NZ Superannuation Bill

AMP Financial Services submission to the Finance and Expenditure Select Committee

Thursday, April 26th 2001, 3:10PM

| 1 | Introduction | ||

| 1.1 | AMP Financial Services is New Zealand's leading financial services company. Our broad network of customer and community contacts provides us with an understanding of the community's financial services needs and concerns. | ||

| (i) | One in eight adult New Zealanders are AMP Financial Services ("AMP") customers. AMP provides over 1,000 New Zealand companies with employee insurance and superannuation services. More than 127,000 New Zealander's are also AMP shareholders. AMP, through AMP Henderson Global Investors, is New Zealand's largest fund manager with over $10b under management. AMP manages NZ's largest employer superannuation master trust, the New Zealand Retirement Trust which represents 27% of assets held in master trusts and is a preferred superannuation provider with over 75 years experience in employer superannuation provision. | ||

| (ii) | In late 2000 AMP surveyed a sample of New Zealanders on their superannuation attitudes and actions. The results of the AMP Superwatch survey are referred to throughout this submission. | ||

| 1.2 | AMP welcomes the opportunity to comment on the New Zealand Superannuation Bill. | ||

| 1.3 | AMP recognises the potential that the Bill brings for New Zealanders to be able to plan their retirement on the foundation of a more soundly based New Zealand Superannuation. | ||

| 1.4 | NZ Superannuation only provides a retirement income sufficient to satisfy a very basic retirement lifestyle (the present taxable amount for a married couple is $21,380 or $14,117 for someone living alone). | ||

| 1.5 | The AMP Superwatch survey found that 83% of those surveyed thought that the present levels of NZ Superannuation were inadequate to provide the retirement income they desired. 'Fixing New Zealand Superannuation' must be seen in the context of a coherent overall superannuation framework in which New Zealanders can make the additional provision for the retirement they want | ||

| 1.6 | AMP recognises that the Bill is a building block of only one of a number of possible overall superannuation frameworks. NZ Superannuation's design is unusual in comparison with other state pensions given its universal entitlement, fixed eligibility and payment level regardless of personal income. | ||

| 1.7 | AMP believes that a more flexible overall superannuation structure incorporating a greater level of personal choice will be better able to cope with the changes that are likely to emerge in the relationship between work and retirement. | ||

| 1.8 | AMP looks forward to working with Government in developing an overall superannuation solution. | ||

| 2 | Submission Structure | ||

| 2.1 | This submission is in two parts: | ||

| (a) | The New Zealand Superannuation Bill; and | ||

| (b) | An outline of an alternative, overall superannuation structure AMP believes is more appropriate to the modern and emerging work/retirement relationships | ||

| 3 | Submission on the New Zealand Superannuation Bill | ||

| 3.1 | If the Government is immovable in its commitment to the present structure of NZ Superannuation, AMP sees the Bill as a positive step in ensuring its sustainability. We see the following features as positive: | ||

| (i) | The concept of prefunding and the resultant spreading of NZ Superannuation's cost. | ||

| (ii) | In the absence of other policy changes, prefunding should increase the overall level of saving. Effective investment of these savings has the potential to increase economic growth and reduce the effect of an increasing proportion of elderly. | ||

| (iii) | The bringing together of all the provisions for the payment of NZ Superannuation into one piece of legislation. | ||

| (iv) | The visibility of the funding provisions. | ||

| (v) | The arms length relationship between the Guardians and the Government. | ||

| (vi) | That the fund will be managed on a commercial basis. | ||

| (vii) | The provisions for political party buy-in to either the entitlement to NZ Superannuation or the funding provisions. Given the very long lead times that superannuation planning entails both for the individual and the state, regardless of the additional security provided by pre-funding, New Zealanders will not have confidence in the new scheme unless there is broad political agreement to the Bill's principles. Consensus on the Bill's provisions should be built now; the Bill should not proceed in its absence. | ||

| However, we see parts of the legislation that can be improved. | |||

| 3.2 | Part 1 The perception is being created through comment on the size of the Fund and that NZ Superannuation is more secure, that people do not need to do anything more to have the retirement they want. The Bill entrenches the present level of NZ Superannuation which, we reiterate, provides a very basic level of retirement income. The AMP Superwatch survey demonstrates that New Zealanders aspire to a retirement lifestyle beyond that which NZ Superannuation will provide. If the Bill is passed, this message needs to be reinforced. The Retirement Commissioner is the appropriate body to distribute the message. The Office of the Retirement Commissioner must be adequately funded and we recommend that the Retirement Incomes Act 1993 is amended to provide for funding of the Office entirely from Government. |

||

| 3.3 | Clause 16 The perception that NZ Superannuation is a generous benefit is also reinforced by the base rate being the married rate of 65% of average earnings. There is a widespread perception that this is also the rate payable to individuals. As more people, particularly women, over 65 are single, the married rate is also less relevant. We recommend the references in Clause 16 to the level of benefit refer to the amount payable to an individual, either married or single. |

||

| 3.4 | Clause 59 The definition of 'controlling interest' is too narrow. Because of the potential size of the Fund in relation to the size of the NZ equities market and 'free-float' issues, the definition as written could exclude the fund from listed New Zealand equity investments. It could also preclude the fund from private capital investments. Private capital is a growing investment class in balanced portfolios. The clause needs to be either deleted or redrafted to reflect its true intention. |

||

| 3.5 | Clause

76 We question why the Fund is subject to income tax for the following reasons: |

||

| (i) | The Minister of Finance is considering exempting the income of private superannuation schemes from taxation while taxing withdrawals from these funds - the so-called TET tax regime. It is inconsistent that the fund this Bill proposes will have its income taxed. Inconsistency between Government and private schemes is undesirable. | ||

| (ii) | The contribution calculation will be based on an after tax earning assumption. This will result in a considerably higher contribution requirement than if a gross earning assumption is used. The tax receipts will be used to pay the higher contribution. | ||

| (iii) | It makes the 'pay off the mortgage' argument between paying off national debt and accumulating investment assets so much easier. The funds after-tax investment returns have to be greater than the gross cost of debt if there is to be any benefit in accumulating assets rather than paying off the debt. With a 33% tax rate the before-tax investment return needs to be at least 50% higher than the interest rate on the debt before accumulating assets becomes worthwhile; and this does not take account of any investment risk. | ||

| 3.6 | As mentioned above, the Bill is being discussed in the absence of an overall superannuation structure covering private provision. The overall framework must be proposed, debated and put in place so that NZ Superannuation's place within it is coherent and well considered. To do otherwise is to run the very great risk of incremental, ad hoc and inconsistent changes with huge accompanying compliance costs which kill the superannuation goose. We have already seen developments of this nature with the conceptually complex Superannuation Fund Withdrawal Tax to address the potential for tax minimisation provided by the 39% top marginal tax rate. | ||

| 4 | Exploring Alternative Superannuation Structures | ||

| 4.1 | It is clear that we face a changing demographic, social, economic and technological landscape and that the pace of change increasing. A rapidly changing global economy needs flexible local structures to maximise the opportunities presented. Nowhere is this more important than in the way people work. People are adopting a more flexible approach to working - working part-time, taking breaks from work whether voluntary or not, sometimes working as employees, other times as contractors or self employed. New Zealanders are not unique in this respect. It is a global phenomenon. This means that people will demand a more flexible approach to retirement. | ||

| 4.2 | The concept of a fixed retirement age will become increasingly irrelevant. As the proportion of the population approaching and over 65 increases, they will choose to progressively withdraw from the workforce before that age, or work beyond 65 if they are fit and willing and opportunities present themselves. | ||

| 4.3 | Financial considerations may drive people to work longer. Young people entering the workforce now are often starting their working lives with debt from student loans. As this is a recent (but significant) phenomenon, the full implications have yet to materialise. However for those with large student loans, it is highly likely that other major lifecycle financial commitments will have to be deferred; e.g. saving for a house, bringing up and educating children, and, what has been typically left to people's forties and fifties, saving for retirement. | ||

| 4.4 | The inflexible design of NZ Superannuation is inconsistent with people making their own retirement decisions. An individual working beyond 65 and in control of their own retirement income is likely to choose to have it commence when they have retired and their regular earned income reduces or ceases. It is therefore inefficient for the state to impose a retirement income on the individual at a fixed age. In this context, AMP supports an overall superannuation environment that maximises people's ability to make retirement decisions relevant to their personal circumstances and believes that overall community and economic welfare will be maximised as a result. | ||

| 4.5 | AMP's Superwatch survey results support individual retirement provision compared to state provision. 74% of respondents said that they themselves should take the greatest responsibility to provide for their retirement compared with 19% thinking the greatest responsibility lay with the Government. | ||

| The components of a flexible retirement income regime | |||

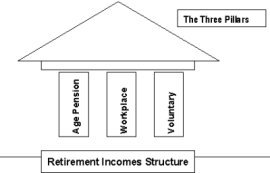

| 4.6 | AMP supports the three-pillar framework for retirement income provision endorsed by the World Bank, IMF and OECD. The three pillar framework comprises: | ||

|

|||

|

|||

| The Three-Pillar structure is widely accepted internationally, particularly in countries New Zealand naturally compares itself with; e.g. Australia, the United Kingdom and the United States. | |||

| 4.7 | There are many variations on the three-pillar theme. AMP puts forward the following outline of a structure we consider would provide a flexible retirement income regime which meets the needs of the modern world. The detailed provisions still need careful analysis of undesirable incentives, disincentives or behavioural changes; e.g. disincentives to remaining in employment. The details need to be debated. | ||

| (a) | NZ Superannuation at its present levels is a guaranteed minimum retirement income for those who cannot provide this income from their own resources. | ||

| (b) | Individuals have flexibility as to when NZ Superannuation starts, on or after 65, with an appropriate increase in its base level. | ||

| (c) | The following features are introduced to approved superannuation schemes: | ||

| (i) | Individuals can determine the level of contributions they make, up to a determined maximum. (The question of a compulsory second pillar needs to be considered. The World Bank supports a compulsory second pillar as did 67% of respondents in a recent National Business Review survey.) | ||

| (ii) | The tax status of the scheme is EET - all contributions are deductible from whatever source (personal or employer), investment earnings are not taxed, all benefits whenever received are taxable income of the person at that time. | ||

| (iii) | Generally benefits must be taken as an income stream in retirement. An obvious exception would be payments on death. There would be flexibility to choose when the income stream commences on or after age 65. | ||

| (iv) | NZ Superannuation would be reduced to take account of the income paid from approved schemes. The rate of reduction would need to be determined but we suggest a reduction of 25c for each dollar paid from an approved scheme. Consideration should be given to abatement for other income and assets at a reduced rate to take account of people who choose not to save in approved schemes | ||

| (v) | Scheme funds must be invested prudently consistent with the needs of a retirement savings scheme. | ||

| (d) | AMP sees the following advantages with this flexible approach: | ||

| (i) | State and private provision are integrated with the 'incentives' provided to private provision reflected by an offset to NZ Superannuation | ||

| (ii) | Individuals can choose when their retirement income commences. A person working beyond 65 can defer receipt of their pension to the time they really need it or can start with a smaller pension in recognition of a reduced part-time earned income. | ||

| (iii) | Individual private savings promotes a sense of ownership, control and interest. This is becoming evident in Australia. | ||

| (iv) | EET recognises the fundamental deferred income nature of retirement savings and the inappropriateness of taxing retirement savings at people's marginal tax rates while they are working. | ||

| 5 | Conclusion | ||

| The Bill will provide New Zealanders with greater confidence that they will receive NZ Superannuation at the present levels when they retire. As NZ Superannuation is such a significant part of the retirement income for the vast majority of New Zealanders, the greater certainty will be beneficial.However, AMP believes that the present structure of NZ Superannuation is inflexible and is not well suited to the modern employment/retirement environment. The superannuation structure of the last decade in particular has been an unsuccessful experiment and out of step with the rest of the world. Piecemeal reform in the absence of a coherent and well-considered overall framework is a dangerous path to follow. AMP strongly believes that the first step is to establish the framework within which NZ Superannuation operates and then determine the shape of NZ Superannuation to fit the framework. The Bill should be deferred and reconsidered after the first step is complete. | |||

| « Babyboomers cry out for less tax on retirement savings | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |