Save more or invest better?

The current policy focus on raising the quantity of savings in NZ will do little to increase wealth, let alone savings. Instead, policymakers should focus on raising the quality of investment and education, by ensuring the right individual incentive structures exist.

Wednesday, January 10th 2001, 12:44PM

In our September Quarter Economic Overview we provided a framework for generating economic growth, and highlighted that it is the quality of both capital and labour that most matters.

In this article, we argue that the current policy focus on raising the quantity of savings in New Zealand will do little to increase wealth, let alone savings. Instead, policymakers should focus on raising the quality of investment and education, by ensuring the right individual incentive structures exist.

We doubt that the proposed government retirement income fund will create the right incentive structure. Striking a balance between providing a retirement income for those in need, while maintaining incentives to invest as an individual, is critical for the future of New Zealand.

- When it comes to saving, the world is our oyster!

- "We must save more" appears to be the kiwi policymaker's cry. This advice is based on the idea that New Zealand lacks savings, as most often evidenced by:

- The government fearing that it will not be able to pay for retirement income at its current level, given the wall of grey-hair that approaches. And,

- The declining household savings rate, the persistent current account deficit, and growing external debt.

On the one hand, we dispute that there is a shortage of savings in NZ.

First, the most common measurement of savings - the difference between household income and expenditure - is at best misleading. There are many other forms of savings available to the householder, many of which the government provides.

Second, in a global capital market, there is no such thing as an 'optimal' level of domestic savings. Total investment can (and often should) exceed total savings, with NZ's current account deficit simply reflecting the fact that the use of foreign capital makes up the difference.

Third, a country can have a zero savings rate in aggregate, yet still be fine. Zero aggregate savings simply means that those who are saving (e.g., working) are exactly matched by those who are dis-saving (e.g., retired). Demographics matter.

On the other hand, we have significant concerns related to the quality of investment in NZ.

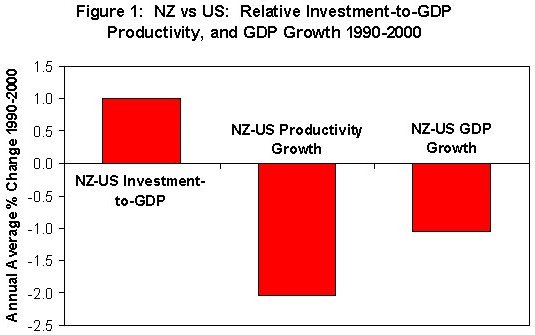

Figure 1, for example, shows that although NZ's investment rate has been similar to the US (as a % of GDP), our economic performance has lagged considerably. It is little wonder that investors have sought these greener pastures, leading the NZ dollar to decline and our long-term NZ-US interest rate differential to rise!

In a global capital market, people are prepared to invest as long as a tidy profit is made within their 'risk appetite'. However, if people think that the return from putting their money in NZ is insufficient, or too risky, then they will head for 'greener pastures'.

Viewed this way, it becomes apparent that New Zealand has more of a problem about investment quality rather than savings quantity.

- Investment is saving

- Saving is gratification deferred, that is, investing in anything that provides a flow of services into the future, rather than providing instant gratification. In other words, saving is simply the mirror image of investment.

This means that savings can come in many forms including money in the bank, paying off debt, increasing equity in a house, investing in a business, and/or capital gains on shares or antiques.

Investing in education is also an important form of saving. As an individual's stock of knowledge grows, so does their earning potential. For example, it is estimated that in NZ a person with a post-graduate qualification will earn on average 33% per annum more than with no qualification .

Another form of saving is 'insurance' against unexpected events such as poor health, an accident, or loss of income. In New Zealand, a lot of this kind of 'insurance' is provided by government and funded by general taxation.

What this means is that in order to measure 'household savings' correctly, a significant proportion of government spending on education, health, and welfare must be included. In addition, increments in private sector net wealth should also be included. Before you know it, the household savings position looks better (at least quantity wise)!

More importantly, given the close relationship between household and government savings, any effort by government to raise their own level of savings will often be offset by a reduction in private savings. In other words, the government is viewed as saving on behalf of the household. This means that government policies aimed at increasing savings are generally more effective at redistributing them. Often government efforts to raise national savings are like pushing on a balloon - the effort will simply lead to a bulge somewhere else.

- It's not what you've got it's what you do with it!

If policymakers are concerned about household savings, it is either because they are measuring savings incorrectly, or because they are unsure about the quality of investment. We think the latter.

In order to raise the returns on investment and increase wealth policymakers need to understand:

- What is the most efficient delivery mechanism of the various forms of public insurance (e.g., education, retirement income, and health)?

- How is the allocation of private investment influenced by the overall policy environment (e.g., taxation and inflation)?; and,

- Where does 'market failure' exist, necessitating government involvement?

Government policy efforts are thus best focussed on improving the incentive structures to invest, and ensuring the efficient delivery of their various forms of 'social insurance'. This policy focus is very different from simply raising the stock of savings.

- Government retirement income

- The government provision of retirement income is generally justified by 'market failure', where people will not provide sufficiently for their retirement due to their 'short-sightedness'. "She'll be right mate, I'll sort it out after this beer".

However, the promise of a government pension also generates its own 'moral hazard', potentially leading to less private savings. "She'll be right mate, the government has got it sorted".

If the general public believes that the government will not let them starve on the street, then any private incentive to save has been significantly reduced. Striking the right balance is thus about government providing:

- A pension level which the genuinely needy can survive on, and 'interest groups' will accept; while

- Ensuring private investment incentives remain strong.

If this balance is wrong then, because of moral hazard, government involvement can lead to under-funding for retirement income and poor private-sector investment decisions.

- Moral hazard and the Government retirement fund

- The government's proposed retirement income scheme is designed to build up a large 'ear-marked' fund which creates more certainty about future retirement payments. Increased certainty is excellent, unless of course it is illusory. Many uncertainties about the proposed scheme do exist, for example:

- Given that tax smoothing only partially funds the future retirement income, will the growing fund create an 'optic of security' and reduce the level of self-provision? Moral hazard reigns!

- Can we guarantee that future politicians will not touch the fund in the absence of individual ownership? And,

- Will the current scheme boost economic growth by more than the alternatives of reducing the tax rate, or paying down government debt and reducing New Zealand's investment risk premium? Both of these policy alternatives can be managed while still providing a government retirement income for those in need!

Note we have not even questioned the proposed fund's governance arrangements, ethical investment parameters, risk appetite, and private access to the pool of capital!

- Public and private partnership

- Given these big issues, why not continue the partnership between the government and private sector to deliver retirement income?

The private sector can assess the optimal level of retirement income insurance amongst those who can afford it (i.e., reducing moral hazard), while the government can assist those individuals who can not afford to save it.

A partnership is exactly what has evolved over recent years. The government has been focused on providing investment education, improving the neutrality of the tax environment, and ensuring that a credible funds management industry exists. Simply supplementing some of these efforts and better directing public funds to the needy, appears an effective, low cost, solution to our retirement income woes.

For example, for low and middle-income New Zealanders, the government could act like an employer retirement-income subsidy, where for every dollar saved the government matches it. Individual names are then attached to the savings (improving governance), the private sector is competing to manage the funds, government support is better targeted, and moral hazard is reduced. Meanwhile, the current retirement scheme could be left purely as a back up only for those who could not save adequately.

Irrespective of the particular retirement fund, as with all policy, the government must be aware of their influence over private saving and investment decisions.

Source: Adrian Orr, Chief Economist, WestpacTrust

Special Offers

Commenting is closed

| Printable version | Email to a friend |