Michael's last stand

Michael Littlewood doesn't mince his words when describing the super fund to the Finance and Expenditure Select Committee.

Tuesday, April 24th 2001, 4:24PM

The New Zealand Superannuation Bill is placebo policy making. New Zealanders have undoubtedly had a gutsful of political huckstering on the pensions issue. The government is now bending to the political winds by doing something about the "problem" which it describes but then sweeps on past.

I say that doing something does not mean doing anything and that's what this Bill is really all about. If the Bill is the best that we can produce after 25 years' of political too-ing and fro-ing and the members of this Committee endorse its provisions then I think you are failing in your duty to tomorrow's generations of New Zealanders.

Let's get a couple of things

clear:

1. The future cost of New Zealand Superannuation is the benefits

that will be paid. In general terms, that future cost has nothing

to do with the way it is financed but with the amount that is

paid. This Bill and all the debate that has gone on over the last

25 years have not addressed one single aspect of the design elements

that drive the benefit design of New Zealand Superannuation. Specifically,

we have never had a properly researched discussion on:

- the state pension age

- the dollar amount paid

- the inflation linkage

- the qualifications for payment

- the relationship between the married and two different single rates.

That just about covers every single important part of the design.

Why are you politicians so petrified to raise the things that really matter on the sustainability issue? Is it a Pavlov's dogs' type of response to your self-inflicted electoral damage. You know that there's something the matter - you've got that feeling in your political bones - you don't quite understand what the problem is so we'll put concrete boots on the issue and tip the whole thing into Wellington Harbour and hope that no-one notices. Is that it?

Well, it won't go away. You won't be MPs when the real issues will have to be addressed but they will have to be addressed. Robert Muldoon and his ilk aren't here to patch up the mess he created with National Superannuation but we all knew at the time, now nearly 30 years ago, that it would have to be patched up. I was stunned when a senior National Party member of those days told me recently that he thought National Superannuation was one of the best policy moves made by National in the 1970s. He told me proudly that it had won National three elections. I just couldn't believe him. He still doesn't understand what a mess Muldoon created.

2. The second point I want to make clear is that the Big Cullen Fund is fundamentally flawed. It's a classic example of the fallacy of composition. Do we understand that? If I stand up on my seat at a rugby match, I'll get a much better view. However, if everyone stands up, no-one does. It doesn't follow that if saving for retirement is a good idea then having the government do lots of it for us is an even better idea.

Governments are lousy investors - make no mistake; the Big Cullen Fund is just another version of compulsory saving for retirement that was defeated in 1997 but now the government's in charge of the investment process. It will be an arm of government and I don't care how many Chinese walls the Bill erects; it will still be an arm of government. The Minister of Finance has acknowledged that himself.

He has stated that the so-called "Guardians" "will be required to have regard to rather than give effect to directions from the government". How much clearer can he be? In fact, when you think about, it the word "Guardian" is an interesting and revealing description of the role - from whom will they be guarding the Big Cullen Fund?

I think that the Big Cullen

Fund is more likely to politicise the issue of sustainability

because the basic issues surrounding the benefit design of New

Zealand Superannuation haven't even been raised, never mind settled.

As I have said already, fixing the benefit design means that we

fix the costs - the most the Big Cullen Fund can hope to achieve

is a minor contribution to inter-generational smoothing of cash

flows. How does that make New Zealand Superannuation more sustainable

as the government claims?

Besides which, this is all voodoo economics in the best traditions

of the snake oil salesman - the Bill has an implicit theme underlying

it that we New Zealanders are lousy savers and we've just got

to do something about it. We need to lift the quantity of savings

in New Zealand. However that, on its own, will do little to increase

wealth, let alone savings. Instead, we should focus on raising

the quality of investment. We can only do that by ensuring the

right individual incentive structures exist. We need only look

at Japan (that produces the most serious amount of savings in

the developed world and is in deep, deep trouble) and compare

it with the US that is apparently as profligate as we are with

its money. Now, in which country would you rather be the Minister

of Finance today? A rhetorical question, I hope.

Finally, I want to point you in the direction of a couple of charts

in my submission:

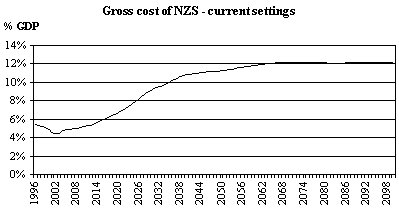

This first chart is based on a modelling tool produced for the Super 2000 Task Force called PRISM. It shows the expected cost of New Zealand Superannuation projected out over the next 100 years.

You mustn't think the baby boomers are the long-term problem and that superannuation costs will reduce once they are all dead. They won't. They increase steadily over the period after 2050 and top out at about a gross 12% of GDP by 2100 (about a net 10%). The Government justifies the Big Cullen Fund by focussing on the cost between 2030 and 2050 by which time the net cost will reach about 9% of GDP. So, why isn't the government concerned about the generations of taxpayers after 2050 and, particularly after 2100 when the last dollar will have been paid from the Big Cullen Fund? There is no answer to that.

Next, again from PRISM:

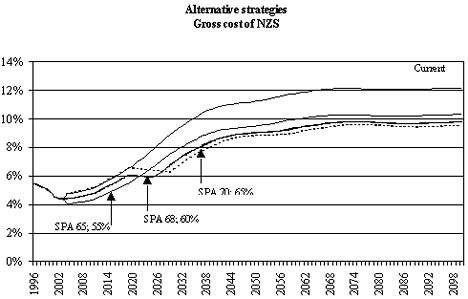

Notes: source - PRISM. "SPA" is the State pension age; the percentage figures (55%, 60% and 65%) refer to the proportion that the married couple's NZS bears to the national average wage (net to net)

PRISM is a bit limited in that the only policy option that can be deferred is the introduction of an increase in the State pension age. You can see this in the two lines that illustrate the costs of increasing the age from 65 to either 68 or 70. The chart shows that increase happening from 2020 to 2030. In my view, any changes to the design (including a reduction in the amount paid) have to be deferred until after all current pensioners are dead. You politicians have eliminated the possibility of any change for current retirees.

Now I'm not recommending any of these as changes to New Zealand Superannuation. All I ask is why aren't we talking about them as options rather than the ineffective, dopey Big Cullen Fund? Each of the three options I illustrate will make a much larger contribution to easing the cost of New Zealand Superannuation for future generations than the hugely expensive, distortionary and probably ineffective Big Cullen Fund.

I ask why we haven't debated any of the design elements of New Zealand Superannuation? Why don't we talk about what we have to pay for before we discuss how we have to pay for it, never mind whether we can afford it in the first place?

This Bill should be defeated in all its respects. We should then start talking about the things that really matter.

| « The demographic issue | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |