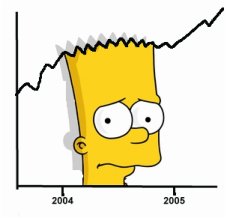

Markets to trade like Bart Simpson's hairdo

The outlook for international sharemarkets for the balance of the year isn’t too flash according to Perpetual Trust’s head of investment market research Brigette Leckie.

Wednesday, October 13th 2004, 12:06AM

“It’s the first time I have seen this degree of divergence (in views) in the 20 years I have been in the industry,” she says.

Leckie says there is a lot of volatility as views shift from inflation to recession.

Leckie says there is a lot of volatility as views shift from inflation to recession.

Her views are that while the pendulum is shifting from one extreme to another it is unlikely to settle at the extremes.

On a regional view she is less excited about the growth prospects of the United States market than others such as Europe, Japan and emerging markets.

She thinks that the growth in the United States will slow down and come back to average rates.

Companies are in quite good shape as they have tidied up their balance sheets, reduced debt and now have strong liquidity.

Part of the problem is a lack of pricing power.

On a sector basis Leckie has some concerns about the technology sector, suggesting that there is still some downside to run.

The problems revolve around excess capacity, especially in the chip market, and high valuations.

“Technology is not screamingly cheap,” she says.

While Leckie sounds a note of caution, it’s not all bad news.

“There is no reason to be overly bearish on equities,” she says.

Indeed “2005 looks more promising,” she says as earnings look better.

In the meantime markets are going to move sideways. “I compare it to a Bart Simpson sort of hairdo.”

| « ING launches private equity fund | Sovereign takes regulation bull by the horns » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |