Property: Going round in circles

Is property going to contiue with its 'boom-bust' cycles or will it become more disciplined?

Wednesday, June 20th 2001, 4:42PM

Property cycles are logically sequences of recurrent events, reflected in such things as fluctuating vacancies and rentals. From a property manager's point of view, understanding these cycles means being able to make better property decisions to achieve more consistent investment returns.

Although the property cycle can be measured in a number of ways, the way that best reflects the overall health of the property market is the 'total return' cycle: that is, the income generated by property, together with changes in value.

Property cycles stem from particular combinations of circumstances, which tend to be self-replicating over time. The following eight steps have been identified as the key phases of a property cycle:

- An upturn in the business cycle of the real economy occurs.

- Strengthening occupier demand causes fewer vacancies, resulting in increased rents and capital values. This improves the profitability of development, and triggers 'building starts'.

- If credit expansion accompanies the business cycle upturn, a full-blown building boom eventuates, providing funding for a second wave of more speculative development activity.

- Because of construction lags, little new space has been completed, and rents and values continue to rise.

- By the time the bulk of the new buildings reach completion, the business cycle has moved into its downswing. This is accompanied by tighter money supply and increased interest rates to combat the inflationary overheating caused by the boom.

- As the economic boom subsides, occupier demand for property falls - just as the new space supply from the building boom reaches its peak. The result is increased vacancies amid falling rents and values.

- With the economy moving into recession, rents and values fall quickly, while the credit squeeze hits property companies holding unlet buildings and with insufficient income to cover their interest payments.

- The outcome is a property slump, characterised by depressed values, high vacancies and bankruptcies within the property sector.

- Past property cycles

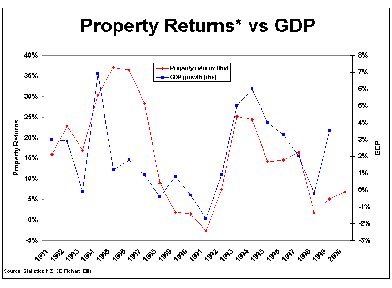

- The following chart shows CB Richard Ellis' estimation of total returns from Auckland office, retail and industrial property for the past 20 years. Since Wellington's cycle followed a similar path over this period, the chart should also provide a reasonable approximation of the overall total-return property cycle for New Zealand since 1980.

Some of the points previously discussed are apparent in the chart - for example, the data identifies two distinct cycles in the past 20 years.

The chart also shows how the economic and property cycles are connected. As with property, there were two major economic cycles in the past 20 years, with peaks and troughs that broadly coincided. However, a closer look reveals a number of differences.

The most significant of these occurred between 1984 and 1987, when the property market was booming amid a languishing economy. However, the 1999 economic recovery showed a much stronger impetus than the property market. So clearly, while the economic cycle influences the property cycle, other factors (e.g. inflation) also play a part in influencing property returns.

A discussion of the 'drivers' at various points of the property and economic cycles helps to unravel the relationship between the two.

The excesses of the early 1980s are well documented. During this time, deregulation had an enormous impact on freeing up financial markets, and significant amounts of capital found their way into the property sector. However, the 1987 sharemarket crash ended the fervent speculative environment and brought both the financial and property markets back to reality. This resulted in the total return from property free-falling in line with the weak economy between 1988 and 1991.

1992 signalled the start of a new economic and property cycle - a period often referred to as the 'export-led' recovery. The recovery was initially driven by the low exchange rate, which stimulated strong export growth.

By 1993, the rapid growth of the export sector started to flow into the domestic economy, providing a sustained rise in household spending. Eventually, increased occupier demand for property led to improved take up and higher rentals. Although the rate of the recovery varied between the office, retail and industrial markets, one by one, vacancy and rental levels recovered enough for property developers to re-enter the market around the mid 1990s.

In 1998, just as the first new build projects and major refurbishments got underway, New Zealand entered another economic downturn. This was caused by a combination of the Asian economic crisis; currency crises in Mexico, Brazil and Russia; and, closer to home, severe drought conditions, which affected much of rural New Zealand. These economic developments had a severe impact on occupier demand, with the total return from property taking a sharp downturn.

In 1999, a number of factors propelled the economy out of recession. Short-term interest rates dropped to below 5%, with mortgages bottoming at around 6%. This was down from a peak of more than 10% in the previous year. Other measures, such as the life offices' demutualisation, tax cuts and the removal of car tariffs further boosted the domestic economy.

Although returns from the property market responded to the improved economic conditions in 1999 and 2000, the property cycle was still relatively subdued. In part, this was because of oversupply in some market sectors such as CBD offices. In addition, low business confidence at the time prevented significant business investment in sectors such as the industrial property market, which should have benefited from rising manufactured exports.

While the occupier side of the property cycle was weak, investment markets were more active in 1999, due to low interest rates making property investment attractive compared with bank deposits. Investors made a yield play for property, which in some sectors enabled positive gearing for the first time since 1992/93.

However, as interest rates rose again in 2000, property became less attractive, stemming the rate of recovery.

- More of the same?

- The question is; will 'boom-bust' cycles continue to be routine or will the industry become more disciplined? While a major cycle is unlikely in the foreseeable future, there are several reasons why cyclical oscillations will continue.

- On the demand side, conditions will continue to fluctuate according to the economic cycle.

- On the supply side, the inevitable impact of construction lags will always create cyclical risks. Compounding this, the property market remains largely reactive rather than forward looking.

- Financial incentives also contribute to development cycles. While the need to achieve lending quotas is not publicised as it used to be in the 1980s, lenders continue to make money only by lending.

However, there are also good reasons to suggest that the amplitude of future cycles will be reduced. There is an increased focus on the market by analysts ready to sound warning bells if needed and there is an increased acceptance of, and reliance on, forward-looking research.

In summary, these ongoing developments may in the longer term bring more efficiency and less cyclical volatility, even if the property cycle itself is unlikely to completely disappear.

- Outlook

- The recent contraction of business investment confidence and GDP growth globally will serve to contain the level of New Zealand's GDP expansion, consequently flattening the growth path for property.

Nevertheless, most economic forecasters are projecting increased growth by the end of 2001. The benefits of New Zealand's economic expansion are forecast to widen, with further growth in the export sector being supplemented by growth in the domestic economy. Should this economic forecast eventuate, the property market is expected to have a prolonged growth cycle.

In the industrial sector, a more active occupier market is expected to provide a stronger platform for rent and total return growth. However, growth is likely to be moderate in comparison with the mid 1990s.

Retail property performance is closely tied to population growth, employment, tourism and their effect on retail spending. While the demand outlook is generally positive, the possibility of significant new supply could change this, as retail spending patterns might not be able to keep pace with floor space growth. Hence, performance differences between individual assets will widen, with increased competition and a range of winners and losers emerging.

In the office sector, occupier demand is forecast to outstrip new supply entering the market over the next 12 months. Any improvement will be positive, but recognising that vacancy rates remain high, the benefit to rental growth will be a few years away (rent movements generally follow vacancy movements with a lag of about 12 months).

Andy Evans is Armstrong Jones' general manager property and Zoltan Moricz is national manager research at CB Richard Ellis. Special Offers

« How the Govt cut the Retirement Commissioner's funding King builds an empire » Commenting is closed

Printable version

Email to a friend