Commerical property produces highest ever capital gains

Returns from investing in New Zealand commercial property continue to improve, with almost all sectors showing a significant increase in total returns compared to March 2004 according to Property Council National Director Connal Townsend.

Wednesday, July 6th 2005, 10:41PM

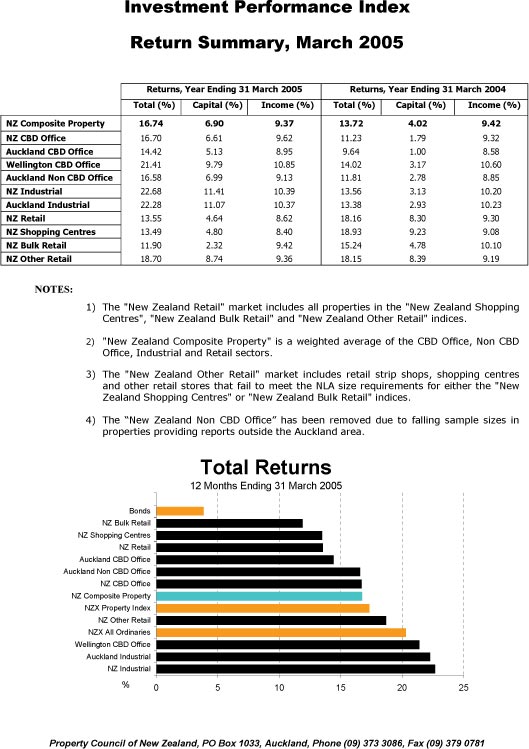

The latest figures from the Property Council of New Zealand’s Investment Performance Index survey show commercial property investors have received an average return of 16.74% in the year to March 2005, well above the 13.72% investors earned on average for the previous year.

“While income returns remained steady at 9.37%, it is the strong increase in capital value that has driven the total return growth,” Townsend says.

“This is illustrated by the capital returns for each sector, ranging from 2.32% for New Zealand Bulk Retail to 11.41% for New Zealand Industrial,” he says.

Property Council Research chairman Alan McMahon, says these capital returns, measuring the increase in capital value, are the highest ever recorded in one year.

“It is little wonder that there is such strong demand for non-residential property investment in New Zealand as, across the board, every sector has shown growth,” he says.

In contrast with results from the last few quarters, the standout sector for the year to March 2005 was the industrial market.

New Zealand industrial gave a total return of 22.68% (up from 13.56% in March 2004), while Auckland industrial followed not far behind with a total return of 22.28% (up from 13.38% in March 2004).

Both rises were aided by large increases in capital returns over the last 12 months:

New Zealand industrial increased from 3.13% to 11.41%, while Auckland industrial increased from 2.93% to 11.07%.

Both figures signify the highest returns for these markets since the inception of this Index.

Wellington CBD continued to be the strongest office sector with a total return of 21.41%, while the Auckland CBD Office sector continued its recent rapid improvement to record a total return of 14.42%, up from 9.64% in March 2004.

For the first time in the last 12 months, the majority of retail sectors dropped out of the top five spots, with just ‘other retail’ (combined small shopping centres, small bulk retail outlets and strip retail) maintaining its place with a total return of 18.70%, up from 18.15% in March 2004.

The rest of the retail categories experienced a fall in total returns over the past 12 months. In the year to March 2005, shopping centres returned 13.49%, bulk retail returned 11.90% and the combined retail category returned 13.55%, compared with 18.93%, 15.24% and 18.16% respectively in March 2004.

Keep up-to-date with current property investment news by joining the NZ Property Magazine's email newsletter service. To join click here

| « NZPIF Conference 2005 | Property developers warned to comply with securities law » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |