[GRTV] AIA talks affordability, products and AI

For insurers, this year has been dominated by two conversations - affordability and AI. With customer expectations (and pain points) changing fast, insurers have to be quick to respond.

Fisher Funds moves to woo advisers back

After years of neglecting the adviser market, the investment manager is going on the charm offensive.

[GRTV] SBS Wealth expands its advice offering

In this Special episode of Good Returns TV SBS Wealth talks about its plans to expand its advice offering and discusses it's investment strategy which is different to many of its peers.

[GRTV] Tiger FinTech’s Greg Boland on market shifts and NZX struggles

Greg Boland of Tiger FinTech discusses the fading dominance of the Magnificent Seven stocks, a shift to energy and AI-app companies, and the NZX’s struggles.

[GRTV] Turning FMA visits into opportunities: Head of client engagement at Insurance people shares insights from her experience

Insurance People’s Katrina Church sees FMA visits as an opportunity, not a threat. Speaking on Good Returns TV, she stresses the importance of preparation, strong governance, and a client-first approach to ensure firms stay on track and add real value.

[GRTV] Antipodes portfolio manager discusses emerging markets fund's potential amid volatility

Antipodes Portfolio Manager John Stavliotis discusses the opportunities in emerging markets, their strong growth potential and diversification benefits.

[GRTV] RI practice now ingrained but greenwashing a major concern says RIAA

Dean Hegarty, co-CEO of Responsible Investment Association of Australasia joins GRTV’s Philip Macalister to discuss RI performance, greenwashing concerns and the growth of impact investing, as the organisation releases its annual benchmark report.

New quiver from Arrow Finance

Luke Jackson's new gig aims to dominate the short term lending market.

[GRTV] The nitty gritty of Smart’s ETFs

Instead of buying the needle in the haystack, exchange-traded funds or ETFs give investors the opportunity to buy the whole haystack, Smart CEO Anna Scott tells GRTV in our latest episode.

[GRTV] Smart is launching four new ETFs

The ETFs are sector focused investing in Bitcoin, gold and technology. A fourth new ETF tracks the NZX20.

[GRTV] New name, new funds for Smartshares

NZX is rebranding its funds management business, retiring the SuperLife brand and teasing some new funds.

[GRTV] Stronger and more unified voice needed to force KiwiSaver changes

The Retirement Commissioner Jane Wrightson talks to Philip Macalister about changes she would like to see made to KiwiSaver.

[GRTV] Perpetual Guardians growth plans

Perpetual Guardian chief executive Patrick Gamble tells Philip Macalister about the firm’s plans to grow its funds management and financial advice business.

[GRTV] New FAP regime creates opportunities for advisers

The creation of Financial Advice Providers (FAPs) has created a whole new set of opportunities for financial advisers.

[GRTV] FMA monitoring gives FAPs eight out of 10

Think about proportionality says the FMA in the wake of its financial advice provider monitoring report.

[GRTV] From infantry to insurance, protection is a common thread

Four months after stepping into Naomi Ballantyne’s shoes, new Partners Life CEO Michael Weston, says he’d be naive to say the idea of taking the company forward wasn’t a bit daunting.

[GRTV] Rick Willis shares MDRT secrets

MDRT country chair Rick Willis led one of the biggest contingents of New Zealand advisers to the association's annual meeting in Vancouver last month. He talks to GRTV about the trip and how MDRT changed his life.

[GRTV] What needs to change with KiwiSaver

Consilium managing director Scott Alman talks to Philip Macalister about changes he would like to see made to KiwiSaver.

[GRTV] Public aware that ignoring climate change is ignoring investment risk

Just over five years ago Barry Coates was trying to find products for an ethical investment portfolio and gave up after a week. He says with a master’s degree in finance from Yale University, it should’ve been easy but the data wasn’t comparable and there were no objective measures.

[GRTV] Richard Klipin reflects on time at FSC

Richard Klipin signs off as Financial Services Council (FSC) chief executive this week, he talks to Philip Macalister about his achievements and his thoughts on financial advice.

[GRTV] Peer support helps with compliance stress

GRTV talks to AIA chief distribution officer Sharron Botica about the second AIA wellbeing survey and what has changed since the first one.

[GRTV] FANZ stands on its legacy in face of competition in the mortgage space

GRTV sits down with the new chief executive of Financial Advice New Zealand.

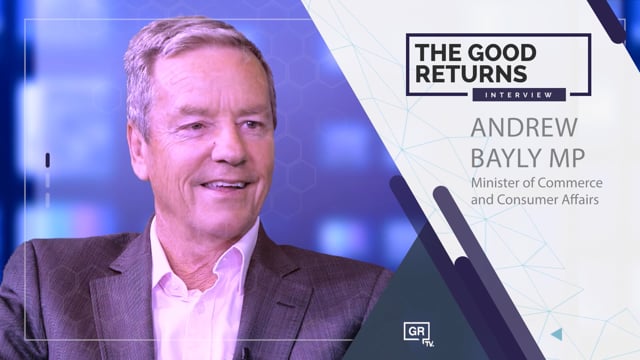

[GRTV] Bayly wants a twin peaks model for financial regulation

Minister of Commerce and Consumer Affairs Andrew Bayly talks to Good Returns TV about his plans for financial services, why KiwiSaver reform is not top of the list and his views on financial advice.

[GRTV] A trip around investment issues with MyFiduciary’s Chris Douglas

It’s not just changes to the trustee tax tax rate that’s driving PIE growth, MyFiduciary principal Chris Douglas tells Good Returns TV.

[GRTV] Free model portfolios aim to improve the industry

GRTV speaks to Clayton Coplestone, principal of Heathcote Investment Partners, about a joint initiative with Kernel to get advisers thinking about portfolio construction.

[GRTV] New report looks at ways to improve access to financial advice + VIDEO

Fidelity Life chief executive Campbell Mitchell discusses the finding of a new new report into financial advice take up and outlines things that need to change.

[GRTV] How well do NZ equities funds perform?

For the first time ever S&P has added New Zealand equities funds into tis highly regards SPIVA report.

Only 54% of active NZ equities managers beat the benchmark index in 2023

[With VIDEO] A bare majority of actively managed New Zealand equity funds managed to beat the benchmark S&P/NZX 50 Index in calendar 2023 but less than a quarter managed to outperform over 15 years.

[GRTV] Two main challenges see $3 billion annual premium opportunity go begging

The market potential in the business risk space is enormous, says Cecilia Farrow, founder and executive director of Triplejump Group.

[GRTV] Tony Vidler: Advisers seek freedom in new world order

Most FAPs have elevated their standards and practices dramatically over the last two years and are now trying to establish efficiency into their businesses, says adviser Tony Vidler.

[GRTV] Three to four fund sweet spot with multi manager KiwiSaver

KiwiSaver is not perfect but even in its current state it is still positive and important to New Zealanders.

[GRTV] Get the country’s under insurance back on the agenda

Life insurance statistics for September have seen an uptick in lapse rates says Asteron Life executive general manager Grant Willis.

[GRTV] Coolabah Capital: new funds and long-short strategies

GRTV talks to Coolabah Capital CIO Chris Joye about how his firm gets double digit returns.

[GRTV]Selecting the right fund manager

Fifteen years ago financial consultant Noah Schiltknecht immigrated to New Zealand from Switzerland and four years ago he founded Makao Investments, a wholesale financial planning and advisory firm.

[GRTV] Cracking the mass affluent market

GRTV talks to Kernel Wealth Management’s Dean Anderson about a massive inter-generational transfer of wealth on the way and what it means for advisers.

[GRTV] Highly aspirational – an adviser’s take on the Million Dollar Round Table

Financial adviser Aaron Baker gives his take on the financial adviser’s version of visiting Mecca - a trip to the Million Dollar Round Table conference in the US.

[GRTV] You never write off the Kiwis

Andrew Inwood, Global CEO of Coredata Group compares New Zealand with Australia and further afield, finding some similarity between Kiwis and Germans.

[GRTV] Advisers can thrive

The Adviser Platform managing director Ryan Edwards, talks business plans, following its purchase of mortgage aggregator Q Group and how he thinks advisers are doing under the new regime.

[GRTV] KiwiSaver: a ticket to prosperity that politicians don’t get

Politicians don’t get KiwiSaver, says Simplicity co-founder and managing director Sam Stubbs.