Why Resimac closed up shop in NZ

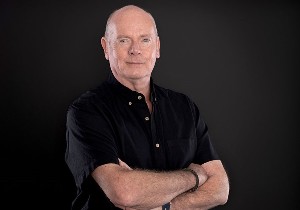

Resimac New Zealand’s biggest writer, Jeff Royle, says the lender had great products but was trying to act like a bank.

Thursday, June 27th 2024, 9:01AM

Added to that the lending market has been hit hard in terms in volume and he expects some other non-bank lenders will be reviewing their business.

For Resimac, the problem was compounded by its products being cheap, he says. “It was probably the non-bank lender’s undoing.”

“They had the most amazing products and they're going to be really hard to replace, but they were too cheap.”

“Last year less than $300 million was lent on mortgages for the whole year. It was shocker or the lending market overall. With low lending volumes and cheap products, the writing was on the wall for Resimac.”

Royle says the lender also went through a period of putting the hammer down on credit. “Although its products were marketing leading, trying to get them approved for borrowers became a bit of a mission.

“To me somebody in credit was putting the brakes on, but not enough to upset the sales people. They just put in a few roadblocks at the back end. I had many meetings with Resimac over the past two to three years and the theme was ‘you are actually more of a bank than a bank’.”

While there is no chance of Resimac going under as it is a big listed Australian company, it has thrown a spanner in the works, particularly as there is been a total blackout of information, apart from a short press release, to advisers and customers in New Zealand.

Royle has about $3 million of mortgages settling with Resimac this week and has been advising other clients with applications sitting in the wings to get them in before July 1 when the non-bank lender will stop accepting any new business in New Zealand.

While Resimac says it will continue servicing New Zealand, Royle has not been able to get any other information despite seeking meetings with business heads when he was in Australia a few days ago.

He says the company may eventually sell its mortgage book or somebody will offer to buy it. “There are clear rules around this – a customer cannot be adversely affected and the buyer cannot hike up interest rates – so it won’t be a big issue, but I have had clients phoning in a panic worried about the future of their mortgage.”

He says what does happen and has happened is the lender has mortgages on numerous fixed rates and when it comes to the end of the fixed rate period the new business operator only offers the borrower the floating rate, which is always the highest rate.

“I can see a lot of people jumping ship if that happens.”

Resimac’s products are between one and one-and-a-quarter per cent cheaper than the other lenders. Resimac’s 80% mortgage prime deal has a fixed interest rate of 7.69% compared to its nearest rival Pepper Money’s rate of 9.69%.

Royle says it’s not actually so much the rate, as the product range Resimac offers in its niche that is going to be hard to replicate, such as its overseas investor product. “Nobody can touch it as the moment.”

It allows Kiwis and Aussies living elsewhere in the world to buy in a house in their own country. Resimac uses a borrower’s gross income and discounts it by only 10% , while ANZ, for example, uses a borrower’s net income and discounts it by a further 20% making it nearly impossible to have enough income to service a mortgage. “This is why Resimac’s products are market leading and popular,” Royle says.

He is talking to a couple of the existing players to try and persuade them to replicate some of the products, although with a price attached to them. “While the products will be more expensive, it is the right thing to do, as any business has to have a sustainable model, otherwise what is the point.”

| « Bizcap cracks $1 bill mark and adds LOC product | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |