Investment:

Should you hedge offshore shares?

Thursday, April 12th 2001, 3:23PM

- Currency Management

- For most investors the question of how to handle their foreign currency exposure causes considerable angst. Investors often get bogged down considering questions about the future direction of currency movement. And some may even delay the funding of an investment programme because they are concerned about currency.

It is appropriate for investors to consider currency. Nobody likes the short term losses that can arise from rapid and powerful currency movements. But at the same time investment decisions need to be made in the light of the investors objectives, a coherent strategy and be based upon recognition of true ability to forecast currency movements.

- Are currency movements predictable?

- We need to examine the ability of managers to profit consistently from currency movements. A recent Russell Research Commentary examined this topic in detail. The authors concluded that currency markets are prone to inefficiencies that arise from the fact that some investors are not primarily motivated by profit (e.g. central banks, tourists and corporate treasury departments). The study also found evidence supporting some simple trading rules. Hence the proposition that investors can profit from active currency management is plausible.

However, the authors also uncovered many implementation and operational issues that present a significant hurdle to investors. Currency management is complex and requires a deep understanding of the interaction between interest rates and currency movements, and in the pricing and operation of derivatives. In general, these skills can only be found with professional money managers.

The question of what benchmarks to set and how to derive an investment strategy should be based on the assumption that currency markets are, by and large, efficient. And there is no point in trying to time the implementation of an investment strategy, to take advantage of future currency movements - they are too unpredictable. If active management of currency management is to be considered it is more appropriate to incorporate this into manager mandates after benchmarks have been set.

Risk and return arguments

All investors are different. So there is no way to provide a "one size fits all" solution. Key differences that will arise are:

- risk tolerance;

- the incidence of future liabilities; and

- portfolio constraints.

But we can examine two asset classes, offshore bonds and offshore shares, to get a feel for the best generic strategies.

Investors are not obliged to accept currency risk in respect of any asset, either domestic or offshore. The existence of a deep and liquid market in forward currency contracts means that it is quite feasible to hedge exposures back to the New Zealand dollar, even when the assets are spread throughout many countries. Given this, the question for investors is not so much, "should I invest offshore? As it is "How much of my offshore exposure should be hedged?".

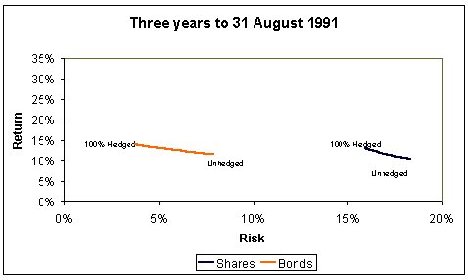

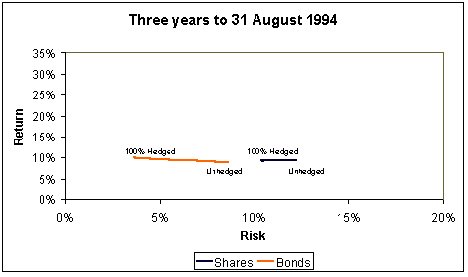

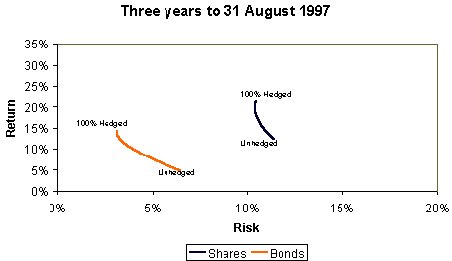

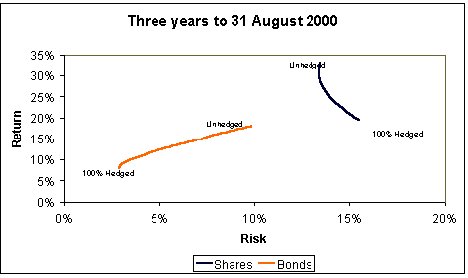

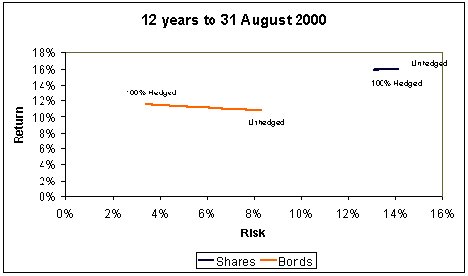

Figures 7 to 10 display the trade off between hedged and unhedged returns for both global bonds and global shares over four different time periods. Each chart shows returns (measured by compound annual returns) and risk (measured by the annualised standard deviation of quarterly returns) over three years.

Figure 8

Figure 9

We observe a marked contrast between offshore shares and offshore bonds.

In three of the four periods examined, hedged bonds provided higher returns than unhedged bonds. But the differences in hedged and unhedged returns are not great enough for us to conclude that returns from hedged bonds are systematically higher than unhedged. Note, however, that the riskiness of hedged bonds is substantially less than that of unhedged bonds for each period. The difference is large enough for us to conclude that hedged bonds are less risky than unhedged bonds.

We can reason this through when we think about the nature of bonds. They are naturally a low risk, low return asset. Their purpose, in a portfolio context, is to diversify and reduce risk. But we know that currencies are volatile and hard to predict. Currency movements may transform bonds into a higher risk asset, without necessarily improving returns. This suggests that New Zealand investors should have a natural preference for bonds where the currency is predominantly hedged to New Zealand dollars.

Historical data tells us less about the behaviour of international shares. Just as is the case with bonds, we cannot conclude that the returns from shares that are hedged to New Zealand dollars are systematically greater or less than the returns from unhedged shares. We also cannot draw any conclusions about comparative risk. Sometimes hedged shares are more volatile than unhedged. Sometimes they are not. And there is not enough evidence to suggest that there is any systematic difference in the riskiness of hedged shares compared with unhedged shares.

The rational explanation of this is that shares are a high risk asset. Therefore, rational investors will only invest in them if they can expect higher returns. The additional risk imposed by foreign currency exposure is relatively small. We can also argue that corporations often have a natural hedge in that their profits are often derived from investments in many different countries. So the imposition of adjustments through derivatives is less effective.

Perhaps the most powerful illustration of this point is provided by Figure 11. This chart captures the behaviour of assets over a long time. In this case, twelve years. We can see that hedging makes a difference to the riskiness of bonds, but the effect of hedging upon shares is not substantial.

- So what should investors do?

- Many investors experience some angst in the face of strong currency movement. About half of them will be nervous about their investment because they think the NZ dollar is going to appreciate at any moment (devaluing their offshore investment). The other half may be thinking that the NZ dollar will continue to spiral. And there is no way of predicting which group is right, or whether they are both wrong.

In fact, the future direction of currency is never certain. If it ever was, then the markets would react quickly to capitalise on that certainty, and the price would adjust. That is largely how markets work. So what should investors do?

Historical evidence examined by Russell suggests international bonds should be predominantly hedged.

The case for hedging international shares is less clear. Long term investors should not be sensitive to currency. But that will be cold comfort if they are unhedged and the NZ dollar has soared, or they are hedged when the NZ dollar has plunged.

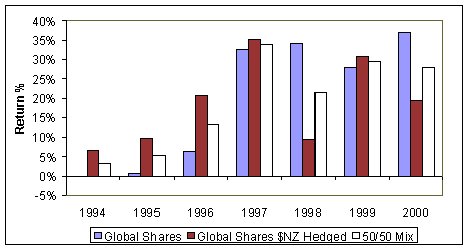

Figure 12 - Annual returns to 31 August 2000

From Figure 12 we observe that the returns of the hedged and unhedged World Share index to August of each year since 1994. In the year to August 2000, unhedged investors were happy. But in the year to August 1999 it was the hedged investors who got more. All of which reinforces the point that currency movements are hard to predict.

There is another option to help calm short-term nerves. This is for investor to literally hedge their bets, as shown in the third column of Figure 12. With a 50% hedge the investor will not ever experience the major highs of an unhedged portfolio, but they also will not be subject to the worst of the lows.

This conclusion is reinforced by an earlier Russell Research commentary by Gardner and Thierry that discussed the "Regret Syndrome". Investors experience regret when the hedging strategy that they pursue differs from the market norm, and underperforms the market norm for some period. For example, investors who were predominantly hedged over 2000 will have experienced regret because their strategy has done less well than that of other investors who are unhedged. Regret is different from risk in that when we talk about risk it is forward-looking. Regret is always retrospective.

Gardner and Thierry attempted to quantify regret, and came up with measures of expected regret. That is, we know that investors will not be happy at some point in the future. What Gardner and Thierry did is propose a framework to calculate how often they will be unhappy, and how unhappy they will be. The authors note that although regret refers to an emotional response to investment it is still a genuine consideration because regret may be detrimental to future decision making.

They conclude that the best strategy for minimising regret is to impose a 50% hedge. Minimising regret will generally be secondary to maximising portfolio efficiency. But in the absence of a clear efficiency argument, investors can consider goals such as minimising regret.

- Conclusion

- We conclude that all investors, especially New Zealand based investors, need to place a significant proportion of their assets offshore. However, it is critical that offshore investment be globally diversified. Simply spreading investment to Australia is not sufficient to capture the full benefits of global diversification.

The management of currency needs to be considered independently of the decision to invest offshore. This is because hedging strategies have the potential to allow offshore investment without necessarily changing the currency base. An analysis of historical evidence reveals that a hedged exposure to international bonds generally yields the same return as an unhedged exposure, but with less risk. But in the case of shares, the effect of currency hedging upon risk is less evident. In the absence an efficiency argument, we believe there is room for secondary considerations. Once those are considered, a 50% hedge on international shares is a sound option.

| « Practice Management: |

Special Offers

Commenting is closed

| Printable version | Email to a friend |