ASB Bank survey shows strong support for tax incentives

Investors want tax incentives to encourage saving, reveals ASB BANK's latest Investor Confidence Survey.

Friday, March 15th 2002, 11:22AM

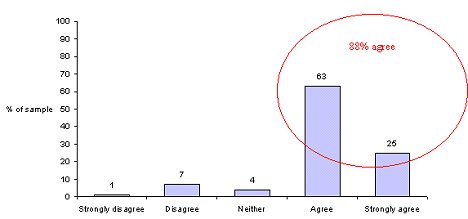

A total of 88% of respondents are 'in favour of there being a tax incentive to encourage people to save', including 25% who strongly agree with the statement.

The support for tax incentives is 23% higher than support for compulsory retirement savings at 65%, with 14% of respondents who strongly agree with compulsion.

Agreement is strongest among those already saving for retirement, where 91% agree with tax incentives, including 29% who agree strongly.

Respondents between the ages of 40-49 years showed the most intense support, with 33% strongly agreeing with tax incentives.

Chief Manager ASB BANK Investments, Roger Perry, says it sends a strong message from the New Zealand public.

"We believe it is inevitable that a future New Zealand government will respond to the public's wish for some sort of tax incentives for retirement savings."

"While the debate on retirement savings in New Zealand has been dominated by an 'either, or' mentality, the trend in other Western countries has been towards providing a range of options. These include 'pay as you go' state systems, pre-funded state systems like 'The Cullen Fund', and some form of tax incentive for workplace schemes and private savings. This approach reduces the risk of relying on just one retirement savings system to meet the build up in pension obligations when the 'baby boom' generation starts to retire after 2010."

"By the year 2051 it is estimated there will be over a million New Zealanders, or a quarter of the population, in retirement. This will put pressure on the Government's ability to maintain the current level of Government Superannuation," he says.

Government Superannuation is set at an annual payment of $14,705 a year for someone living alone, and $22,296 for couples over 65 years of age.

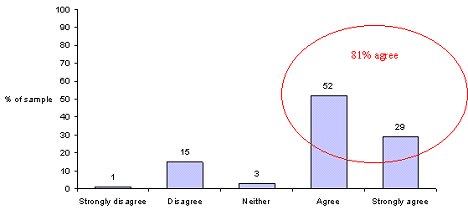

A total of 81% of respondents indicated that they would save more if tax incentives were introduced. However, Mr Perry indicated that this figure should be interpreted with caution.

"Other countries' experience shows that tax incentives do not change the overall amounts people save, but they can alter the way people save."

"New Zealanders have a disproportionate amount of their savings tied up in property, breaking the golden rule of not putting all your eggs in one basket. An incentive to diversify savings into financial assets will reduce savers' risk of relying solely on property investment, and thus improve their chances of meeting their retirement income needs," he says.

Full Results Follow

The ASB BANK Investor Confidence Survey is a nationwide survey, which has been undertaken every quarter since May 1998, interviewing a sample of up to 1000 respondents.

Tax incentives

In this question, all respondents (n=660) were asked to say whether

they agree or disagree with a statement which said…. "I

am in favour of there being a tax incentive to encourage people

to save"

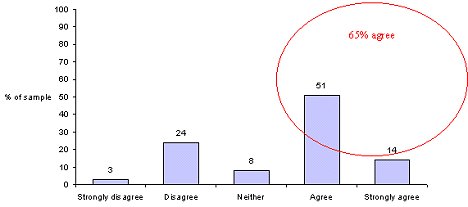

A large proportion - 88% of all respondents (down from the previous 90%) - agreed with this statement, including 25% (down from 34%) who agree strongly. This represents a slight weakening in support (though support is still very strong) compared to the previous quarter.

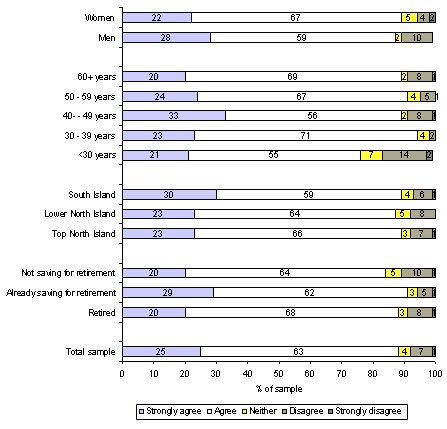

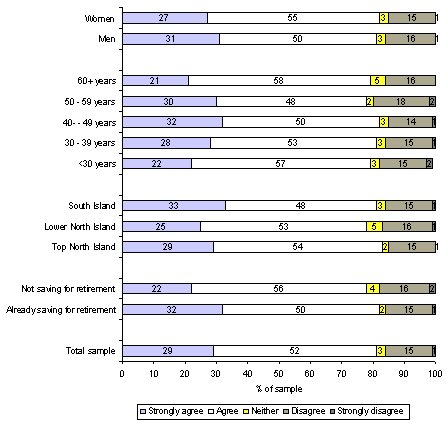

The chart below shows these opinions amongst various subgroups of interest.

Agreement is especially high among those between 30 and 39 years and those who already save for retirement, while it is somewhat lower from those under 30 years.

Women agree slightly more than men. There was negligible difference in the areas.

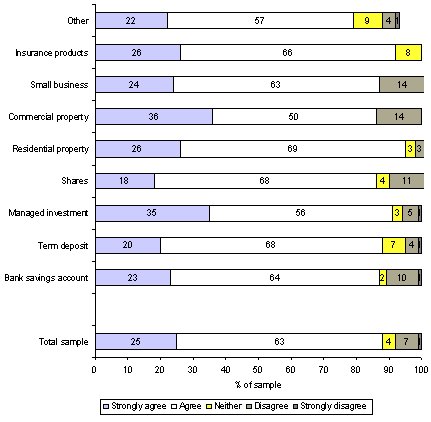

Agreement or disagreement varies dramatically by product that respondents consider to be their main investment.

Agreement is especially high among those with residential property, insurance products, and managed investment.

Those with 'other' (i.e. non-mainstream) investments are less likely to agree.

Those respondents who are not yet retired (n=564) were further asked to say whether they agree or disagree with a statement which said…. "If there was some form of tax incentive to save, I'd save more than I do now"

Overall, there is less agreement to this statement than to the previous one ("I am in favour of there being a tax incentive to encourage people to save"). This confirms the fact that people more likely agree to more general statements than to more personal effects. Nevertheless, there is still strong agreement that reflects people's intentions to save more if there was some form of incentive to do so.

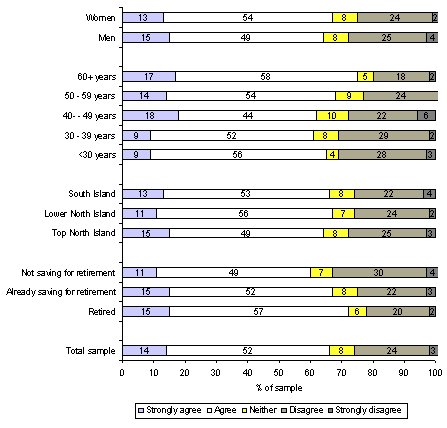

The chart below shows these opinions amongst various subgroups of interest.

Agreement is somewhat lower among those between 50 and 59 years, those who not save for retirement, and those in the lower North Island.

There are no significant differences between women and men.

Agreement or disagreement varies dramatically by product that respondents consider to be their main investment.

Agreement is especially high among those with shares, commercial property, and 'other' (i.e. non-mainstream) investments.

Those with investments in insurance products, in small businesses, and with managed investments are less likely to agree.

Compulsion

In this question, all respondents (n=660) were asked to say whether

they agree or disagree with a statement which said…. "I

am in favour of some form of compulsory savings scheme to ensure

that people provide for themselves in retirement"

A significant majority- 65% of all respondents

(continuing a decline in the last quarter which followed previously

rising trends) - agreed with this statement, including 14% who

agree strongly.

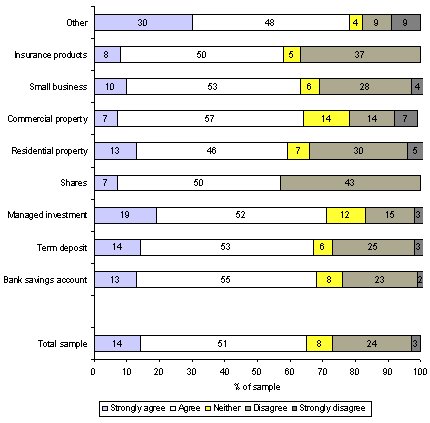

The chart below shows these opinions amongst various subgroups of interest.

Agreement is strongest amongst those already retired, and weakest amongst those not yet saving for retirement (though on balance even this group tend to agree rather than disagree).

Agreement increases with increasing age,

though those aged under 30 years are more likely than the 30 -

39 year age group to support compulsion.

Agreement or disagreement varies by product that respondents consider to be their main investment.

Those with their main investment in the major institutional based products (ie. Bank savings, term deposits or managed investments) show significantly greater support of compulsion - potentially, one could speculate that this is a hangover from the originally proposed compulsory scheme tending to favour these types of investments.

Those with their main investment in property, shares, small business or insurance products are less in favour of compulsory savings.

| « Huge support of National's savings policy: English | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |