Mike Pero CEO leaves industry

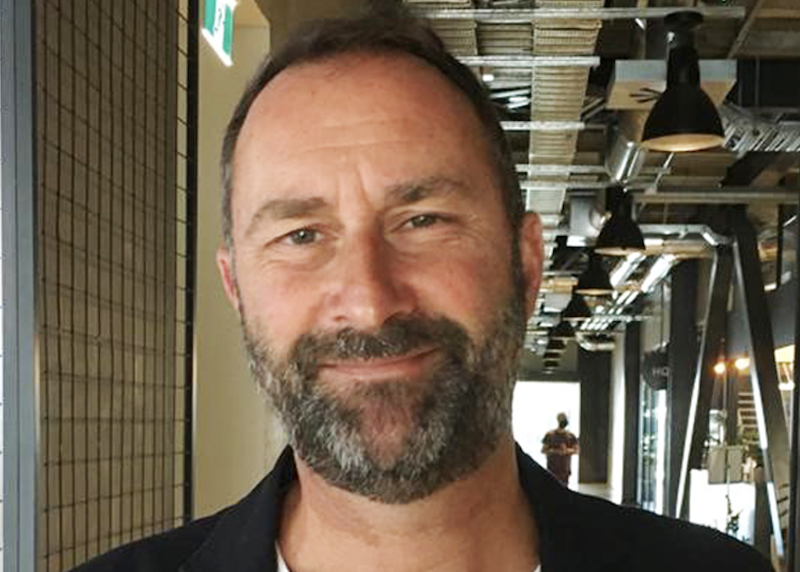

Mike Pero Mortgages chief executive Mark Collins has accepted a new role outside of the finance industry.

Thursday, January 27th 2022, 12:54PM

Collins, who also headed up Liberty Finance and Mike Pero Real Estate is the new chief executive at ChildFund.

ChildFund New Zealand was established in 1990 and has been helping children and youth to thrive in communities impacted by poverty.

Collins has been in the finance sector for more than 20 years with roles at Sovereign and NZ Home Loans and has his own personal charitable enterprise.

Child Fund says the appointment takes it a step closer to being one of Aotearoa’s most impactful and innovative charities with the appointment.

“It is a very exciting time to take the helm at ChildFund New Zealand. There is an amazing opportunity to build on the work that has already been done by the ChildFund team and to move forward in addressing the many challenges facing the international development and charity sector,” Collins says.

“Not least the impact of COVID-19 and now Omicron on the work in the field, but also driving forward funding initiatives to ensure we can keep delivering impact to the children and communities we serve.”

Collins says stepping into the international development sector is an opportunity not only to utilise his skills and experience to deliver impact, but an opportunity to grow personally.

“Many years in the finance sector including starting a business that helps people gift their tax rebate back to charities has opened my eyes to the hugely valuable work being done by charities. I have the commercial and leadership skills and I look forward to helping ChildFund optimise its funding and new innovations to lead to even more impact for the children we serve,” he says.

“I can think of no higher calling than making an impact to the lives of children to help them achieve their potential.”

| « CCCFA bad law but huge growth in credit is the bigger picture | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |