More than half Westpac's business is from advisers

Westpac New Zealand is playing “catch-up” in the mortgage market because it had been losing a little market share, said chief executive Catherine McGrath.

Tuesday, May 9th 2023, 9:21AM

The bank's mortgage book grew at 5% to $65.2 billion in the six months ended March compared with a year earlier when mortgages sold by registered banks grew at 3.5% over the same period.

“We want to broadly perform at systems growth,” but there has been a little slippage in the last few years.

“We might have a little catching up to do,” McGrath told TMM Online.

“We have an appetitite to continue to grow and to support more mortgage customers.”

While Westpac's net interest margin (NIM) at 2.10% in the latest sixmonths is considerable lower than ANZ New Zealand's NIM at 2.67% and Bank of New Zealand's at 2.45%, McGrath said that reflects the other banks' greater degree of lending to higher-margin business customers.

“In our mix of business, we have a lower proportion of business banking than some of the other banks.”

Westpac, like the other banks, continues to increase its dependence on using mortgage advisers to originate loans – advisers accounted for 51.1% of new mortgages in the latest six months, up a percentage point from the six months ended September and compared with 49.9% in the September 2021 year.

McGrath wouldn't be drawn on whether she expects advisers to continue to increase their market share. “My view is we need to be where our customers are and different customers want different things.”

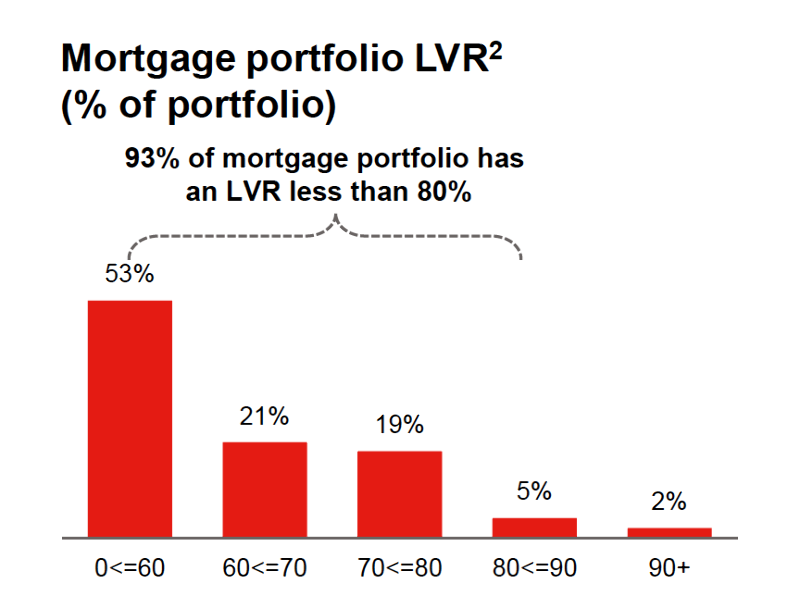

While interest rates have risen steeply since the Reserve Bank began hiking its official cash rate in October 2021 from 0.25% to 5.25%, Westpac's deliquency rates remain very low.

McGrath said that partly reflects low unemployment and the fact that those with jobs are likely to be experiencing pay rises.

But Westpac's economists estimate that, because most mortgages are fixed – 91% of Westpac's were at March 31 – only about 100 basis points of RBNZ's hiking has filtered through to customers so far and there's another about 160bp to go and the passthrough rate won't peak until early next year, she said.

“We do think there's a bit more challenge and difficulty to come,” and customers finding themselves in difficulty should contact the bank early to explore their options.

| « Westpac fattens margins as mortgage book grows | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |