director of Centrix, Keith McLaughlin agrees.

“Back in January 2020, arrears on mortgages were 1/5% of the portfolio. They are now down to about 0.9%,” he said.

“I think responsible lending and comprehensive credit reporting have played a major role in dropping the arrears across major mortgage portfolios, to the extent that I don't think it is a major issue.

“The introduction of this legislation is affecting more people than just the vulnerable.”

As a credit reporting agency, Centrix might normally be expected to support legislation that led to fewer bad debts.

McLaughlin said even the 0.9% of arrears needed to be dealt with, but a sledgehammer approach that covered the entire market was not the right solution.

| « Non-bank deposit takers fail to elude latest Govt crackdown | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

advisers got no mercy, named and punished including being struck off.

Sign In to add your comment

| Printable version | Email to a friend |